- United States

- /

- Hospitality

- /

- NasdaqGS:MCRI

How Monarch Casino & Resort's (MCRI) Higher Earnings and Capital Returns Are Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- Monarch Casino & Resort recently reported higher third-quarter and nine-month revenues and net income, announced a cash dividend of US$0.30 per share payable in December 2025, and disclosed additional share repurchases totaling US$11.3 million during the past quarter.

- The continuation of dividend payments and share buybacks underscores the company's confidence in its operations and commitment to returning capital to shareholders.

- We'll consider how Monarch Casino & Resort's consistent capital returns through dividends and buybacks influence its broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Monarch Casino & Resort's Investment Narrative?

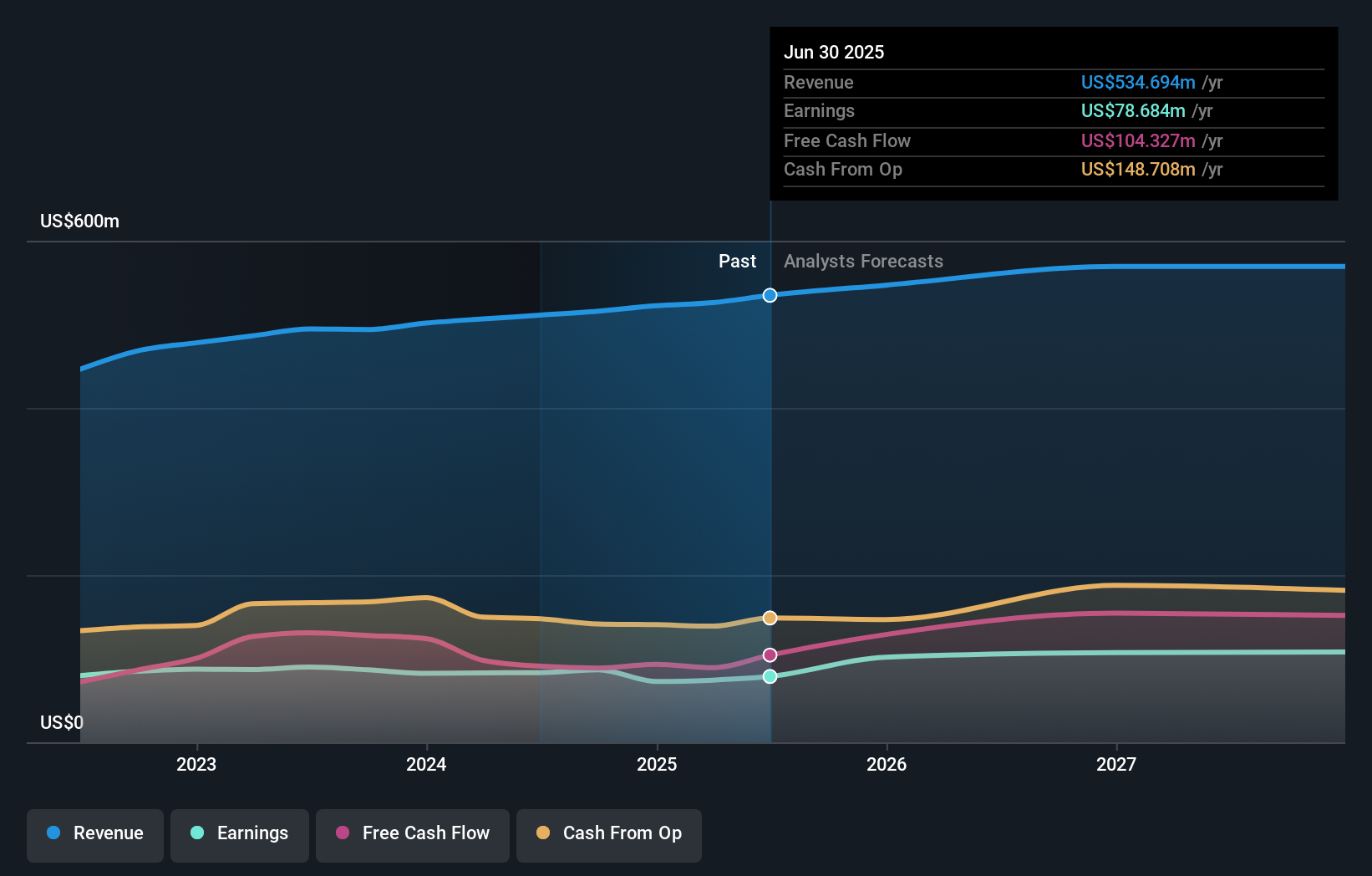

To view Monarch Casino & Resort as an attractive holding, investors typically need to believe in the company’s ability to maintain reliable profit growth and capital returns, even as industry growth slows. The recent news, stronger third-quarter financials, a continued quarterly dividend, and steady buybacks, might reinforce investor confidence in operational resilience and disciplined shareholder returns. These moves could support sentiment after a notable share price decline in recent months. However, short-term catalysts like a rebound in earnings growth or margin improvement haven’t visibly emerged; while net income has grown, profit margins remain below last year and earnings are forecast to lag the broader market. Key risks, such as limited revenue growth and relatively low forecast returns on equity, remain in focus. The latest announcements support stability rather than game-changing momentum for the stock.

Yet, underlying profit margins may pose a growing concern you should be aware of. Despite retreating, Monarch Casino & Resort's shares might still be trading 43% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Monarch Casino & Resort - why the stock might be worth as much as 77% more than the current price!

Build Your Own Monarch Casino & Resort Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monarch Casino & Resort research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Monarch Casino & Resort research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monarch Casino & Resort's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCRI

Monarch Casino & Resort

Through its subsidiaries, owns and operates hotels and casinos.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives