- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

Update: Lindblad Expeditions Holdings (NASDAQ:LIND) Stock Gained 99% In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, Lindblad Expeditions Holdings, Inc. (NASDAQ:LIND) shareholders have seen the share price rise 99% over three years, well in excess of the market return (44%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 37% in the last year.

See our latest analysis for Lindblad Expeditions Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

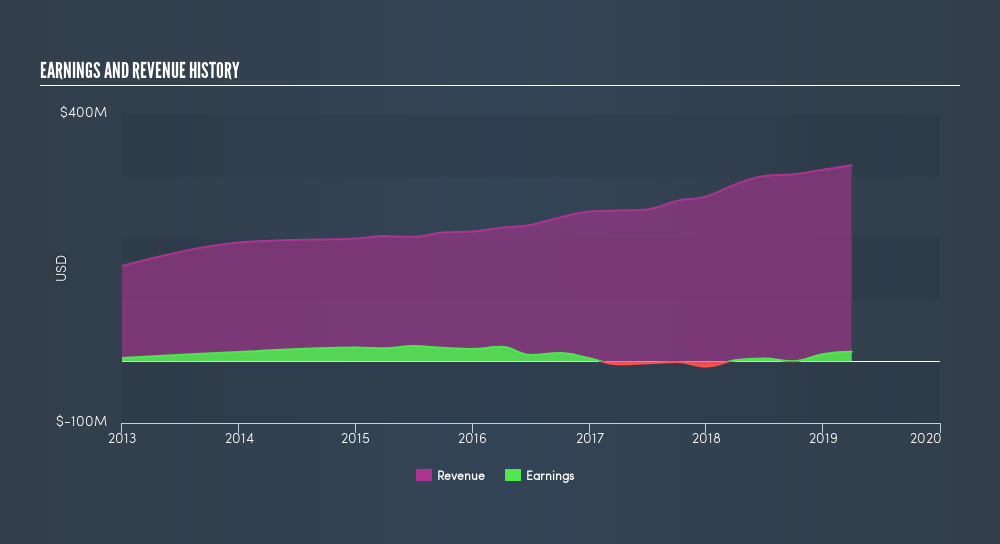

During the three years of share price growth, Lindblad Expeditions Holdings actually saw its earnings per share (EPS) drop 13% per year. This means it's unlikely the market is judging the company based on earnings growth. Given this situation, it makes sense to look at other metrics too.

It may well be that Lindblad Expeditions Holdings revenue growth rate of 13% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We know that Lindblad Expeditions Holdings has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pleasingly, Lindblad Expeditions Holdings's total shareholder return last year was 37%. That's better than the annualized TSR of 26% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Lindblad Expeditions Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives