- United States

- /

- Consumer Services

- /

- NasdaqGS:DRVN

Will Driven Brands’ (DRVN) Post-Car Wash Revenue Guidance Shift Change Its Core Investment Narrative?

Reviewed by Sasha Jovanovic

- Driven Brands Holdings Inc. previously updated its 2025 earnings guidance, projecting revenue of US$1.85 billion to US$1.87 billion from continuing operations after reclassifying its international car wash arm as discontinued following a divestiture.

- This shift sharpens the focus on the core ongoing business, giving investors a clearer view of future revenue streams without the divested car wash operations.

- Next, we’ll examine how this revised revenue outlook, reshaped by the international car wash divestiture, affects Driven Brands’ broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Driven Brands Holdings Investment Narrative Recap

To own Driven Brands, you need to believe its core U.S. and Canadian auto service businesses can steadily compound revenue as vehicles age and miles driven stay resilient. The updated 2025 guidance, which now excludes the divested international car wash operations, mainly clarifies the near term picture rather than changing the key catalyst of expanding Take 5 and related services. The biggest current risk remains pressure on same store sales in Franchise Brands and collision, which could limit margin progress.

The most relevant recent update is the Q3 2025 earnings release, which showed higher revenue and a swing back to profitability compared with the prior year, alongside earlier 2025 guidance for modest same store sales growth and 175 to 200 net new stores. Viewed together with the latest guidance revision, these data points give investors a cleaner baseline to assess whether store growth and mix shift into higher margin services can offset ongoing headwinds in more discretionary segments.

But while the guidance reset simplifies the story, investors still need to factor in the risk that weak Franchise Brands trends could...

Read the full narrative on Driven Brands Holdings (it's free!)

Driven Brands Holdings’ narrative projects $2.6 billion revenue and $250.1 million earnings by 2028.

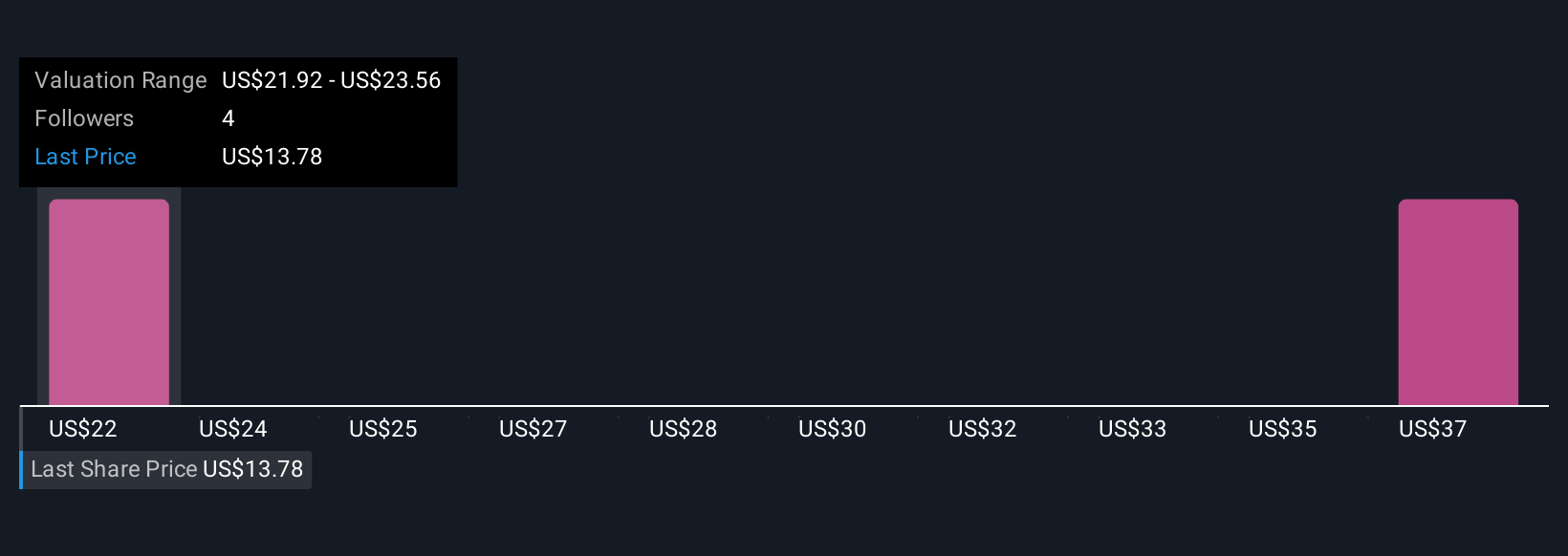

Uncover how Driven Brands Holdings' forecasts yield a $21.92 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$21.92 to US$39.16, underscoring how far apart individual views can be. You can weigh these against the core catalyst of Take 5 expansion, which many see as crucial for offsetting softer same store sales elsewhere in the business over time.

Explore 2 other fair value estimates on Driven Brands Holdings - why the stock might be worth just $21.92!

Build Your Own Driven Brands Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Driven Brands Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Driven Brands Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Driven Brands Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRVN

Driven Brands Holdings

Provides automotive services to retail and commercial customers in the United States, Canada, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026