- United States

- /

- Consumer Services

- /

- NasdaqGS:EWCZ

What European Wax Center, Inc.'s (NASDAQ:EWCZ) P/S Is Not Telling You

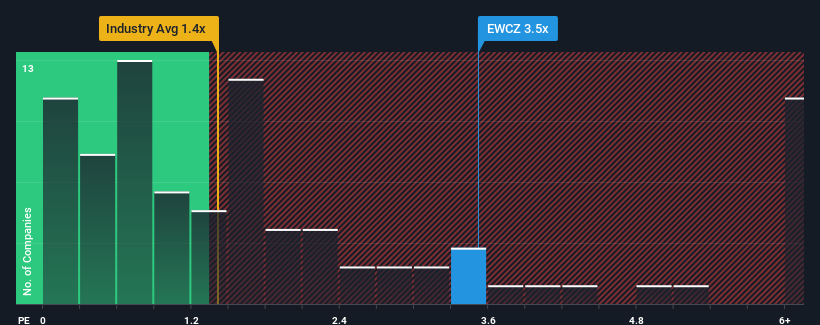

When close to half the companies in the Consumer Services industry in the United States have price-to-sales ratios (or "P/S") below 1.4x, you may consider European Wax Center, Inc. (NASDAQ:EWCZ) as a stock to avoid entirely with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for European Wax Center

How European Wax Center Has Been Performing

Recent revenue growth for European Wax Center has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on European Wax Center will help you uncover what's on the horizon.How Is European Wax Center's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as European Wax Center's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.4% last year. The latest three year period has also seen an excellent 111% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 9.2% each year over the next three years. With the industry predicted to deliver 16% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it concerning that European Wax Center is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that European Wax Center currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about this 1 warning sign we've spotted with European Wax Center.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if European Wax Center might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EWCZ

European Wax Center

Operates as the franchisor and operator of out-of-home waxing services in the United States.

Reasonable growth potential and fair value.

Market Insights

Community Narratives