Stock Analysis

- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Who is Adjusting their DraftKings (NASDAQ:DKNG) Stake, Because of the M&A Bid

DraftKings (NASDAQ:DKNG) is having a volatile few months and the stock is currently down 20.79% from six months ago. It seems that the company is still establishing its business and would be hard to find a fundamental baseline. Sometimes, looking at large trading activity is more informative, especially for younger companies. That is why, we will review which large players are optimistic for the stock and get a better indication of the potential for DraftKings.

While we would never suggest that investors should base their decisions solely on what institutions and insiders have been doing, logic dictates you should pay some attention to whether they are buying or selling shares.

See our latest analysis for DraftKings

The Last 12 Months Of Insider Transactions At DraftKings

In the last twelve months, the biggest single sale by an insider was when the Director, Shalom Meckenzie, sold US$353m worth of shares at a price of US$50.83 per share. The sale was almost a year ago, but seeing an insider sell at around the current price of US$48.3 still presents a point of inquiry.

In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive). Shalom Meckenzie was the only individual insider to sell shares in the last twelve months and still retains 4.71% of the company as of 13 September 2021.

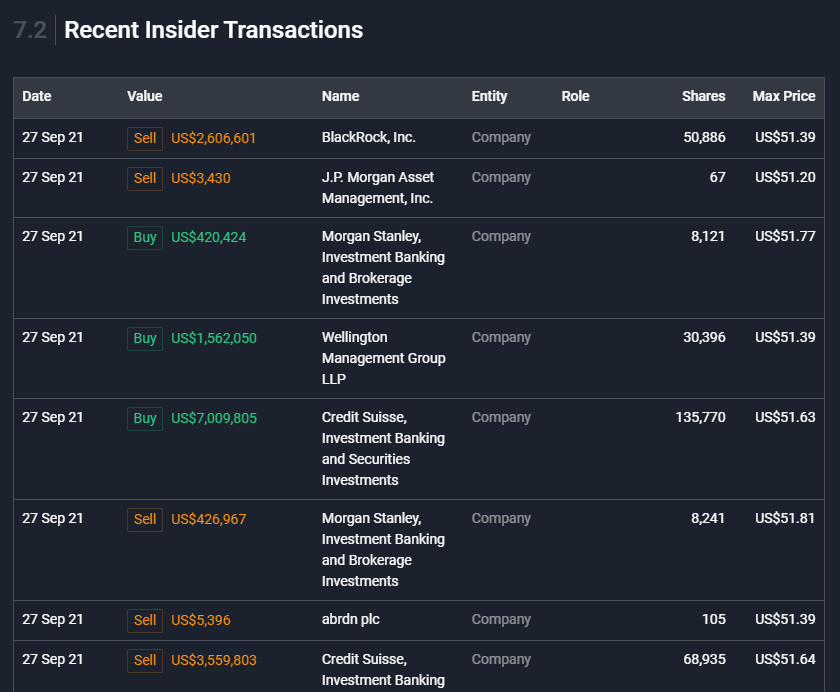

The company also saw some increased trading activity in the last three months. The balanced mix of buying and selling shows that companies are still fighting over the positioning on DraftKings, and we will also take a look at the biggest trades made recently.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

It seems that the large financial institutions are either adjusting or initiating new positions on DraftKings. In the small example below, we see bullish activity from Wellington Management Group and Credit Suisse, while BlackRock has sold some of their position.

The list below is not comprehensive, and we have the extended version in the DraftKings Report HERE.

Knowing which institutions are backing DraftKings helps with estimating the long term potential and expected volatility of the stock.

Mergers & Acquisitions Are The Possible Reason Behind The Trading Shift

The probable main reason behind all this trading may be the recent bid by Jason Robins, the company CEO, to acquire Entain (LSE:ENT). Mergers & Acquisitions can be messy as the offers change and are accepted or rejected by the target company, and this will no doubt change the price outlook for DraftKings in the next few days, especially because this is set out to be an acquisition of "equals" at least in market cap terms.

Acquisitions are hard to pull of, and it is even harder not to destroy value in the process, but if the CEO manages this bid well it can give DragtKings a foothold on a global scale.

Besides trading activity, we want to know if insiders and managers retain a position in their own company. This helps investors know if their interests are aligned with the interests of managers who have a healthy stake in the company, or if DraftKings is being run by career managers which may behave differently than shareholders would like.

Does DraftKings Boast High Insider Ownership?

DraftKings' insiders own about US$1.8b worth of shares (which is 8.7% of the company).

Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders, and possibly that management sees potential in their company to rise in stock price even more.

Key Takeaways

Large institutions are frequently adjusting their positions of DraftKings over the last few months. The Company may not have found its baseline yet and the volatility may be more suited for experienced traders rather than long-term investors.

Members of the board and management have a stake in the business, but the recent influx from financing may prompt them to adopt a more risky behavior, such as the bid from the CEO to acquire Entain (LSE:ENT) for BP£16b (DKNG is a US$19.5b Market Cap Company). The company must announce intentions by the 19th October, so put DraftKings in your watchlist to get updates!

We've discovered 3 warning signs that you should run your eye over to get a better picture of DraftKings.

Of course, DraftKings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're helping make it simple.

Find out whether DraftKings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential with excellent balance sheet.