- United States

- /

- Consumer Services

- /

- NasdaqGS:LOPE

Grand Canyon Education (NASDAQ:LOPE) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Grand Canyon Education, Inc. (NASDAQ:LOPE) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Grand Canyon Education

How Much Debt Does Grand Canyon Education Carry?

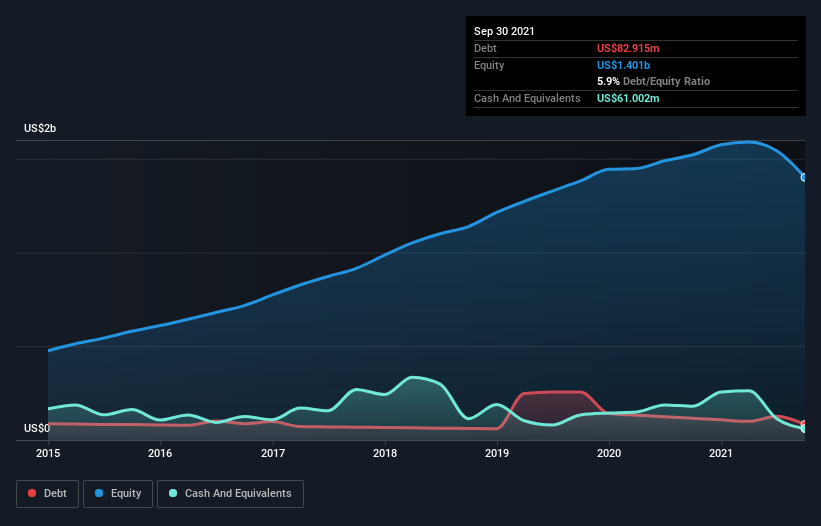

You can click the graphic below for the historical numbers, but it shows that Grand Canyon Education had US$82.9m of debt in September 2021, down from US$116.1m, one year before. However, it does have US$61.0m in cash offsetting this, leading to net debt of about US$21.9m.

A Look At Grand Canyon Education's Liabilities

The latest balance sheet data shows that Grand Canyon Education had liabilities of US$203.8m due within a year, and liabilities of US$75.8m falling due after that. Offsetting this, it had US$61.0m in cash and US$101.8m in receivables that were due within 12 months. So it has liabilities totalling US$116.9m more than its cash and near-term receivables, combined.

Given Grand Canyon Education has a market capitalization of US$3.40b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Grand Canyon Education has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Grand Canyon Education has barely any net debt, as demonstrated by its net debt to EBITDA ratio of only 0.071. Happily, it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like an Olympic ice-skater handles a pirouette. Fortunately, Grand Canyon Education grew its EBIT by 5.7% in the last year, making that debt load look even more manageable. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Grand Canyon Education's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Grand Canyon Education recorded free cash flow of 49% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Grand Canyon Education's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its net debt to EBITDA is also very heartening. Taking all this data into account, it seems to us that Grand Canyon Education takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. We'd be motivated to research the stock further if we found out that Grand Canyon Education insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LOPE

Grand Canyon Education

Provides education services to colleges and universities in the United States.

Flawless balance sheet with proven track record.