- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Is Expedia Still a Bargain After Recent Tech Partnerships and 31% Share Surge?

Reviewed by Bailey Pemberton

- Wondering whether Expedia Group is still a good deal after its meteoric run? You are not alone. Getting a handle on its true value could make all the difference for your next move.

- The stock has seen a roller coaster recently, surging 13.7% over the past month and climbing an impressive 31.7% year-to-date. However, it dipped 8.9% in the last week.

- Recent headlines highlight Expedia Group's new tech partnerships and a continued focus on streamlining its travel booking platforms. These developments have driven investor optimism, fueling the stock’s upward momentum and adding new dimensions to its growth outlook.

- When we run Expedia Group through our checklist, it scores a 4 out of 6 for undervaluation. Next, we will break down what this score means, how different valuation approaches line up, and why there may be an even better way to judge value than simply running the numbers.

Approach 1: Expedia Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors assess what the business is really worth, beyond just current market moves.

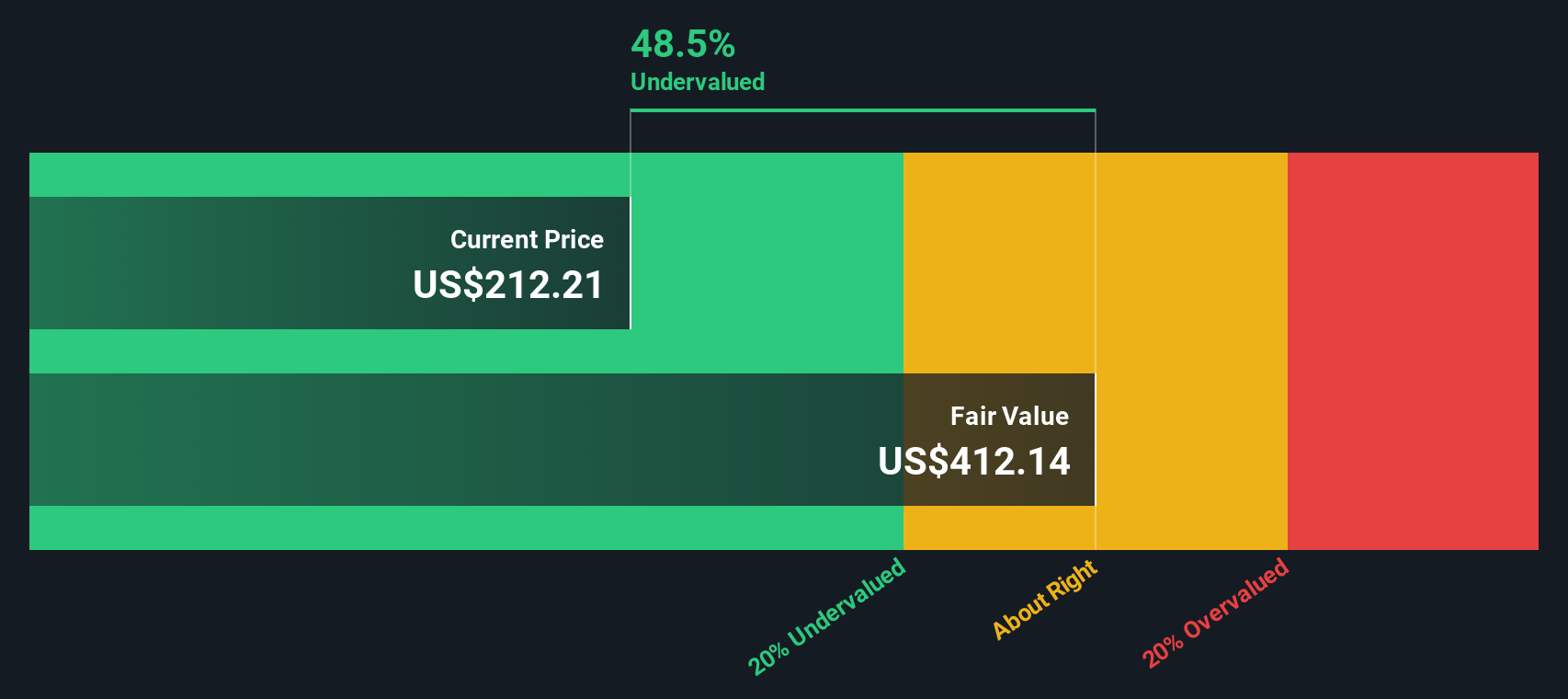

For Expedia Group, recent numbers show a trailing twelve-month Free Cash Flow (FCF) of $2.93 billion. Analysts provide projections out to 2029, estimating annual FCF will grow gradually to about $3.25 billion in five years. Beyond those estimates, Simply Wall St extrapolates continued FCF growth, with projections reaching approximately $3.94 billion by 2035. All cash flows are calculated in US dollars.

Applying this model and discounting the projected cash flows back to the present results in an estimated intrinsic value of $438.87 per share. Based on this calculation, Expedia Group stock may be trading at roughly a 44.4% discount to its fair value using the DCF approach. This suggests it is significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Expedia Group is undervalued by 44.4%. Track this in your watchlist or portfolio, or discover 897 more undervalued stocks based on cash flows.

Approach 2: Expedia Group Price vs Earnings

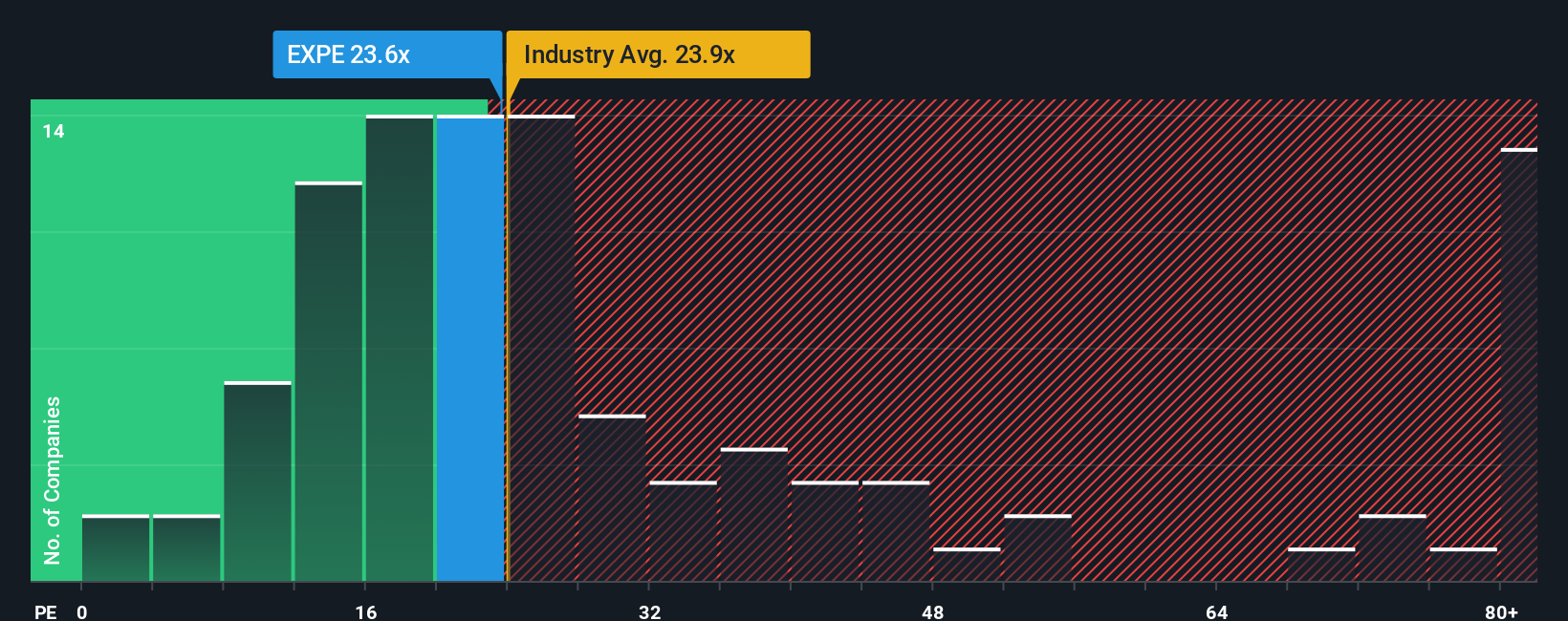

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Expedia Group because it connects a firm's share price directly to its actual earnings. For investors, it’s a quick way to gauge how much the market is willing to pay for every dollar of company profit, making it especially relevant when steady profits are being delivered.

While the “right” PE ratio varies, it typically grows alongside higher earnings growth prospects but should shrink for riskier businesses or those in lower-growth industries. Comparing Expedia Group's PE ratio of 21.6x to the Hospitality industry average of 20.7x and the peer average of 28.8x, the stock trades slightly above the broader sector but well below the tight group of direct competitors.

Simply Wall St's proprietary “Fair Ratio” estimates what a suitable PE multiple should be given a company’s earnings growth, risk profile, profit margins, market cap, and industry context. Unlike a simple benchmark comparison, the Fair Ratio offers a more personalized evaluation by factoring in all these moving parts rather than relying solely on broad averages.

For Expedia Group, the Fair Ratio is calculated at 29.9x compared to its current 21.6x. This sizeable gap suggests the market is not fully valuing potential earnings growth and company strengths reflected by the Fair Ratio framework.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Expedia Group Narrative

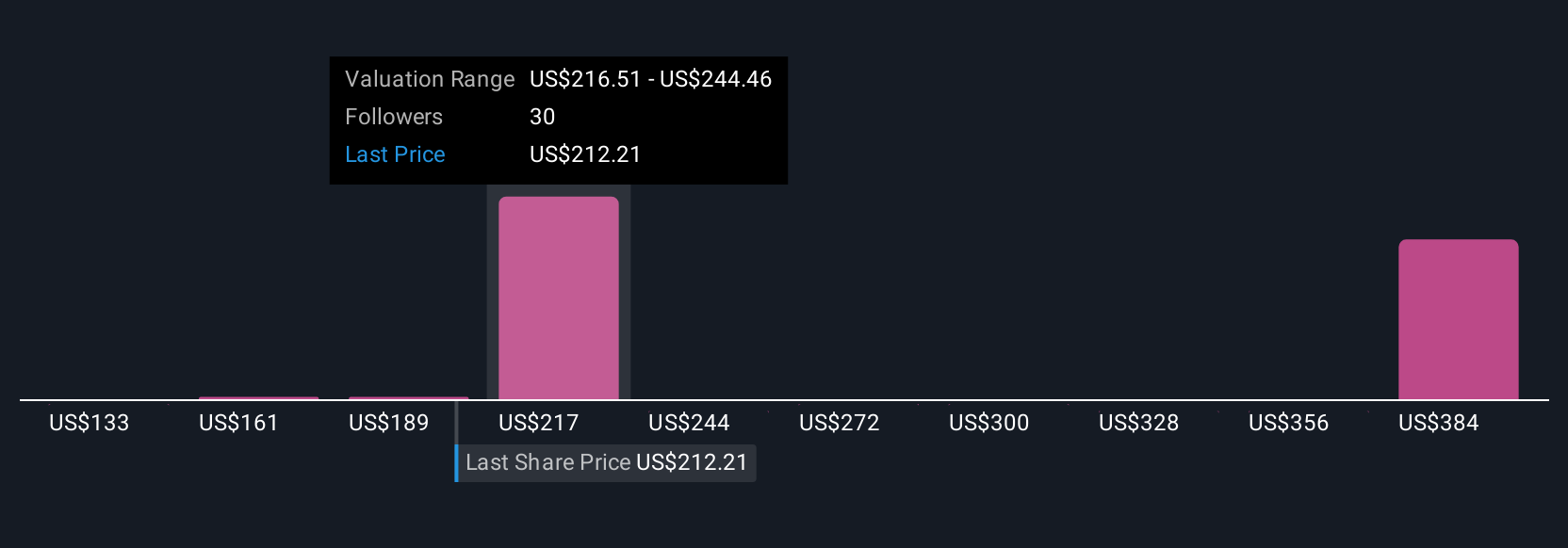

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way to make your investment decision more personal and insightful: it connects your own perspective or story about Expedia Group to your financial estimates and, ultimately, to your fair value for the company.

With Narratives on Simply Wall St's Community page, millions of investors can easily craft and compare these stories. Investors can link what they believe about a company's future, such as growth drivers, risks, or industry shifts, to financial forecasts and a resulting fair value. This means that instead of just crunching numbers, you clarify what you think will happen, see how it translates into future revenue or earnings, and instantly view whether the current share price suggests opportunity or caution compared to your fair value.

Narratives are always dynamic and automatically update as new information like news or earnings emerges, so your investment thesis stays relevant. For example, one investor might create an optimistic Expedia Group Narrative based on accelerating AI adoption and robust international expansion, leading to a fair value estimate of $290 per share. Another, more cautious investor might focus on travel slowdowns and risk, assigning fair value as low as $168 per share. Which story fits your view best?

Do you think there's more to the story for Expedia Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives