- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Marriott International (MAR): Exploring Valuation After Recent Modest Uptick in Share Price

Reviewed by Kshitija Bhandaru

Marriott International (MAR) has caught the eye of investors recently, following a modest uptick in its share price over the past week. The stock's current trading pattern invites a closer look at the factors shaping its recent movements.

See our latest analysis for Marriott International.

While Marriott International’s latest share price moves have been fairly modest, that comes after a solid stretch for long-term holders. Despite some recent ups and downs, its 1-year total shareholder return of just over 6% shows momentum may be cooling compared to the impressive multi-year gains. However, the company’s steady fundamentals still have investors’ attention.

If you’re looking for your next opportunity, now is a great time to broaden your investing scope and discover fast growing stocks with high insider ownership

As the stock hovers near recent highs with fundamentals still intact, investors must now weigh whether Marriott International is trading at a fair value or if there is still a compelling upside to be captured.

Most Popular Narrative: 6.2% Undervalued

With the narrative fair value estimate at $285.29, Marriott International’s latest close of $267.57 shows a modest discount according to widely followed analyst expectations. Investors are watching these levels closely, especially as fresh growth drivers begin to shift the company’s valuation outlook.

Global expansion continues to accelerate, with net rooms growth approaching 5% and a record pipeline (over 590,000 rooms, 40% under construction), reflecting strong demand for Marriott's brands in international markets, particularly APAC and EMEA, where a rising middle class is driving double-digit RevPAR increases. This provides a foundation for multi-year revenue growth.

Want to know the secret behind Marriott's valuation edge? It’s all about aggressive global expansion, surging loyalty program numbers, and some unexpected margin twists. Curious how bullish growth assumptions transform future earnings and the share price? Unlock the inner workings behind the analysts’ numbers.

Result: Fair Value of $285.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty or slower leisure travel demand in key markets could moderate Marriott's growth trajectory and challenge the bullish outlook.

Find out about the key risks to this Marriott International narrative.

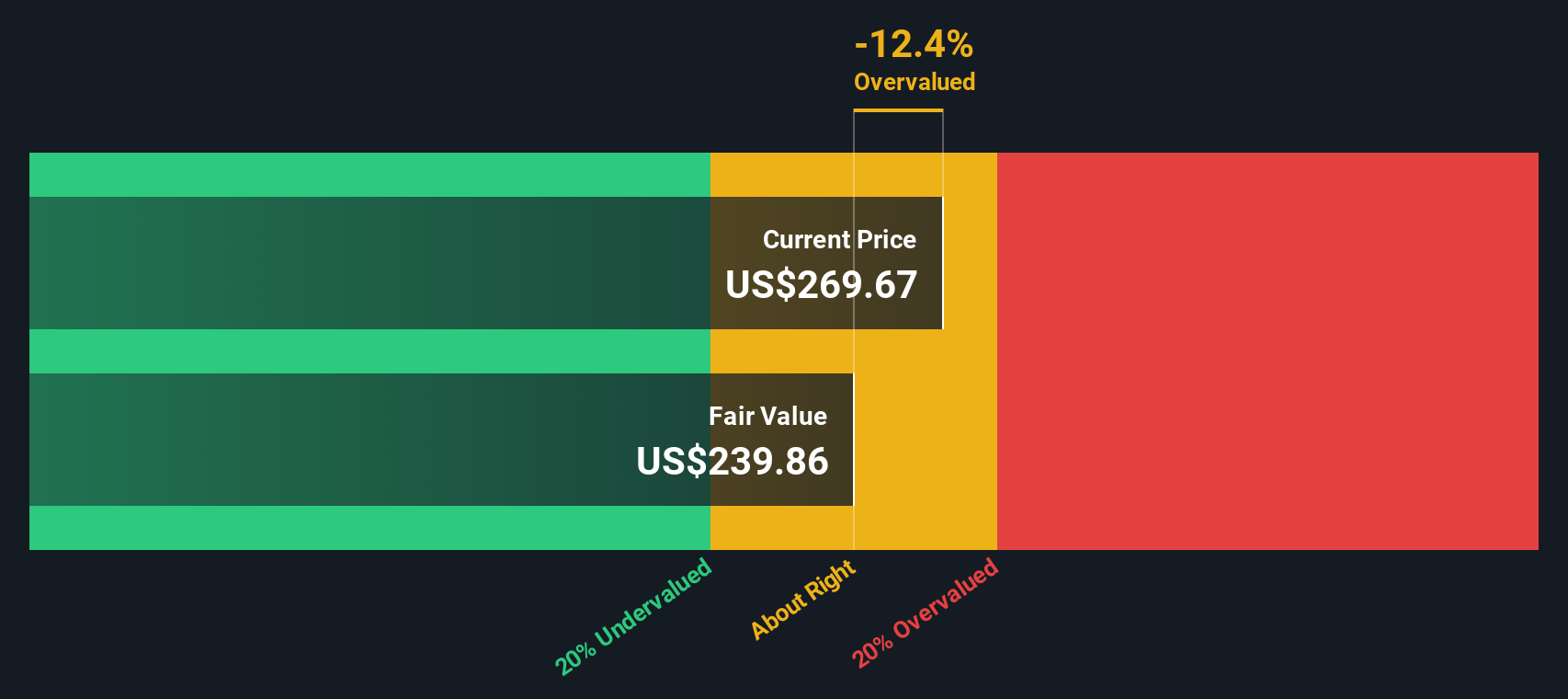

Another View: The SWS DCF Model Offers a Cautious Perspective

Looking at Marriott International through the lens of our SWS DCF model, the outlook becomes more conservative. The DCF model currently suggests the stock is trading above its estimated fair value, which may indicate a potential overvaluation compared to its recent market price. Does this highlight hidden risks or an opportunity being missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marriott International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marriott International Narrative

Prefer to examine the numbers first-hand or dig deeper on your own terms? You can shape your own narrative in just a few minutes with Do it your way

A great starting point for your Marriott International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Expand your portfolio by checking out specialized growth and income stocks that fit your strategy on Simply Wall Street.

- Uncover the growth potential of tomorrow’s tech leaders by reviewing these 24 AI penny stocks at the forefront of artificial intelligence.

- Capture reliable income streams by browsing these 19 dividend stocks with yields > 3%, featuring companies with robust dividend yields over 3%.

- Ride the next big trend in digital finance and discover real-world applications through these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026