- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

How Menu Innovation and Aggregator Partnerships at Domino's (DPZ) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Domino's Pizza is regaining sales momentum in the U.S. after a slow start to 2025, fueled by new menu launches, expanded aggregator partnerships, and enhancements to its loyalty program.

- Management believes these changes are strengthening Domino’s position for long-term value creation, as the company gains market share in both delivery and carryout channels.

- We’ll explore how renewed U.S. demand and aggregator-driven growth shape Domino’s investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Domino's Pizza Investment Narrative Recap

To invest in Domino’s, you need to believe its digital and menu innovation, partnered with delivery aggregators, can continue fueling both US and global market share gains despite a mature pizza category and valuation concerns. Recent news of improving US sales momentum validates that short-term demand drivers remain intact, while the upcoming Q3 earnings report still stands as the most important near-term catalyst. The biggest risk, namely challenging future year-over-year comparisons after several new initiatives, remains material given recent growth has been driven by these product and partnership launches.

Among recent company announcements, the permanent addition of menu innovations like Stuffed Crust and new Bread Bite flavors is particularly relevant. Expanding the menu is part of Domino’s effort to boost transaction growth and help support same-store sales, a key metric for near-term performance, especially as aggregator distribution broadens and competitors also chase value-conscious consumers.

However, against these positive signals, it is worth noting that Domino's faces the potential for tougher comparisons ahead as...

Read the full narrative on Domino's Pizza (it's free!)

Domino's Pizza's narrative projects $5.6 billion revenue and $720.0 million earnings by 2028. This requires 5.5% yearly revenue growth and a $122.9 million earnings increase from $597.1 million.

Uncover how Domino's Pizza's forecasts yield a $509.24 fair value, a 18% upside to its current price.

Exploring Other Perspectives

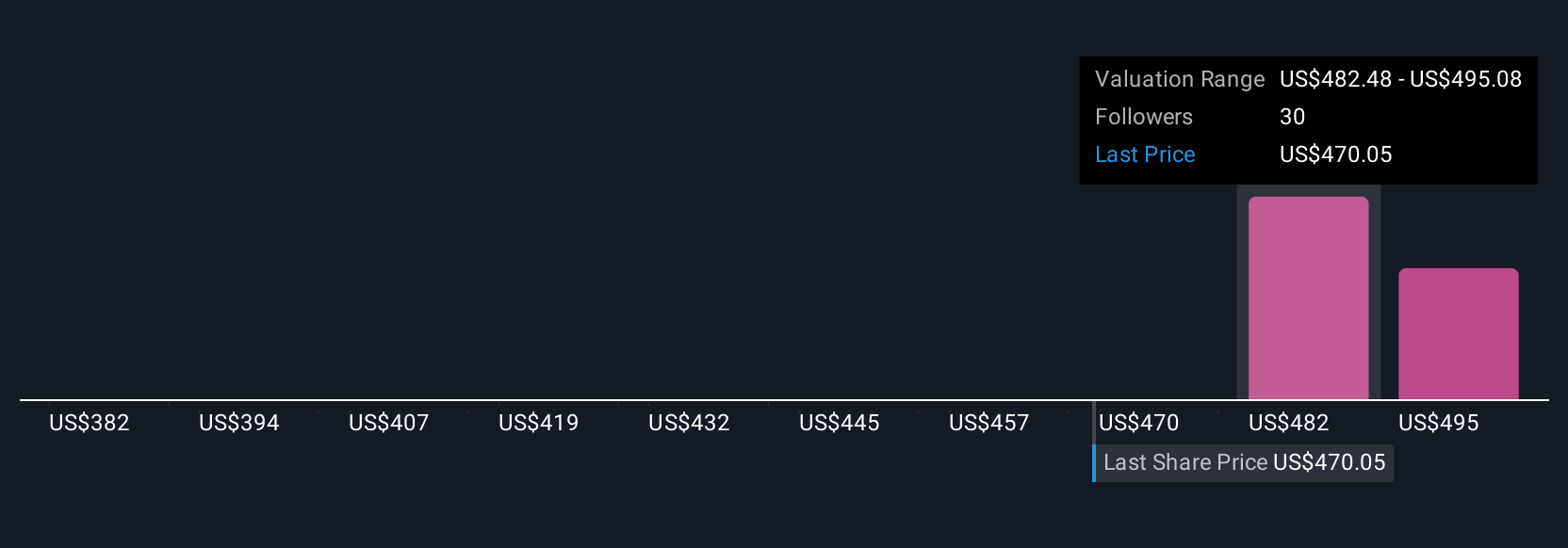

Simply Wall St Community members submitted four fair value estimates for Domino’s ranging from US$372.95 to US$509.24 per share, reflecting wide differences in growth expectations. While some are optimistic on aggregator-driven growth, others highlight that tough future comparisons could affect Domino’s longer-term earnings trajectory, so make sure to review the variety of opinions before making your own assessment.

Explore 4 other fair value estimates on Domino's Pizza - why the stock might be worth as much as 18% more than the current price!

Build Your Own Domino's Pizza Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Domino's Pizza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Domino's Pizza's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives