- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

Three Undervalued Small Caps In United States With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but over the past 12 months, it has risen by 23%, with earnings forecast to grow by 15% annually. In this environment, identifying undervalued small-cap stocks with insider buying can present unique opportunities for investors seeking growth potential.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 21.0x | 0.9x | 42.66% | ★★★★★★ |

| PCB Bancorp | 11.3x | 2.8x | 41.46% | ★★★★★☆ |

| Hanover Bancorp | 8.9x | 2.0x | 49.93% | ★★★★★☆ |

| Citizens & Northern | 13.2x | 3.0x | 41.95% | ★★★★☆☆ |

| German American Bancorp | 14.3x | 4.8x | 44.90% | ★★★☆☆☆ |

| MYR Group | 33.3x | 0.5x | 43.71% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -85.08% | ★★★☆☆☆ |

| Titan Machinery | 3.4x | 0.1x | -25.79% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -88.95% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

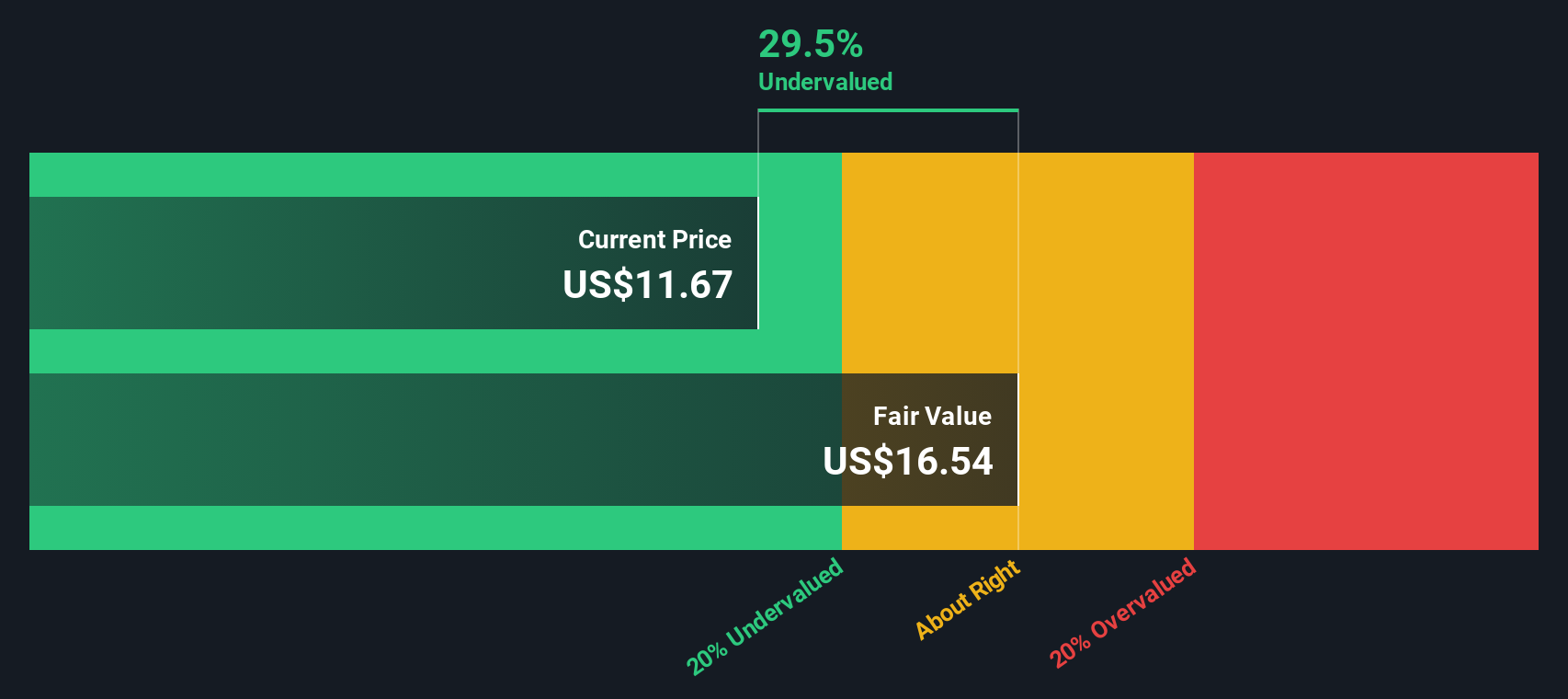

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings operates expedition cruises and adventure travel experiences, with a market cap of approximately $0.56 billion.

Operations: Lindblad generates revenue primarily from its Lindblad and Land Experiences segments, with recent figures showing $405.86 million and $185.61 million, respectively. The company reported a gross profit margin of 44.10% for the period ending June 30, 2024.

PE: -10.5x

Lindblad Expeditions Holdings, a small-cap stock, recently reported second-quarter 2024 sales of US$136.5 million, up from US$124.8 million the previous year, though net loss remained steady at around US$24.67 million. Insider confidence is evident with recent share purchases in August 2024 worth nearly US$6 million. The company also announced new Galápagos expedition vessels and added two independent directors to its board in July 2024, signaling strategic growth and leadership strengthening efforts.

Distribution Solutions Group (NasdaqGS:DSGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Distribution Solutions Group operates through its subsidiaries Lawson, TestEquity, and Gexpro Services to provide a range of industrial products and services with a market cap of approximately $1.27 billion.

Operations: Distribution Solutions Group generates revenue primarily from Lawson ($463.59 million), Testequity ($782.97 million), and Gexpro Services ($402.23 million). For the period ending June 30, 2024, the company reported a gross profit margin of 34.21%.

PE: -81.6x

Distribution Solutions Group (DSG) is actively pursuing acquisitions to enhance its long-term growth, as highlighted by their CEO's recent comments. The company reported Q2 2024 sales of US$439.54 million, up from US$377.98 million a year ago, though net income fell to US$1.9 million from US$3.02 million. DSG also increased its borrowing capacity to US$1.06 billion and completed a share repurchase of 55,844 shares for $1.68 million in Q2 2024, signaling insider confidence in the stock’s potential despite recent index drops.

- Navigate through the intricacies of Distribution Solutions Group with our comprehensive valuation report here.

Understand Distribution Solutions Group's track record by examining our Past report.

Leggett & Platt (NYSE:LEG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Leggett & Platt operates in the bedding, furniture, flooring, and specialized products sectors with a market cap of approximately $4.65 billion.

Operations: The company generates revenue primarily from Bedding Products, Specialized Products, and Furniture, Flooring & Textile Products. The net income margin exhibited a downward trend over recent periods, reaching -0.18% as of June 2024.

PE: -2.1x

Leggett & Platt, a company recently added to the S&P 600, has faced challenges with declining sales and significant goodwill impairment of US$675.3 million in Q2 2024. Despite a net loss of US$602.2 million for the quarter, insider confidence remains high with recent share purchases by executives. The company's earnings guidance for 2024 has been lowered, but its forecasted annual earnings growth of 67.34% suggests potential recovery ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Leggett & Platt.

Gain insights into Leggett & Platt's past trends and performance with our Past report.

Where To Now?

- Get an in-depth perspective on all 66 Undervalued US Small Caps With Insider Buying by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Good value with reasonable growth potential.