- United States

- /

- Consumer Services

- /

- NasdaqGS:FTDR

Frontdoor (FTDR) Valuation in Focus After Strong Three-Month Share Price Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for Frontdoor.

Frontdoor’s recent share price momentum has been impressive, particularly when considering performance beyond the past three months. The latest rally reflects growing investor optimism. The company’s 36.8% total shareholder return over the past year and a remarkable 218% total return over three years highlight both short-term and long-term strength.

If Frontdoor’s sustained run has you looking for other standout performers, now is the perfect time to discover fast growing stocks with high insider ownership.

With share prices already running ahead of analyst targets and the company showing robust long-term returns, investors are left to wonder: is there more upside to be captured here, or is all future growth already in the price?

Most Popular Narrative: 9.3% Overvalued

Frontdoor's widely followed narrative sees fair value sitting below the current share price, with the latest closing at $65.85. This creates a key tension: are elevated expectations now ahead of reality?

Ongoing technology investments, including the integration of AI in marketing, sales, and operations, are already showing improvements in campaign performance and process efficiencies, which should help further drive down service costs and support higher net margins over time.

Want to know what future tech bets and profit levers underpin this valuation call? The narrative hints at surprising efficiency gains and digital-driven growth embedded in the fair value calculation. Can these trends really deliver on bold margin forecasts? The answer is in the details. Dive in to see which assumptions set this target apart.

Result: Fair Value of $60.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in home warranty memberships or rising customer acquisition costs could undermine confidence in Frontdoor’s growth projections and disrupt analyst expectations.

Find out about the key risks to this Frontdoor narrative.

Another View: Discounted Cash Flow Tells a Different Story

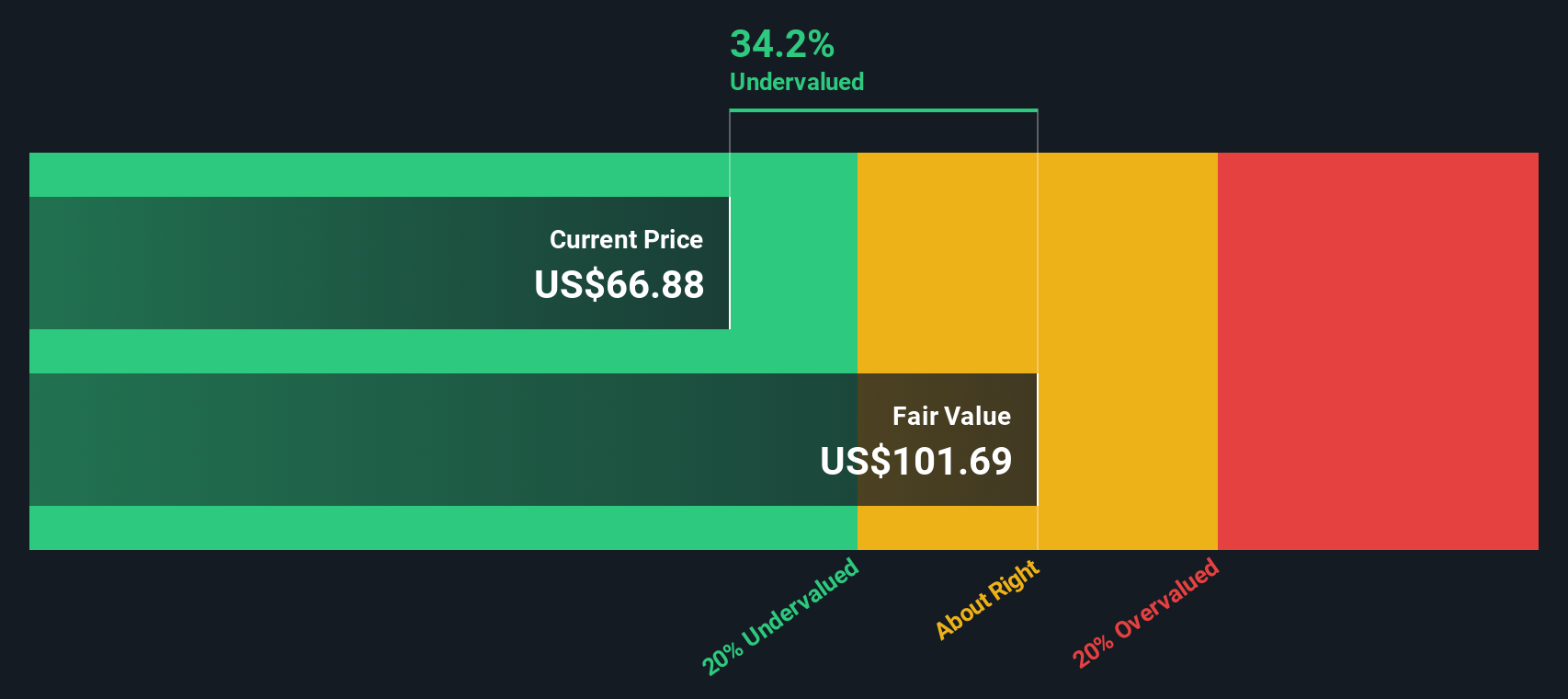

Looking at our DCF model, Frontdoor’s shares appear undervalued by a significant margin. The SWS DCF fair value stands at $99.64, which is well above the current price of $65.85. This discrepancy raises an important question: which method better captures the company’s long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Frontdoor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Frontdoor Narrative

If you prefer to analyze the numbers or shape your own perspective, the tools are at your fingertips to build a custom view in just a few minutes. Do it your way

A great starting point for your Frontdoor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Upgrade your investing strategy and get ahead of the curve with screens filtered for genuine opportunity and growth. Don’t limit yourself—take the next step and see what you're missing.

- Unlock potential double-digit returns with these 890 undervalued stocks based on cash flows, which reveals companies that the market may have overlooked.

- Boost your portfolio’s income by tapping into these 19 dividend stocks with yields > 3% for stocks with strong yields and consistent payouts.

- Ride the next wave of disruptive innovation by checking out these 26 AI penny stocks, featuring businesses harnessing artificial intelligence for significant growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTDR

Frontdoor

Provides home and new home structural warranties in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026