- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

How DoorDash’s Expansion Moves Shape Investor Debates After Recent 7.5% Share Drop

Reviewed by Bailey Pemberton

If you own DoorDash shares or are contemplating a move, you are not alone. This stock has been stirring up plenty of conversations on Wall Street lately. After a white-hot run that sent shares up 434.1% over the last three years, recent weeks have tested the nerves of even the most steadfast believers. DoorDash slipped 7.5% in the past week and 4.0% over the last month, but don't be too quick to call it the end of the party. With shares still boasting a 47.8% gain year-to-date and a 67.1% return over the past twelve months, this is a stock that's delivered for anyone with patience (and perhaps a strong stomach).

What's driving the action? Broadly, investors are sizing up DoorDash amid changing consumer habits and new competitive moves among food delivery platforms. Amid regulatory rumblings over gig worker status and local fees, major headlines have highlighted DoorDash’s expansion into new retail categories and fresh partnerships with big-name grocers. These moves have fueled hopes for even wider appeal and improved margins. These dynamics have injected a mix of optimism and caution into the stock's valuation outlook.

Speaking of value, DoorDash currently earns a value score of 2, out of a possible 6, for being undervalued. This indicates there are definitely areas to scrutinize further. In the next section, we’ll break down the classic valuation checks and see how DoorDash stacks up, before exploring what could be a smarter way to judge if its stock is truly a bargain.

DoorDash scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: DoorDash Discounted Cash Flow (DCF) Analysis

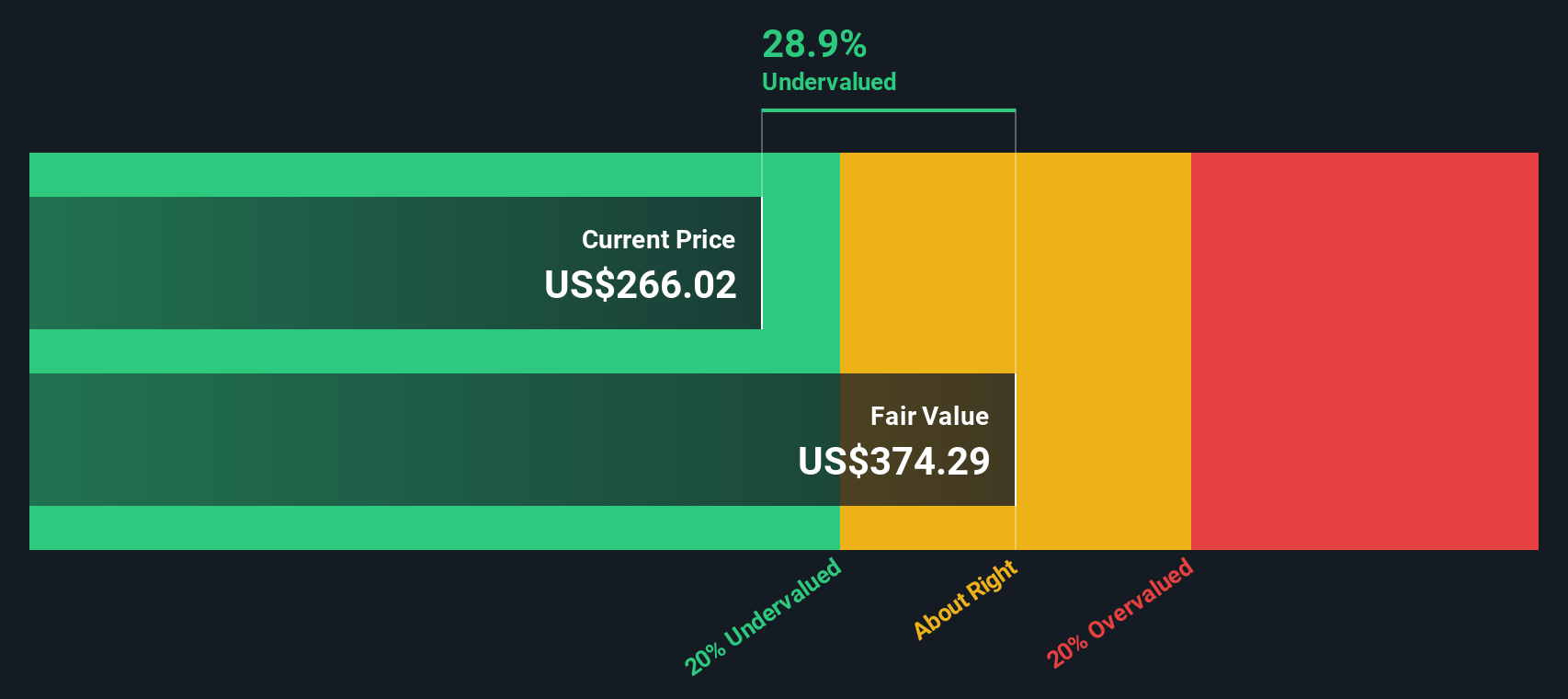

The Discounted Cash Flow (DCF) model is a classic valuation approach. It estimates the fair value of a company by projecting future cash flows and then discounting them back to today's value, giving investors a sense of what the business is really worth based on its expected future performance.

For DoorDash, recent data shows the company generated Free Cash Flow (FCF) of approximately $1.7 Billion over the last twelve months. Analyst estimates cover the next several years, predicting steady FCF growth, with projections reaching $3.5 Billion in 2026 and $7.5 Billion by 2029. Beyond these analyst estimates, DCF analysis continues the trajectory using forecast models and targets more than $12.2 Billion in annual FCF by 2035. All cash flows are based in US dollars.

Summing up these future flows, the DCF approach yields an intrinsic value of $372.18 per share. Compared to the current share price, this suggests DoorDash is trading at a 32.2% discount, making it appear undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DoorDash is undervalued by 32.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DoorDash Price vs Earnings (PE)

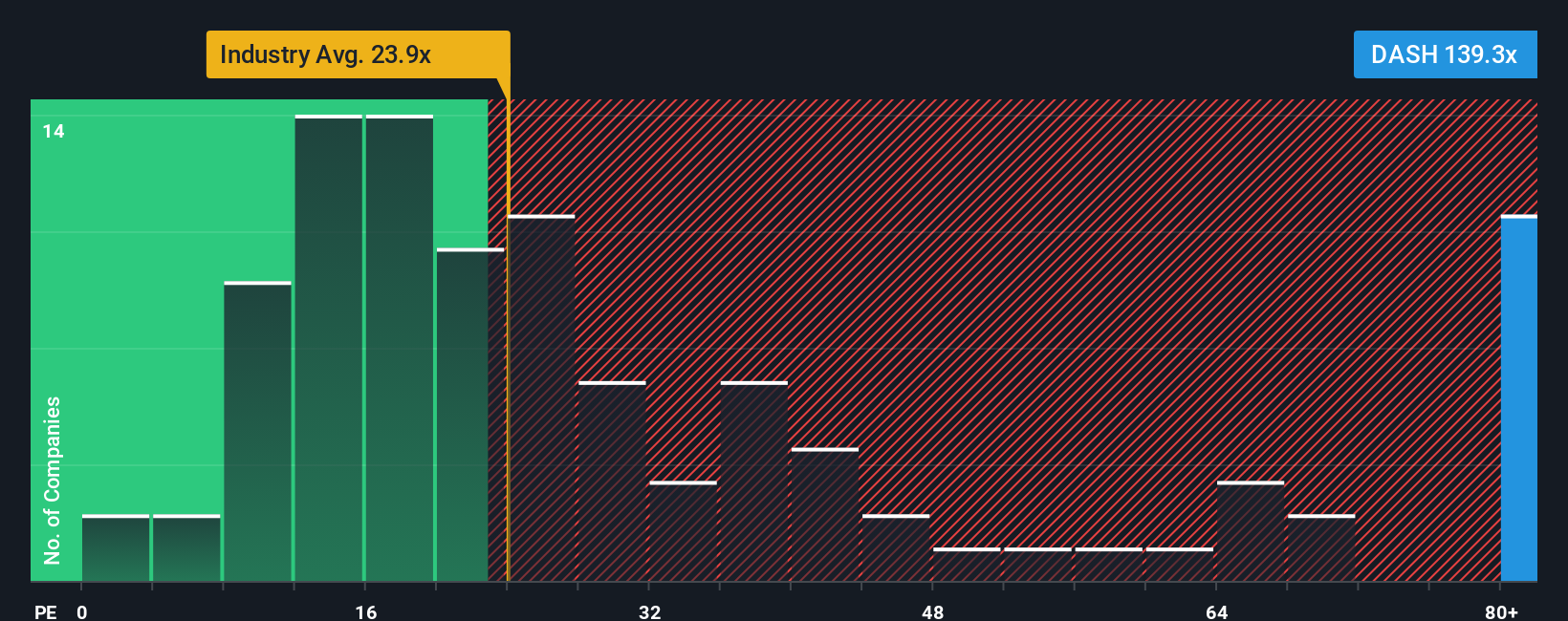

The Price-to-Earnings (PE) ratio is widely regarded as a solid valuation tool for companies that are generating steady profits. It essentially shows how much investors are willing to pay for each dollar of earnings, making it especially useful for assessing more mature, profitable businesses like DoorDash currently shows itself to be.

Of course, what’s considered a “fair” PE ratio varies. Companies expected to grow faster, or those with lower perceived risk, typically command higher PE ratios, while sluggish growth or higher risks can push the ratio lower. For DoorDash, the latest PE stands tall at 138x, notably ahead of the hospitality industry average of 24.25x and a significant jump over the peer group average of 32x. At first glance, this suggests DoorDash may be richly valued compared to its sector.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike basic industry or peer benchmarks, the Fair Ratio incorporates a more nuanced blend of growth outlook, risk factors, profit margins, industry positioning, and market cap to create a more tailored benchmark. For DoorDash, this Fair PE Ratio is estimated at 51.37x. Comparing that to the current market PE of 138x, DoorDash stock appears significantly overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DoorDash Narrative

Earlier, we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is essentially the story that you, as an investor, build around a company: it connects the set of facts and future expectations you believe in with a financial forecast, and ultimately a fair value estimate.

Unlike static scorecards, Narratives help you anchor your investment decisions by linking DoorDash’s business journey, such as expansion moves, technology bets, or regulatory changes, to your personal forecasts for revenue, profit margins, and earnings.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool used by millions of investors, empowering you to visualize and update your own view of a company’s value as fresh news or earnings are released.

This approach makes it much simpler to decide when to buy or sell, because you can instantly compare your Narrative’s dynamically updated Fair Value to the current price and see how your assumptions stack up versus other real investors.

For example, some DoorDash Narratives forecast robust global growth and margin expansion, resulting in a higher Fair Value ($360.00), while more cautious Narratives factor in competition, regulation, or rising costs, yielding a lower Fair Value ($205.00). This demonstrates that perspective truly matters when making investment choices.

Do you think there's more to the story for DoorDash? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives