- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

A Look at DraftKings (DKNG) Valuation Following Railbird Acquisition and Expansion Into Prediction Markets

Reviewed by Simply Wall St

DraftKings (DKNG) is entering the regulated prediction markets through its acquisition of Railbird Technologies, a federally licensed exchange. This move signals a clear shift beyond traditional sports betting for the company.

See our latest analysis for DraftKings.

DraftKings’ share price has been on a rollercoaster lately, with a sharp selloff over the past month but a notable rebound following the Railbird acquisition announcement. While the 1-year total shareholder return is slightly negative at -5.2%, the three-year figure remains impressive at nearly 138%. This reflects the company’s ability to capture long-term growth despite near-term volatility and rising competition.

If Railbird’s entry caught your attention, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With DraftKings trading at a notable discount to analyst targets, fresh strategic moves, and surging institutional interest, investors are left to wonder: is this a compelling entry point, or has the market already priced in the next leg of growth?

Most Popular Narrative: 32.2% Undervalued

At a last close of $34.70, the most followed narrative pegs DraftKings' fair value over $16 above current levels. This sets the stage for a bullish earnings growth story that challenges recent market pessimism.

Ongoing product innovation in live betting, in-game personalization, and AI-driven trading is increasing user engagement and dynamic pricing opportunities. This should boost average revenue per user (ARPU) and improve long-term earnings potential.

Want the inside track? The narrative’s math hinges on accelerating financial momentum, ambitious profit margin gains, and a valuation multiple that implies strong confidence in long-term growth. The real surprises are in the specific projections shaping that premium fair value. Ready to see what’s fueling this optimism?

Result: Fair Value of $51.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increasing regulatory scrutiny and intensifying competition from new prediction market entrants could quickly challenge the bullish outlook for DraftKings.

Find out about the key risks to this DraftKings narrative.

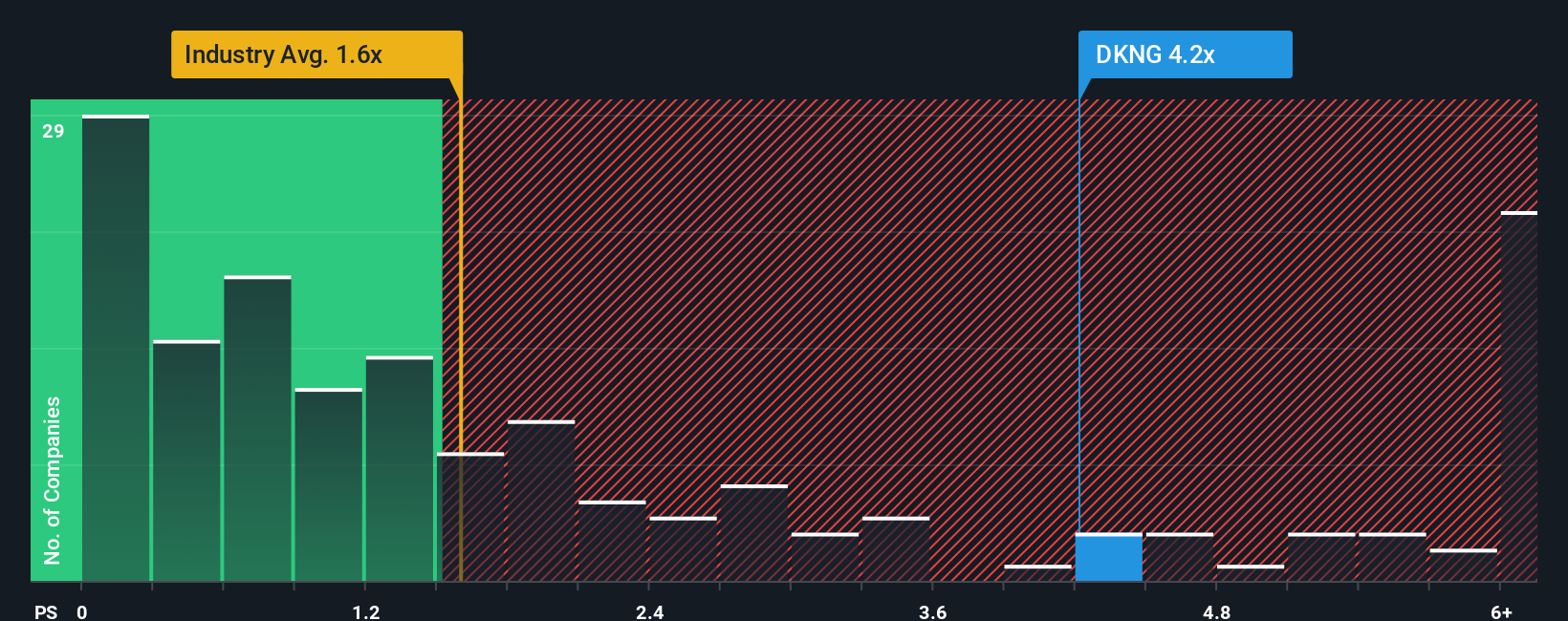

Another View: Multiples Suggest a Premium

Looking at price-to-sales ratios, DraftKings trades at 3.2x, higher than both the US Hospitality industry average of 1.7x and peer average of 2.8x. While the fair ratio sits at 3.5x, current pricing leaves little room for disappointment and increases valuation risk if growth slows. Does this premium reflect justified optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DraftKings Narrative

If you see things differently or want to dig deeper into DraftKings’ story, it’s quick and easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your DraftKings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t limit your investing to just one play; find untapped markets and strong growth paths waiting on the other side of your next click.

- Spot industry disruptors early when you browse these 26 AI penny stocks, which are poised to transform global markets with artificial intelligence breakthroughs.

- Boost your income potential by reviewing these 17 dividend stocks with yields > 3% that offer reliable yields and help steady your portfolio through changing markets.

- Tap into future-focused innovation by checking out these 27 quantum computing stocks, leading in quantum computing and cutting-edge technology advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives