- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (NasdaqGS:DASH) Reports US$141 Million Net Income in Q4 as Stock Moves 1%

Reviewed by Simply Wall St

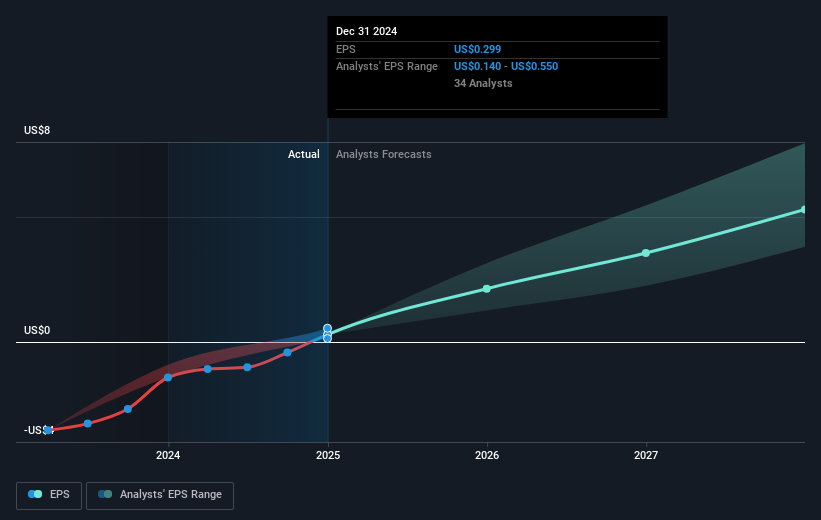

DoorDash (NasdaqGS:DASH) recently announced impressive fourth-quarter results, showing a significant increase in sales and a return to profitability, with net income reaching $141 million compared to a net loss the previous year. This positive financial performance aligns with the company's 1.39% share price gain over the last quarter. The new $5 billion share repurchase program also reflects confidence from the Board in the company's future prospects. Despite a volatile broader market environment, with the S&P 500 and Nasdaq facing their third consecutive weekly declines, DASH's gains highlight its strong financial position. The announced partnerships with The Home Depot and BREZ may have also bolstered investor sentiment. While the broader market saw declines, DoorDash managed to maintain positive momentum, distinguishing itself amidst an overall downturn. This ability to thrive is noteworthy as the company navigates challenges and opportunities in a fluctuating market landscape.

Navigate through the intricacies of DoorDash with our comprehensive report here.

Over the past three years, DoorDash has experienced a total return of 104.76%, reflecting strong investor confidence. This growth is highlighted by their significant performance when compared to the US Hospitality industry and the broader US market, both of which DASH outperformed over the past year. The introduction of innovative partnerships, such as those with The Home Depot and Best Buy, enhanced their service offerings and contributed to expanding their customer base and revenue streams.

Key corporate developments, like DoorDash's addition to the NASDAQ-100 Index and a change in its primary exchange listing to Nasdaq Global Select in late 2024, have also elevated its market presence. Additionally, DoorDash's groundbreaking SafeChat+ feature, launched in March 2024, showcased its commitment to enhancing user safety and trust. Collectively, these efforts have helped DoorDash capture significant investor interest and driven the positive long-term performance of its shares.

- Unlock the insights behind DoorDash's valuation and discover its true investment potential

- Understand the uncertainties surrounding DoorDash's market positioning with our detailed risk analysis report.

- Is DoorDash part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DoorDash, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives