- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Assessing Marriott International (MAR) Valuation: Is There Still Upside for Investors?

Reviewed by Simply Wall St

Marriott International (MAR) shares have shown steady movement this month, with investors paying close attention to the company’s recent financial performance and overall market trends. The stock’s 1-year return is 5%, highlighting moderate gains.

See our latest analysis for Marriott International.

This year, Marriott’s share price has experienced modest fluctuations, with recent gains indicating that investors may be responding positively to the company’s steady performance and ongoing recovery in travel demand. While short-term share price momentum has increased in the last week, Marriott’s long-term total shareholder return stands out, up over 200% in five years.

If Marriott’s steady climb has you thinking bigger, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Marriott’s consistent returns and strong long-term growth, the question facing investors is whether the current price truly reflects future prospects or if there is still room for upside that the market has not yet accounted for.

Most Popular Narrative: 4.9% Undervalued

Marriott International’s most-followed narrative places its fair value at $285.29, just above the recent close of $271.32. This suggests the market is nearly in line with consensus on Marriott’s future prospects, with a slight upside implied by current analyst models.

Global expansion continues to accelerate, with net rooms growth approaching 5% and a record pipeline (over 590,000 rooms, 40% under construction). This reflects strong demand for Marriott's brands in international markets, particularly APAC and EMEA, where a rising middle class is driving double-digit RevPAR increases. These trends provide a foundation for multi-year revenue growth.

Curious to know the bold financial forecasts powering this premium? The narrative hinges on rapid international expansion and a loyalty engine that’s rewriting the rules. What numbers are shaping Marriott’s future fair value? Dive deeper for the projections that analysts are betting on.

Result: Fair Value of $285.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and ongoing labor shortages could slow Marriott’s revenue growth. This may challenge the optimistic consensus around its valuation.

Find out about the key risks to this Marriott International narrative.

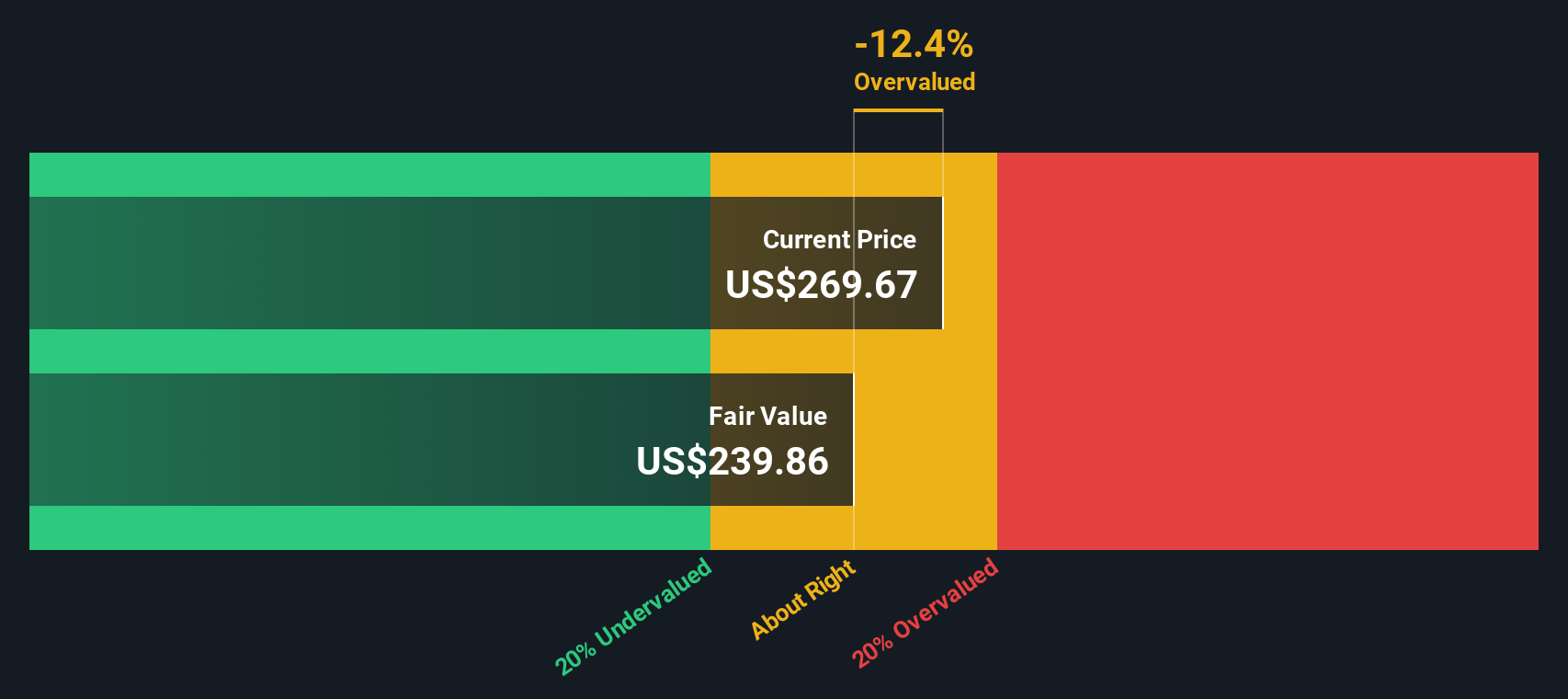

Another View: Testing the Valuation with the SWS DCF Model

While analyst and market multiples point to Marriott being only slightly undervalued, our DCF model offers a sharper perspective. According to this model, Marriott is actually trading above its estimated fair value of $246.24, which signals that the stock may be more expensive than it first appears. Does this shift the outlook for savvy investors looking for upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marriott International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marriott International Narrative

If the consensus view doesn't match your perspective, or you're keen to dig into the numbers yourself, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Marriott International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next market opportunity pass by. Get ahead of the curve by targeting winning themes and emerging sectors that others overlook—your future portfolio will thank you.

- Capitalize on tomorrow’s industry leaders by acting early with these 27 AI penny stocks as artificial intelligence shapes the innovation landscape.

- Uncover hidden gems with real upside potential inside these 3559 penny stocks with strong financials and transform small investments into powerful returns.

- Secure consistent income streams for your portfolio by targeting these 17 dividend stocks with yields > 3% which boasts yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives