- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

What Does Domino’s Expansion Into New Markets Mean for Its Stock Value in 2025?

Reviewed by Bailey Pemberton

- If you’ve found yourself wondering whether Domino's Pizza stock is a tasty bargain or overpriced indulgence, you’re not alone. Let’s dive into what’s driving all the curiosity around its current value.

- The stock has been anything but flat lately, with a 4.0% gain over the last week and a modest 0.7% bump in the past month. However, it’s still down 4.4% year-to-date and 10.7% over the past 12 months.

- Recent headlines have focused on Domino’s expansion into new markets and the company’s continued push into technology-driven delivery, sparking fresh conversations about their long-term growth prospects. Industry chatter has also centered on shifting consumer habits and competitive pressures from other food delivery platforms, both of which help explain the recent volatility.

- Our current valuation checks give Domino’s a score of 0 out of 6, suggesting that the market may be pricing in optimism or missing something important. Next, we’ll break down the pros and cons of different valuation approaches and reveal a smarter way to decide if this stock is worth a spot on your plate.

Domino's Pizza scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Domino's Pizza Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth by projecting future cash flows and discounting them back to today's value. This method provides a grounded view based on the company's actual cash-generating ability over time, rather than just recent profits or market hype.

For Domino's Pizza, the latest reported Free Cash Flow is $622 million. Analyst forecasts provide cash flow estimates for the next few years, growing to a projected $787 million by 2028. In extended projections from Simply Wall St, Free Cash Flow is estimated to reach around $927 million in 2035. Most long-term figures are generated from model extrapolations rather than analyst estimates.

Using these projections and discounting them to their present value, the DCF model calculates an intrinsic fair value for Domino’s Pizza of $352.50 per share. This intrinsic value is 17.9% below the current market price, which suggests that the stock may be overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Domino's Pizza may be overvalued by 17.9%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

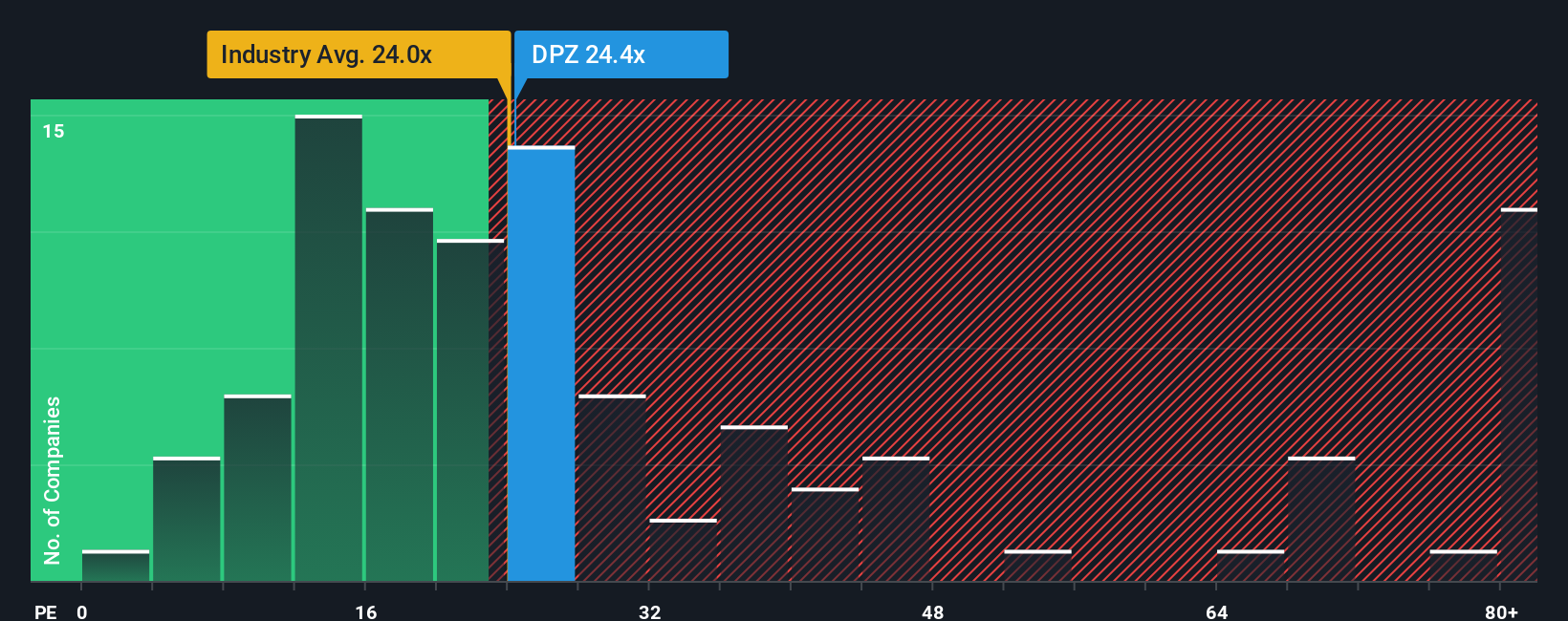

Approach 2: Domino's Pizza Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a solid way to value profitable companies like Domino’s Pizza, since it directly reflects what investors are willing to pay today for a dollar of current earnings. The PE ratio is especially useful when a company has stable profits, providing a clear window into how growth expectations and risk shape its valuation. Higher growth companies or those with lower risks typically command elevated PE ratios, while challenges or uncertainty can push it down.

Currently, Domino’s Pizza trades at a PE ratio of 23.8x. That is almost exactly at par with its peer average of 23.7x and above the broader hospitality industry’s average of 21.4x. These benchmarks offer helpful context, but they do not capture all the factors unique to Domino’s, from its brand power to its market reach and earnings outlook.

This is where Simply Wall St’s Fair Ratio comes in. Instead of just comparing Domino's to its sector or similar companies, the Fair Ratio weighs things like earnings growth, profit margins, business size, and risk. For Domino’s, that Fair Ratio is calculated at 21.1x, indicating what a more custom-fit multiple for the stock should be given its fundamentals and outlook.

With Domino’s actual PE of 23.8x sitting only a little above the Fair Ratio, the stock appears to be valued about right by the market based on earnings. The slight premium is small enough that valuation is essentially balanced from this perspective.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Domino's Pizza Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personal story or perspective about a company. It is where you connect the dots between Domino’s Pizza’s business model, its future prospects, and your forecast for its value. Narratives go beyond simple numbers by helping you link Domino’s story, such as tech upgrades, menu expansion, or global trends, to a financial forecast and fair value estimate. This approach is both simple and powerful. It is available to everyone in the Community page on Simply Wall St, which is used by millions of investors worldwide.

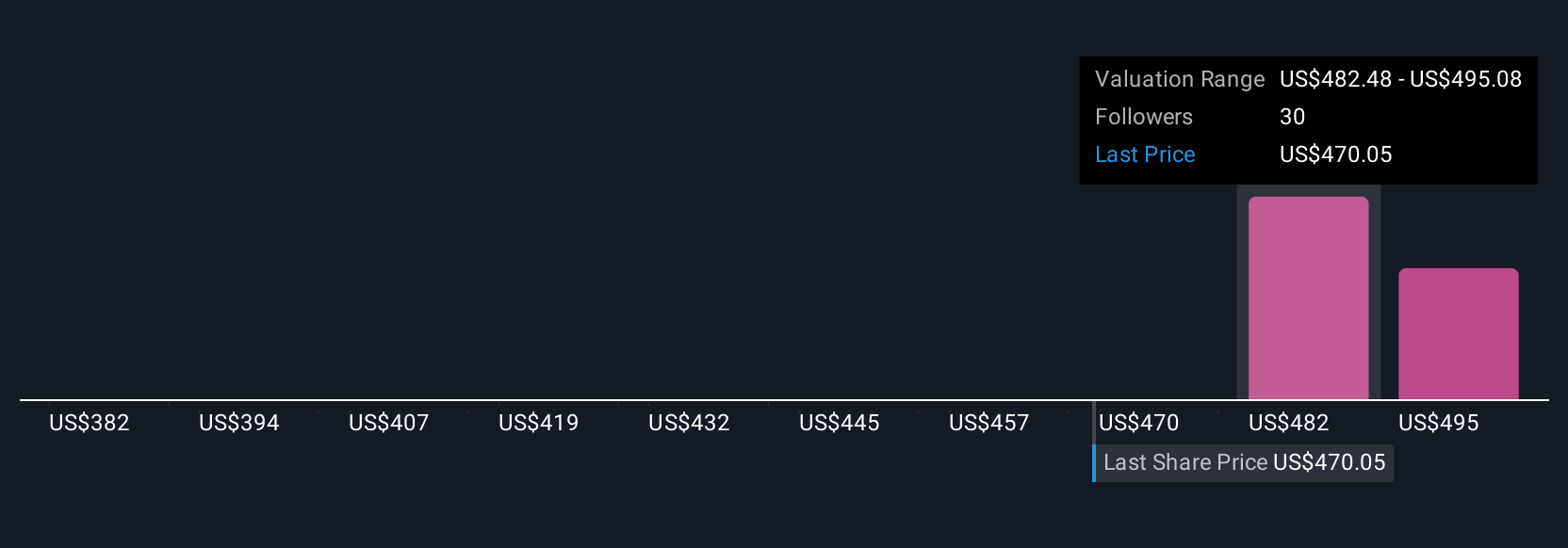

With Narratives, you can quickly see whether your outlook indicates Domino’s is undervalued or overvalued, as the platform compares your fair value with the latest share price and updates dynamically with new information like earnings or news events. For example, some investors may be optimistic, forecasting robust digital growth and assigning Domino’s a fair value as high as $594.00, while others, seeing more risks on the horizon, estimate a much lower fair value at $340.00. Narratives make it easy to compare these viewpoints, update your stance as Domino’s story evolves, and make confident, informed investment decisions.

Do you think there's more to the story for Domino's Pizza? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success