- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Assessing Marriott International’s (MAR) Valuation as Shares Rise on Strong Travel Demand

Reviewed by Simply Wall St

Marriott International (MAR) shares have seen a positive shift over the past month, rising nearly 10%. Investors seem to be recalibrating as travel continues to pick up and hotel occupancy trends remain solid.

See our latest analysis for Marriott International.

Marriott International’s solid 9.5% 1-month share price return follows a choppy start to the year and comes as travel enthusiasm remains strong. While 2024’s share price gains are modest so far, long-term holders can point to an impressive 140% total shareholder return over five years, showing that momentum is continuing even as day-to-day swings persist.

If you’re interested in what else is attracting attention in the market, there is a whole universe of opportunity. Broaden your search and discover fast growing stocks with high insider ownership

With Marriott’s shares climbing and reflecting strong financial results, the question for investors remains: is there still unrecognized value left in the stock, or has the market already accounted for future growth prospects?

Most Popular Narrative: 1.4% Undervalued

Marriott International’s fair value in the most widely followed narrative is set just above the last close, highlighting a razor-thin undervaluation. With shares hovering near consensus value, the narrative’s underlying assumptions take center stage in the ongoing valuation debate.

Global and mid-scale expansion, buoyed by loyalty program growth, is driving long-term occupancy gains, revenue diversification, and increased customer lifetime value. Investment in technology and luxury/lifestyle offerings is improving operational efficiency, deepening guest engagement, and supporting sustained earnings and margin growth.

Curious what numerical leap of faith analysts are making to call this stock nearly fairly priced? Big expansion bets, margin swings, and loyalty program momentum are all in play. The real drivers of this valuation might surprise you. Discover how the narrative justifies every dollar in its calculation.

Result: Fair Value of $289.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and margin pressure could still disrupt Marriott’s expected growth and challenge the current optimistic outlook.

Find out about the key risks to this Marriott International narrative.

Another View: Earnings Multiple Raises the Bar

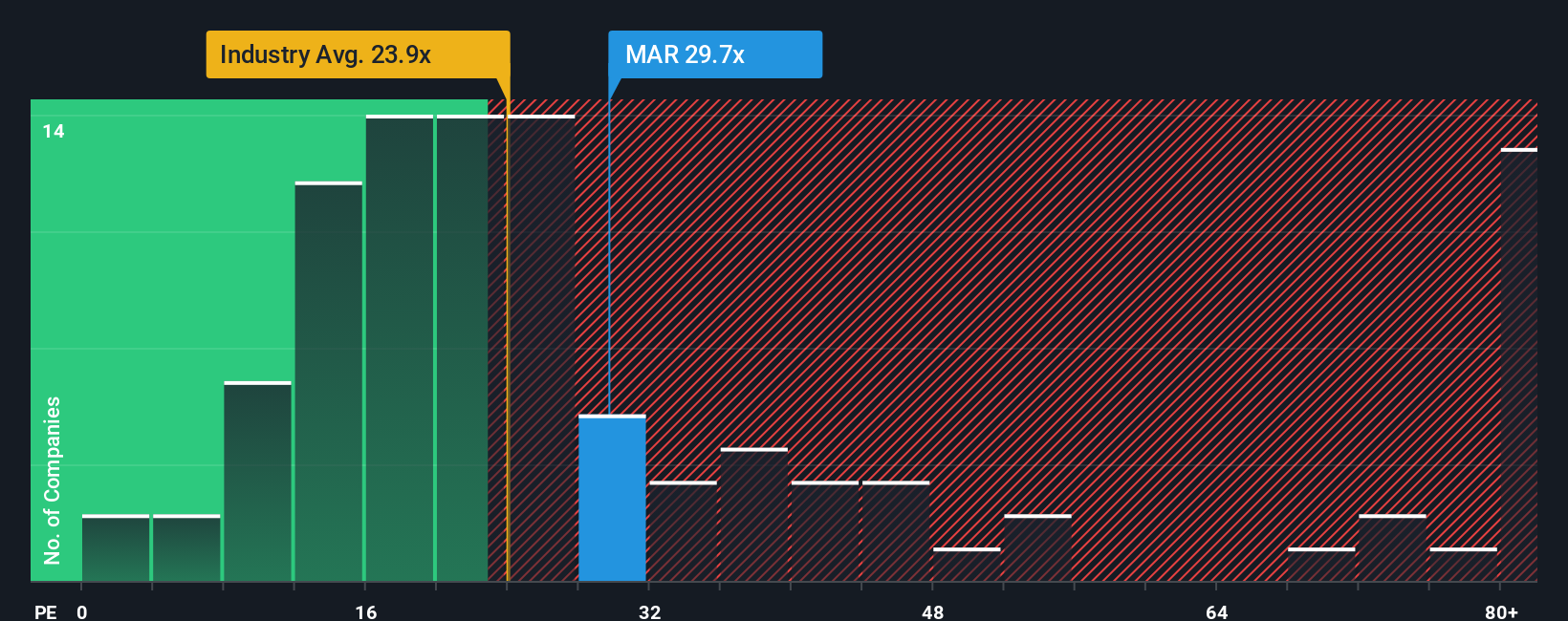

Looking at Marriott International’s valuation through the lens of its earnings multiple tells a slightly different story. The company trades at 29.4 times earnings, above the US Hospitality industry average (20.8x) and the peer group average (28.7x), and even higher than its fair ratio of 27.5x. This premium suggests investors are paying up for future growth, but it also signals increased valuation risk if results fall short. Is the optimism baked in, or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marriott International Narrative

If these perspectives do not quite match your outlook, or if you want a hands-on approach, you can dive into the data and craft your own interpretation in just a few minutes. Do it your way

A great starting point for your Marriott International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for the obvious. Get ahead of the crowd by checking out other timely opportunities you might regret missing if you wait too long.

- Capitalize on the explosive growth in artificial intelligence by starting with these 26 AI penny stocks, which are catching Wall Street’s attention for their real-world breakthroughs.

- Maximize your income potential and hedge against market swings by targeting these 16 dividend stocks with yields > 3%, which are packed with reliable yields over 3%.

- Seize early-mover advantages as innovation accelerates and build your watchlist with these 26 quantum computing stocks, at the frontier of computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives