- United States

- /

- Consumer Services

- /

- NasdaqGS:LAUR

Laureate Education (LAUR) Drops 6.7% After Inflation and Jobs Data Pressure Education Stocks—Has the Outlook Shifted?

Reviewed by Sasha Jovanovic

- In early October 2025, Laureate Education and other education stocks came under pressure after US consumer sentiment data revealed rising short-term inflation expectations and a deteriorating jobs outlook.

- This shift in sentiment was compounded by warnings of possible recession in multiple states and concerns about the impact of a government shutdown on household incomes and demand for education services.

- We’ll explore how these growing macroeconomic concerns and negative consumer sentiment influence Laureate Education’s investment narrative and outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Laureate Education Investment Narrative Recap

Being a shareholder in Laureate Education means believing in sustained demand for private higher education in Mexico and Peru, supported by campus expansion and digital learning initiatives. The recent dip in shares, driven by short-term inflation concerns and jobs data, does little to materially affect the company's central catalyst, enrollment growth, although ongoing macroeconomic risks in its key markets remain the biggest threat to returns and free cash flow.

Ahead of the anticipated Q3 results on October 30, Laureate's recent reaffirmation of 3%-4% revenue growth guidance for fiscal 2025 provides some near-term visibility. This update is especially relevant for investors watching economic headwinds, as it speaks to management’s outlook despite recent market volatility.

On the other hand, investors should stay alert to how quickly lower-than-expected enrollment or currency swings could pressure...

Read the full narrative on Laureate Education (it's free!)

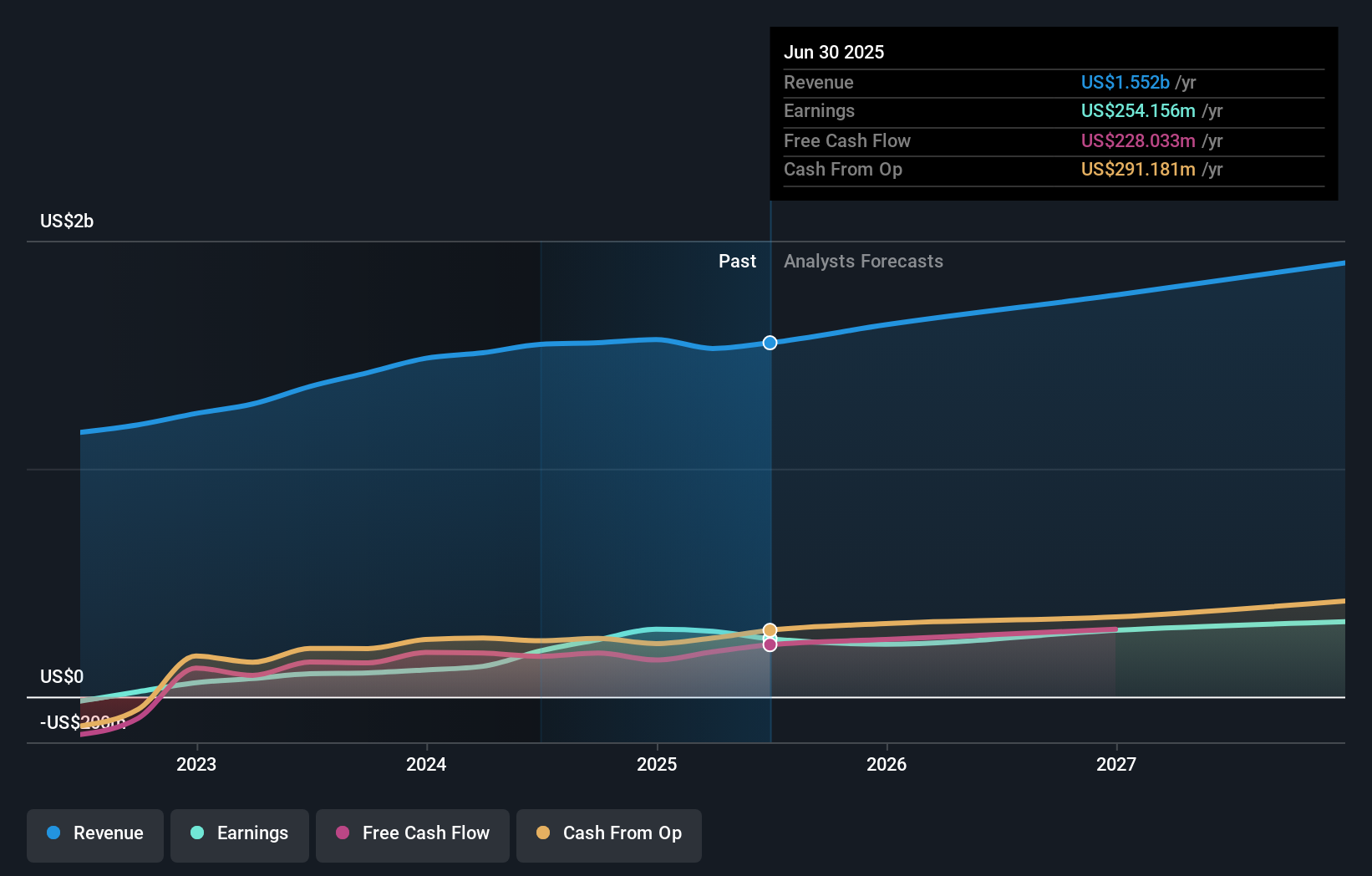

Laureate Education's narrative projects $2.0 billion revenue and $343.9 million earnings by 2028. This requires 8.4% yearly revenue growth and a $89.7 million earnings increase from $254.2 million currently.

Uncover how Laureate Education's forecasts yield a $31.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community have fair value estimates for Laureate Education ranging from US$17 to US$63.19 per share. While opinions on value differ widely, country-specific macroeconomic risks in Mexico and Peru remain central to the company's outlook, making it essential to consider several perspectives before forming your own view.

Explore 5 other fair value estimates on Laureate Education - why the stock might be worth 42% less than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAUR

Laureate Education

Offers higher education programs and services to students through a network of universities and higher education institutions.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives