- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia Group (EXPE): Exploring Current Valuation After Strong Three-Year Shareholder Returns

Reviewed by Simply Wall St

See our latest analysis for Expedia Group.

Expedia Group’s solid upward momentum in 2024 continues to catch attention, especially after this year’s 29.5% year-to-date share price return. While the past week was choppy, longer-term, total shareholder returns of 35% over the last year and nearly 140% in three years highlight persistent confidence in the business and its growth potential.

If stories like Expedia’s shift have you watching what’s next, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With Expedia trading near its highs and showing strong growth, the key question is whether all that future potential is already reflected in the price, or if there is still room for investors to capitalize on further upside.

Most Popular Narrative: 9.4% Undervalued

Expedia Group’s most-followed valuation narrative values the shares at $264.91, around 9% above the last close of $240. This sets the stage for a forward-looking debate about just what is fueling the company's market momentum.

Ongoing shift in consumer preference toward digital and mobile channels, paired with increased adoption of AI-powered search and personalization on Expedia's platforms, is driving higher conversion rates and improved retention. This should support sustained revenue growth and margin expansion. Unified global technology platform and greater automation (including AI-powered developer tools and personalized insurance products) are already producing faster feature delivery, improved customer experience, and reduced operating costs. These developments are expected to further expand EBITDA margins and benefit earnings over the next several years.

Want to see what sets this valuation apart? There is a bold set of growth projections behind that number and a profit profile reminiscent of industry disruptors. The biggest upside surprise hides in their future margin game and the scale of ongoing tech investments. Curious how the numbers play out? Dive in to uncover the critical financial leaps this narrative is betting on.

Result: Fair Value of $264.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. travel demand or tougher competition from rival platforms could quickly undermine Expedia’s momentum and challenge these optimistic forecasts.

Find out about the key risks to this Expedia Group narrative.

Another View: What Do Earnings Multiples Say?

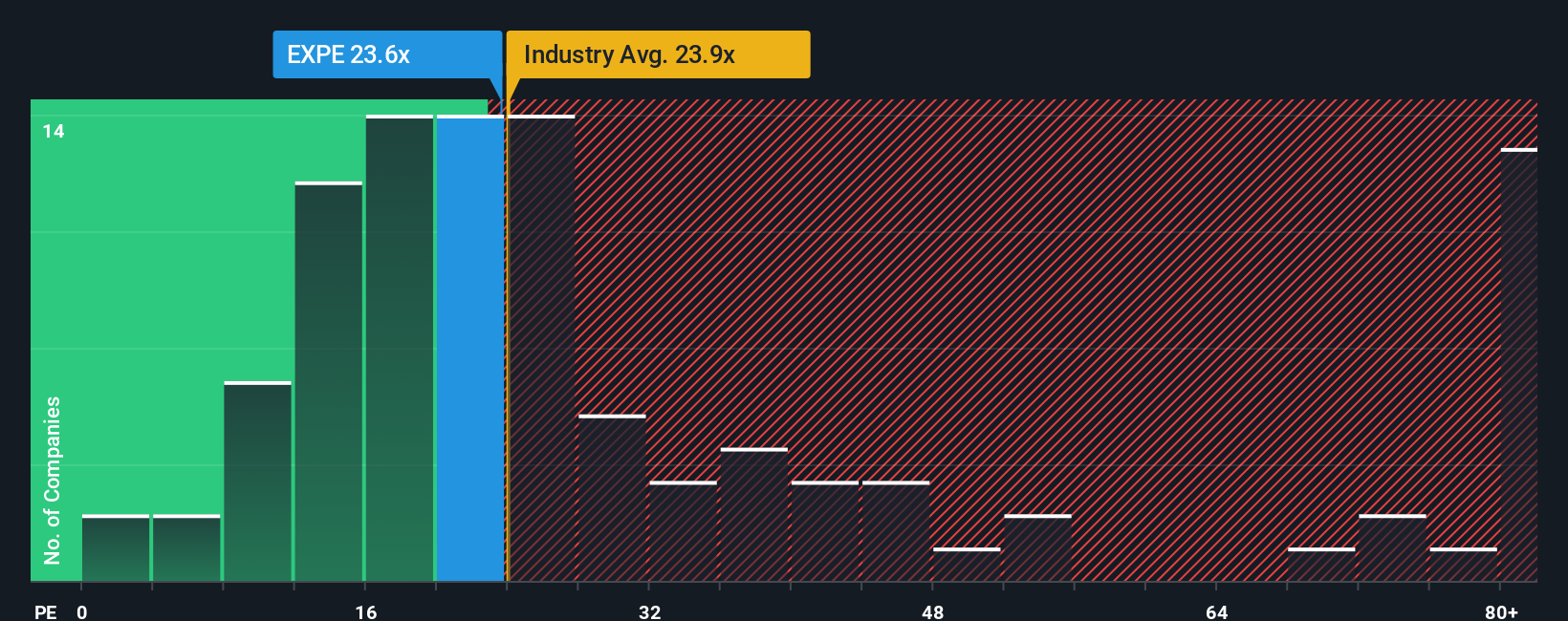

Looking at Expedia’s valuation through the lens of its price-to-earnings ratio, the shares trade at 21.2x, slightly above the US Hospitality industry average of 20.8x but well below peers averaging 29.1x. Compared to our fair ratio estimate of 29.6x, there is room for the market to reconsider its stance. Does this suggest overlooked upside, or premium risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expedia Group Narrative

If this perspective doesn't quite resonate, or you want to chart your own course, you can quickly craft your own data-driven narrative. Do it your way with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Expedia Group.

Looking for more investment ideas?

Smart investors know new opportunities are just a click away. Don’t let the next breakout stock or hidden value slip through your fingers. Explore these handpicked ideas now.

- Capture attractive yields and steady income streams by checking out these 18 dividend stocks with yields > 3% offering payouts above 3% and robust fundamentals.

- Catch the wave of market disruption by spotting winners early among these 27 AI penny stocks built for the smart technology boom.

- Unlock value with these 905 undervalued stocks based on cash flows chosen for their strong cash flows and untapped upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives