- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

Did Menu Innovation and New Partnerships Just Shift Domino’s (DPZ) Investment Narrative Ahead of Q3 Earnings?

Reviewed by Sasha Jovanovic

- Domino's Pizza is set to report its third-quarter earnings on October 14 following recent momentum in U.S. sales from new products and expanded aggregator partnerships.

- Despite these gains, concerns persist among investors over the company’s high valuation relative to its expected average earnings growth and macroeconomic uncertainty.

- We’ll explore how renewed U.S. sales growth from menu innovation and delivery partnerships may reshape Domino’s investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Domino's Pizza Investment Narrative Recap

To be a shareholder in Domino's Pizza today, you need conviction that the business can keep expanding both U.S. and international sales faster than competitors, mainly through tech-driven ordering, menu innovation, and new delivery partnerships. The upcoming third-quarter earnings report is the most important near-term event, as it will reveal if the recent uptick in U.S. sales meaningfully adds to growth and offsets ongoing concerns around Domino’s high valuation, though the long-term risk of a saturated pizza market remains unchanged by recent news.

Among Domino’s recent announcements, the launch of new Cinnamon and Garlic Bread Bites as part of its value-focused Mix & Match Deal stands out. This move directly supports the narrative that continuous menu innovation and value-driven promotions are central to driving traffic, sustaining demand after strong quarters, and may help with upcoming year-over-year comparisons as the company cycles past key one-time growth drivers.

However, investors should also recognize that despite short-term sales momentum, flat category growth and competitive pressures could still…

Read the full narrative on Domino's Pizza (it's free!)

Domino's Pizza's narrative projects $5.6 billion revenue and $720.0 million earnings by 2028. This requires 5.5% yearly revenue growth and a $122.9 million earnings increase from $597.1 million.

Uncover how Domino's Pizza's forecasts yield a $509.24 fair value, a 18% upside to its current price.

Exploring Other Perspectives

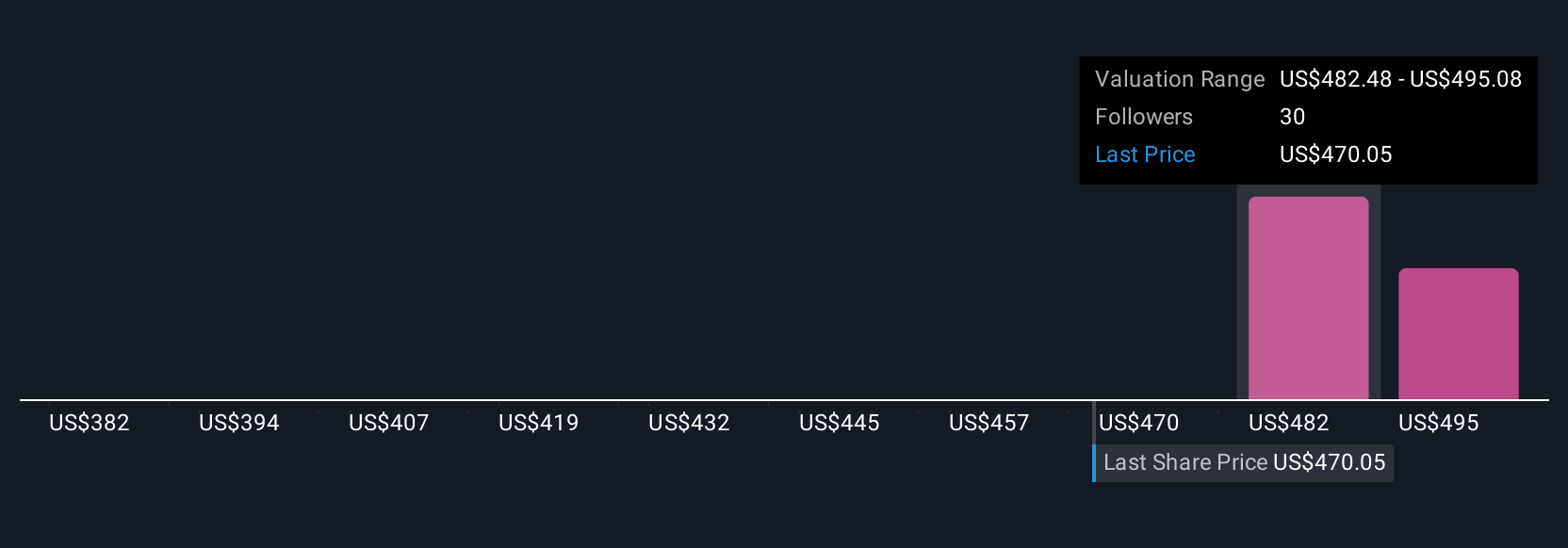

Simply Wall St Community members submitted four fair value estimates for Domino’s, ranging from US$372.95 to US$509.24 per share. While recent product launches support future growth claims, the mixed outlook for global pizza demand means investor opinions on Domino’s prospects continue to vary widely.

Explore 4 other fair value estimates on Domino's Pizza - why the stock might be worth 14% less than the current price!

Build Your Own Domino's Pizza Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Domino's Pizza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Domino's Pizza's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives