- United States

- /

- Healthcare Services

- /

- NYSE:HNGE

June 2025's Top Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but over the past 12 months, it has risen by 9.9%, with earnings forecasted to grow by 15% annually. In this context of steady growth and optimistic forecasts, companies with significant insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 120.2% |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| Hesai Group (HSAI) | 21.3% | 45.2% |

| FTC Solar (FTCI) | 27.7% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Eagle Financial Services (EFSI) | 15.9% | 82.8% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

We'll examine a selection from our screener results.

Duolingo (DUOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Duolingo, Inc. is a mobile learning platform that operates in the United States, the United Kingdom, and internationally with a market cap of $21.65 billion.

Operations: The company's revenue primarily comes from its educational software segment, which generated $811.21 million.

Insider Ownership: 14.2%

Duolingo demonstrates strong growth potential with earnings expected to increase by 39.9% annually, outpacing the US market. Recent Q1 results showed sales of US$230.74 million, up from US$167.55 million a year ago, highlighting robust revenue growth. Despite substantial insider selling over the past three months, Duolingo's innovative expansion in language courses and community initiatives like Duo's Treehouse support its strategic growth trajectory and enhance its value proposition for global learners.

- Get an in-depth perspective on Duolingo's performance by reading our analyst estimates report here.

- The analysis detailed in our Duolingo valuation report hints at an inflated share price compared to its estimated value.

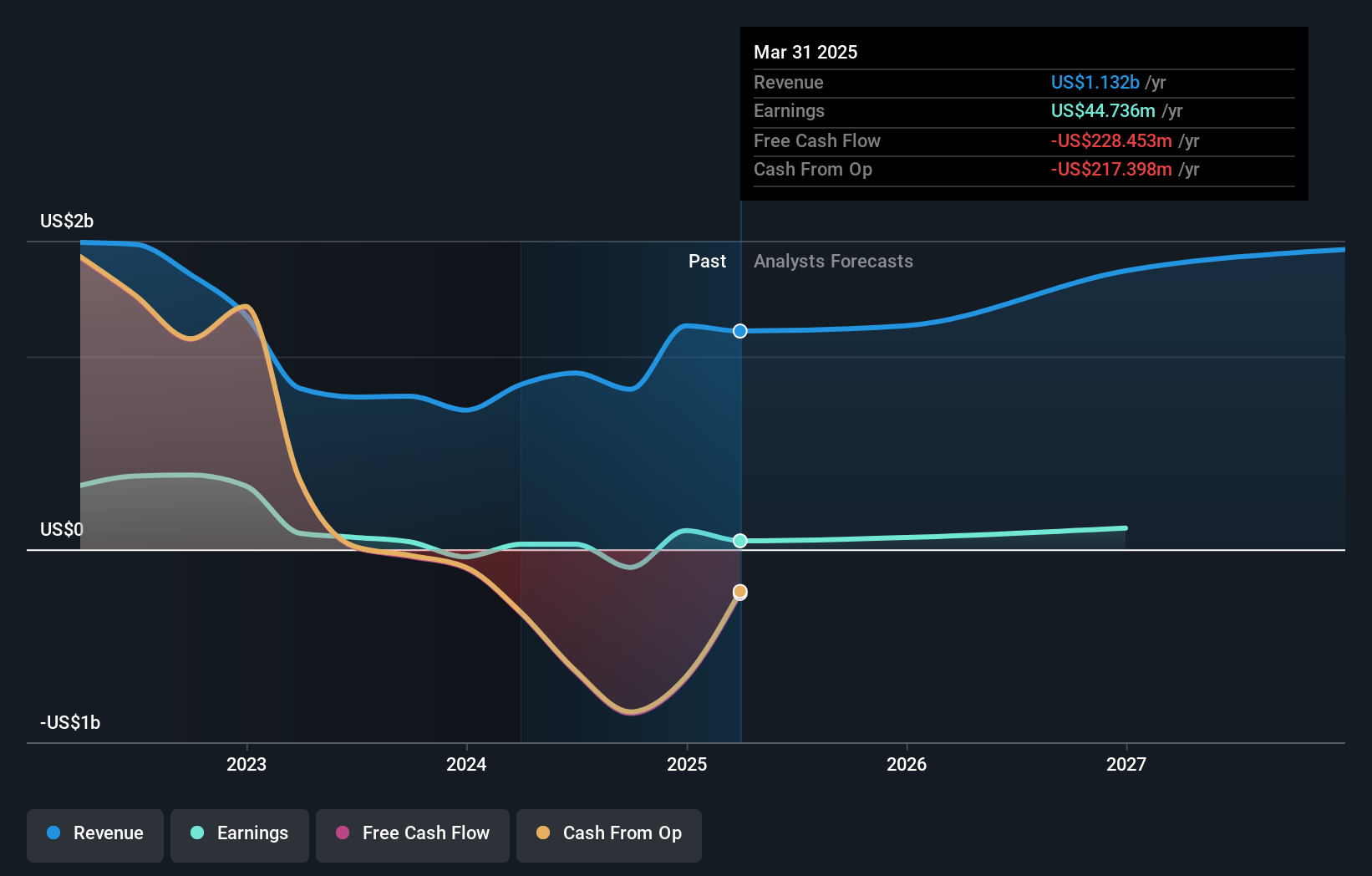

Guild Holdings (GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company, through its subsidiary, originates, sells, and services residential mortgage loans in the United States with a market cap of approximately $977.94 million.

Operations: The company's revenue is primarily derived from two segments: $828.98 million from origination and $153.36 million from servicing residential mortgage loans in the United States.

Insider Ownership: 11.4%

Guild Holdings is set to transition into a privately held entity following a US$1.3 billion acquisition by Bayview Asset Management, with no expected operational changes. Despite recent revenue declines and net losses, the company forecasts robust earnings growth of 52.4% annually, outpacing the broader market's growth rate. However, its financial position remains strained due to insufficient earnings coverage for interest payments. Guild's stock trades significantly below estimated fair value, presenting potential upside opportunities for investors.

- Delve into the full analysis future growth report here for a deeper understanding of Guild Holdings.

- Upon reviewing our latest valuation report, Guild Holdings' share price might be too pessimistic.

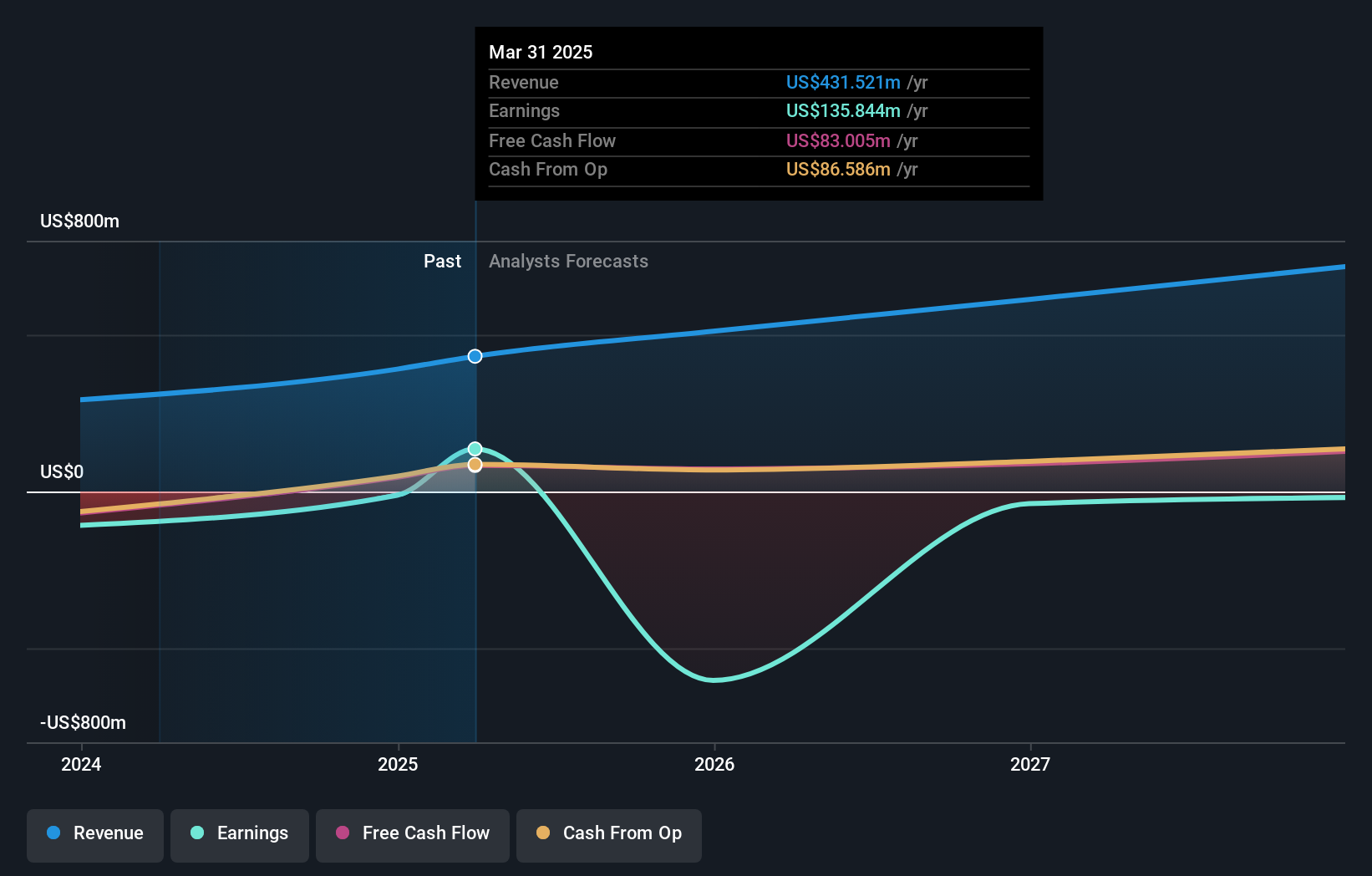

Hinge Health (HNGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hinge Health, Inc. develops healthcare software focused on joint and muscle health, with a market cap of $2.96 billion.

Operations: The company generates revenue of $431.52 million from its healthcare software segment.

Insider Ownership: 25.8%

Hinge Health's recent IPO raised US$437.31 million, positioning it for substantial growth in the musculoskeletal care sector. The company launched HingeSelect, integrating digital and in-person care to reduce costs by up to 50% below PPO rates. With forecasted revenue growth of 15.6% per year and significant earnings growth above market averages, Hinge Health is expanding its network through partnerships with major health plans like Cigna, enhancing access to comprehensive MSK care solutions.

- Click here and access our complete growth analysis report to understand the dynamics of Hinge Health.

- Our valuation report unveils the possibility Hinge Health's shares may be trading at a discount.

Next Steps

- Click here to access our complete index of 192 Fast Growing US Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hinge Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNGE

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives