- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia (EXPE): Exploring Valuation as Share Price Nears Analyst Targets

Reviewed by Simply Wall St

Expedia Group (EXPE) shares continue to attract attention as investors survey recent performance and valuation. Over the past month, the stock has gained 1%, and its annual return now stands at 43%.

See our latest analysis for Expedia Group.

With Expedia Group’s share price up more than 21% so far this year and the 1-year total return at nearly 43%, momentum is clearly building as investors weigh both the company’s rebound and the broader travel sector tailwinds.

If Expedia’s climb has you thinking about other strong performers, this could be the perfect moment to discover fast growing stocks with high insider ownership

With such impressive returns and the share price hovering just below analyst targets, the question remains: is Expedia Group undervalued at this level, or is the market already factoring in all of its future growth potential?

Most Popular Narrative: 0% Overvalued

Expedia Group’s current fair value according to the most widely followed narrative stands at $224.30, almost identical to the last close of $225.30. This signals that the market is already closely reflecting the fundamentals and future expectations priced in by consensus analysts.

“Unified global technology platform and greater automation (including AI-powered developer tools and personalized insurance products) are already producing faster feature delivery, improved customer experience, and reduced operating costs. These factors are expected to further expand EBITDA margins and benefit earnings over the next several years.”

Curious what powers this razor-thin fair value? Look beneath the surface and you’ll find bold gains projected in both profit margins and top-line growth. Don’t miss the story behind the numbers. See what consensus believes is driving these estimates and how it could change the trajectory for Expedia Group.

Result: Fair Value of $224.30 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in the U.S. travel market and competitive pressures from rival platforms could still cloud Expedia’s growth outlook in the coming periods.

Find out about the key risks to this Expedia Group narrative.

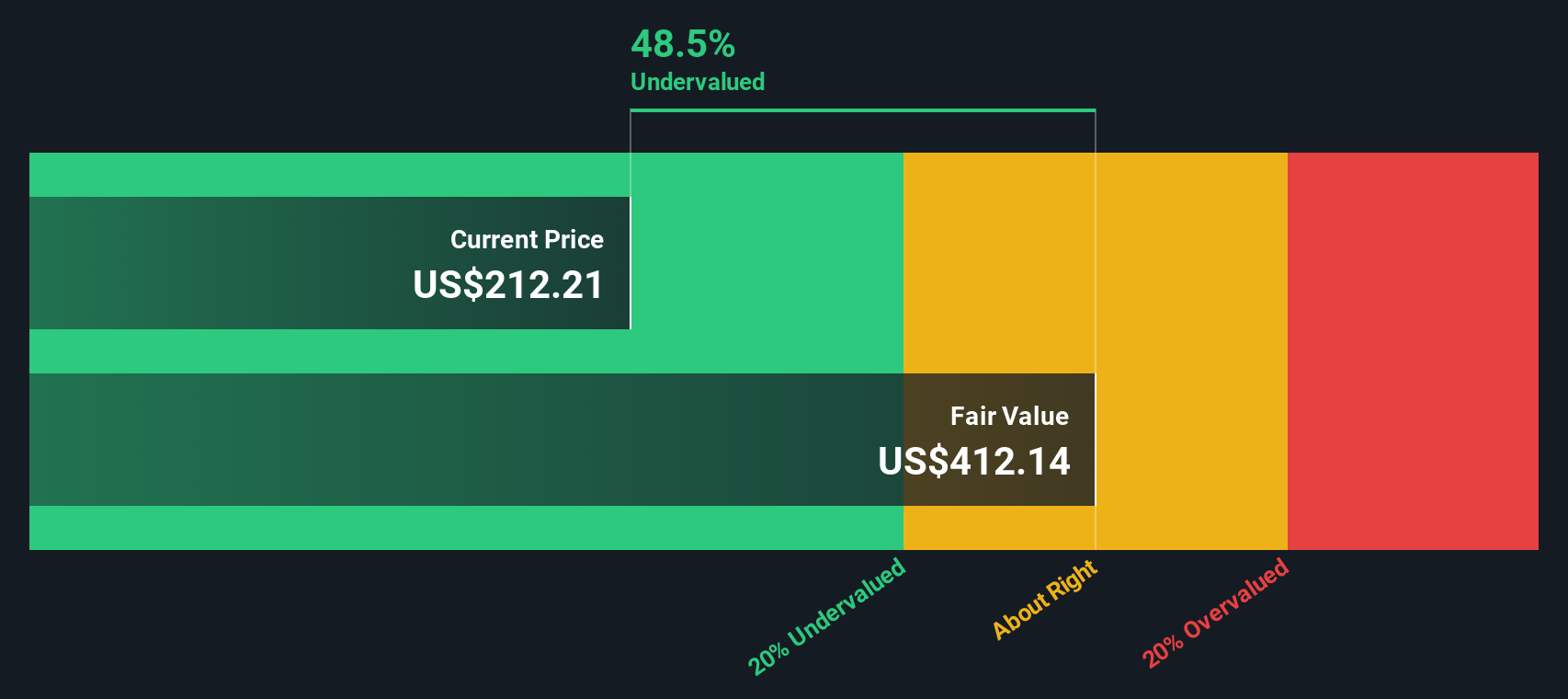

Another View: SWS DCF Model Sees Deep Value

While many investors rely on typical price-to-earnings ratios, our DCF model paints a very different picture. It estimates Expedia Group’s fair value at $424.16 per share, nearly double the current price. This big gap raises a critical question: are current market assumptions missing something fundamental about Expedia’s long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Expedia Group Narrative

If you see Expedia Group differently, or want to dig into the data yourself, building your own take is easy and quick. Do it your way

A great starting point for your Expedia Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Expedia Group and leave potential gains on the table. Make your next move with exciting opportunities targeted to your investing style:

- Uncover new sources of steady income by checking out these 21 dividend stocks with yields > 3% with yields topping 3% for smart cash flow growth.

- Tap into promising companies set for long-term success by researching these 864 undervalued stocks based on cash flows, where undervalued prices meet strong future prospects.

- Experience innovation at its finest when you look into these 28 quantum computing stocks, at the forefront of tomorrow’s computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives