- United States

- /

- Chemicals

- /

- NYSE:SCL

Undervalued Small Caps With Insider Buying In United States August 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, though it is up 22% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying undervalued small-cap stocks with insider buying can present unique opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.1x | 2.1x | 49.12% | ★★★★★☆ |

| PCB Bancorp | 11.4x | 2.9x | 40.74% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 28.81% | ★★★★★☆ |

| Citizens & Northern | 13.3x | 3.0x | 41.83% | ★★★★☆☆ |

| Franklin Financial Services | 9.9x | 2.0x | 37.12% | ★★★★☆☆ |

| Lindblad Expeditions Holdings | NA | 0.9x | 37.75% | ★★★★☆☆ |

| German American Bancorp | 14.4x | 4.8x | 44.75% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -87.80% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -254.82% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings is a travel company specializing in expedition cruises and adventure travel experiences, with a market cap of approximately $0.67 billion.

Operations: Lindblad generates revenue from its Lindblad segment and Land Experiences, with the former contributing $405.86 million and the latter $185.61 million. The company has seen fluctuations in its net income margin, with a notable -0.0928% for the period ending June 30, 2024. Gross profit margin has shown an upward trend recently, reaching 44.10% in the same period.

PE: -9.9x

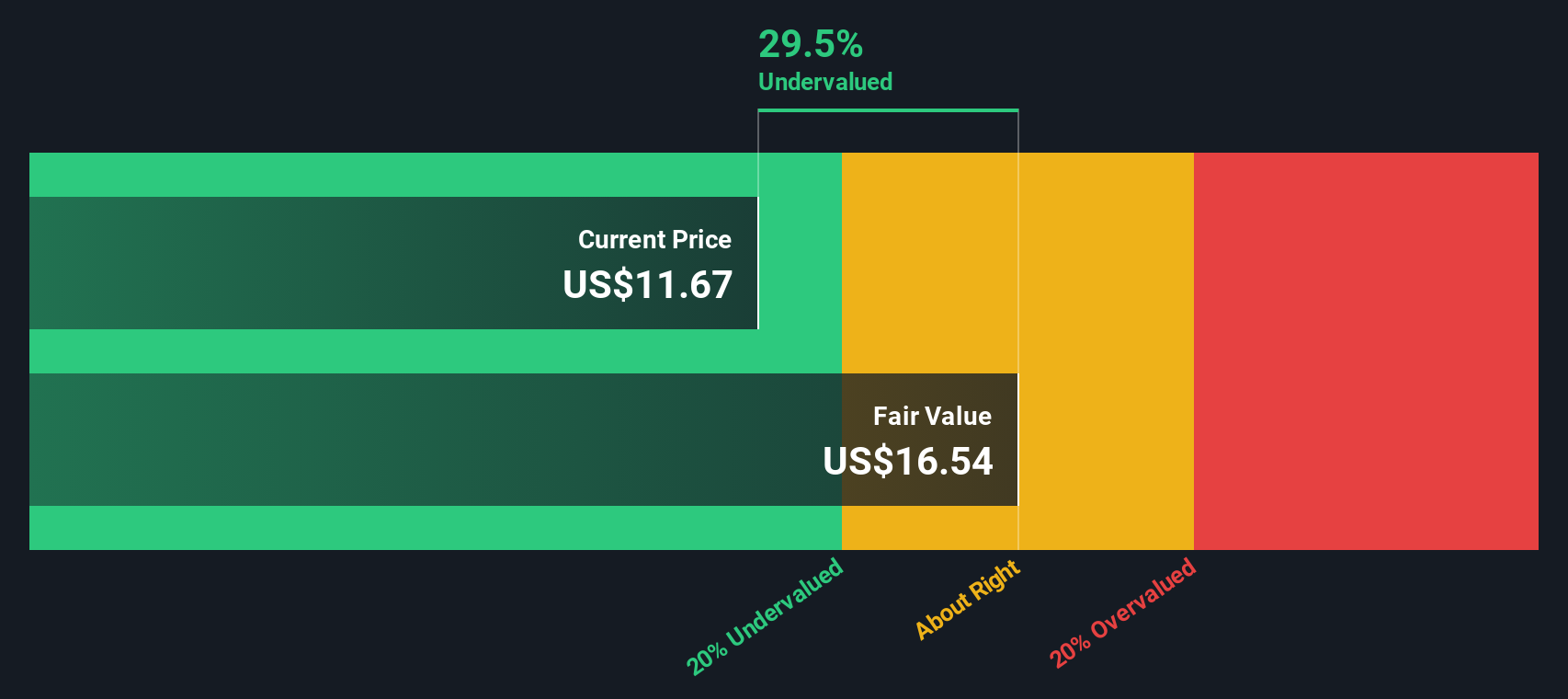

Lindblad Expeditions Holdings, a niche player in expedition cruises, recently reported Q2 2024 sales of US$136.5 million, up from US$124.8 million last year. Despite a net loss of US$24.67 million, insider confidence is evident with significant share purchases in the past six months. The company’s expansion includes two new Galápagos vessels set for revitalization by January 2025, enhancing its fleet and market position.

- Unlock comprehensive insights into our analysis of Lindblad Expeditions Holdings stock in this valuation report.

Understand Lindblad Expeditions Holdings' track record by examining our Past report.

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a company that designs and sells semiconductors, with a market cap of approximately $2.40 billion.

Operations: MaxLinear's revenue primarily comes from its semiconductor segment, amounting to $448.14 million. The company has experienced fluctuations in its net income margin, with the most recent quarter showing a net income margin of -0.42376%. Gross profit margins have varied, with the latest figure at 53.99%.

PE: -6.1x

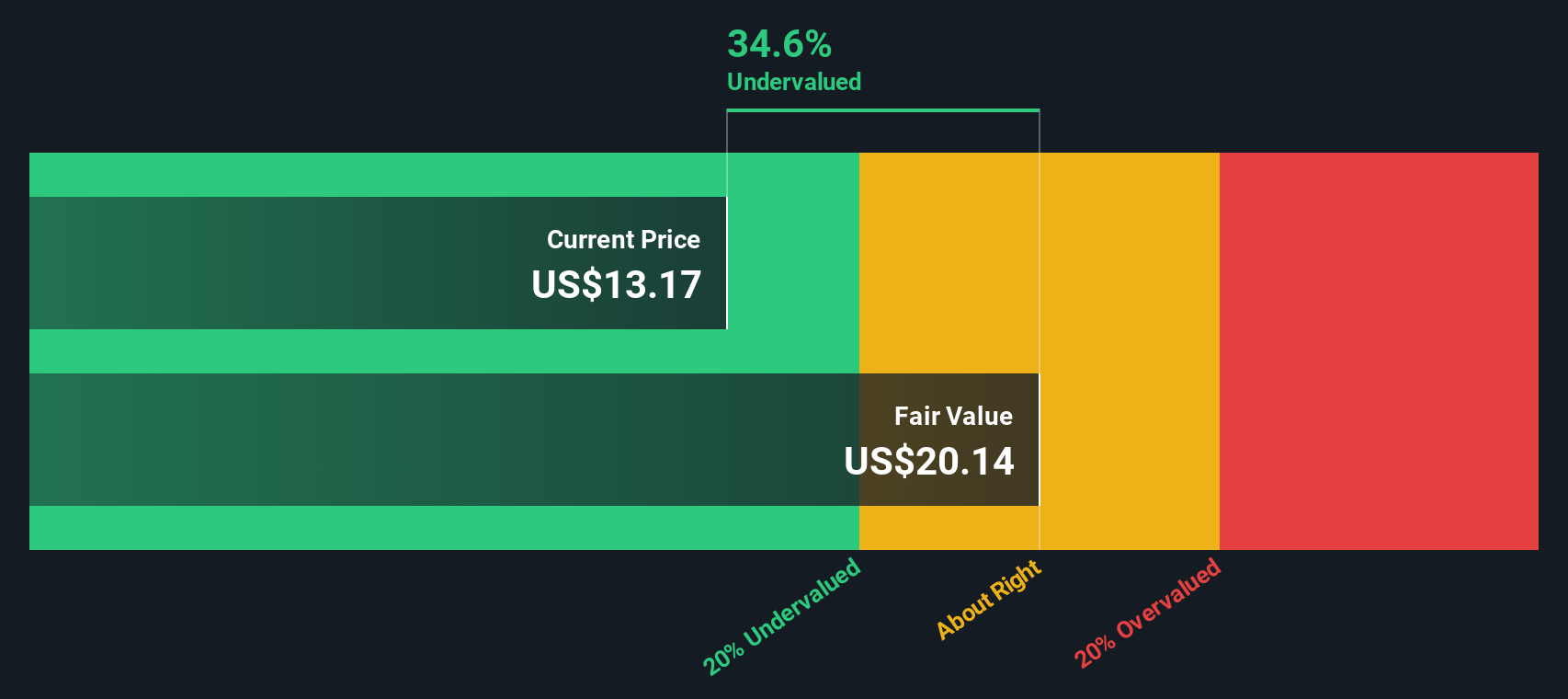

MaxLinear has recently been active at multiple industry conferences, showcasing its Panther III storage accelerator, which promises significant cost and performance improvements in data storage. Despite a challenging financial period with Q2 2024 sales dropping to US$91.99 million and a net loss of US$39.27 million, insider confidence remains strong; CEO Kishore Seendripu purchased 108,303 shares worth approximately US$1.40 million recently. This insider activity suggests belief in the company's long-term potential amidst current undervaluation concerns.

- Get an in-depth perspective on MaxLinear's performance by reading our valuation report here.

Explore historical data to track MaxLinear's performance over time in our Past section.

Stepan (NYSE:SCL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Stepan is a global manufacturer specializing in surfactants, polymers, and specialty products with a market cap of approximately $2.56 billion.

Operations: Stepan generates revenue primarily from Polymers, Surfactants, and Specialty Products. The company's net profit margin has shown fluctuations, with a recent value of 1.58% as of June 30, 2024.

PE: 50.7x

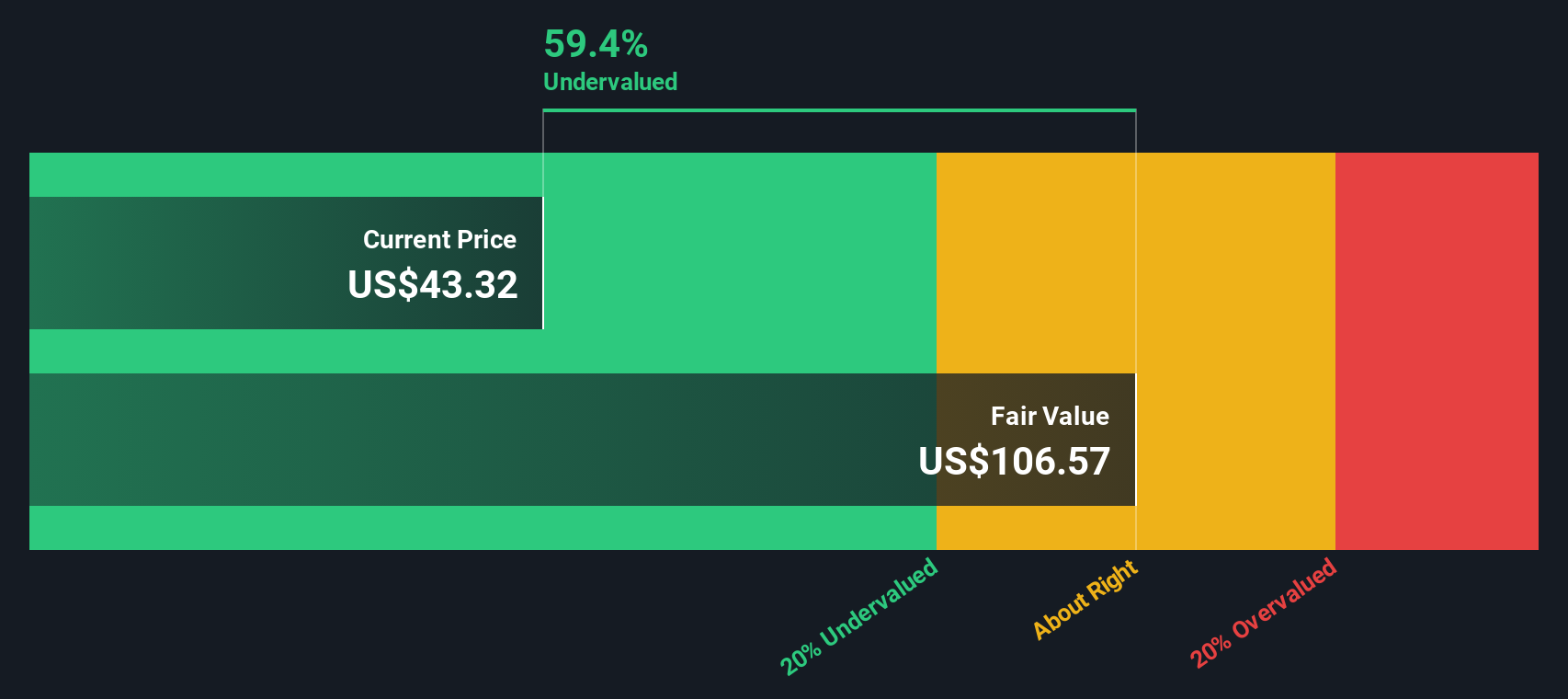

Stepan, a small cap company in the U.S., has drawn attention due to its insider confidence, with substantial share purchases reported over the past six months. Despite a dip in revenue and net income for Q2 2024 compared to last year, Stepan's earnings are forecasted to grow 71.25% annually. The company declared a quarterly dividend of $0.375 per share payable on September 13, 2024. With profit margins improving from 1.6% this year against last year's 3.1%, Stepan remains an intriguing player in the market despite its high debt levels and reliance on external borrowing for funding.

- Click to explore a detailed breakdown of our findings in Stepan's valuation report.

Examine Stepan's past performance report to understand how it has performed in the past.

Next Steps

- Gain an insight into the universe of 64 Undervalued US Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCL

Stepan

Produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products worldwide.

Adequate balance sheet average dividend payer.