- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (DASH): Evaluating Valuation After Strategic Serve Robotics Deal and Push Into Automated Deliveries

Reviewed by Kshitija Bhandaru

DoorDash (DASH) just revealed a new multi-year partnership with Serve Robotics that will bring autonomous robot deliveries to Los Angeles, with national rollout to follow. This move reflects DoorDash’s push to blend automation and AI into its multi-modal delivery network.

See our latest analysis for DoorDash.

After an action-packed year of new launches and partnerships, including the Serve Robotics deal, expansion with Domino’s and Kroger, and major upgrades to its delivery tech, DoorDash’s 1-year total shareholder return sits at an impressive 78%. Momentum is clearly building on the back of these growth initiatives.

If DoorDash’s run of tech-led expansion has you thinking bigger, it could be the perfect moment to discover fast growing stocks with high insider ownership

With the stock up nearly 80% this year, investors have to wonder whether DoorDash’s recent innovation streak leaves more upside on the table or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 10.8% Undervalued

DoorDash's most followed narrative sees its fair value at $298.19, about $32 above the last close. Market optimism over high revenue growth and expanding margins is fueling the bullish case for upside from here.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This trend should diversify and accelerate topline revenue while supporting net margin expansion. Strategic investments in AI and automation, including enhanced search, personalization, logistics optimization, and autonomous or robotic delivery, are expected to lower fulfillment costs per order over time. These initiatives may drive sustained improvements in operating leverage and net margins.

Want to know the growth blueprint at the heart of this bold price target? One key financial lever stands out, promising an earnings surge few expect. Ready to see which pivotal assumptions tip the scales on DoorDash’s future? Click through for the full narrative drivers.

Result: Fair Value of $298.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition from major retailers and regulatory shifts around gig labor could quickly change DoorDash’s growth trajectory and profit outlook.

Find out about the key risks to this DoorDash narrative.

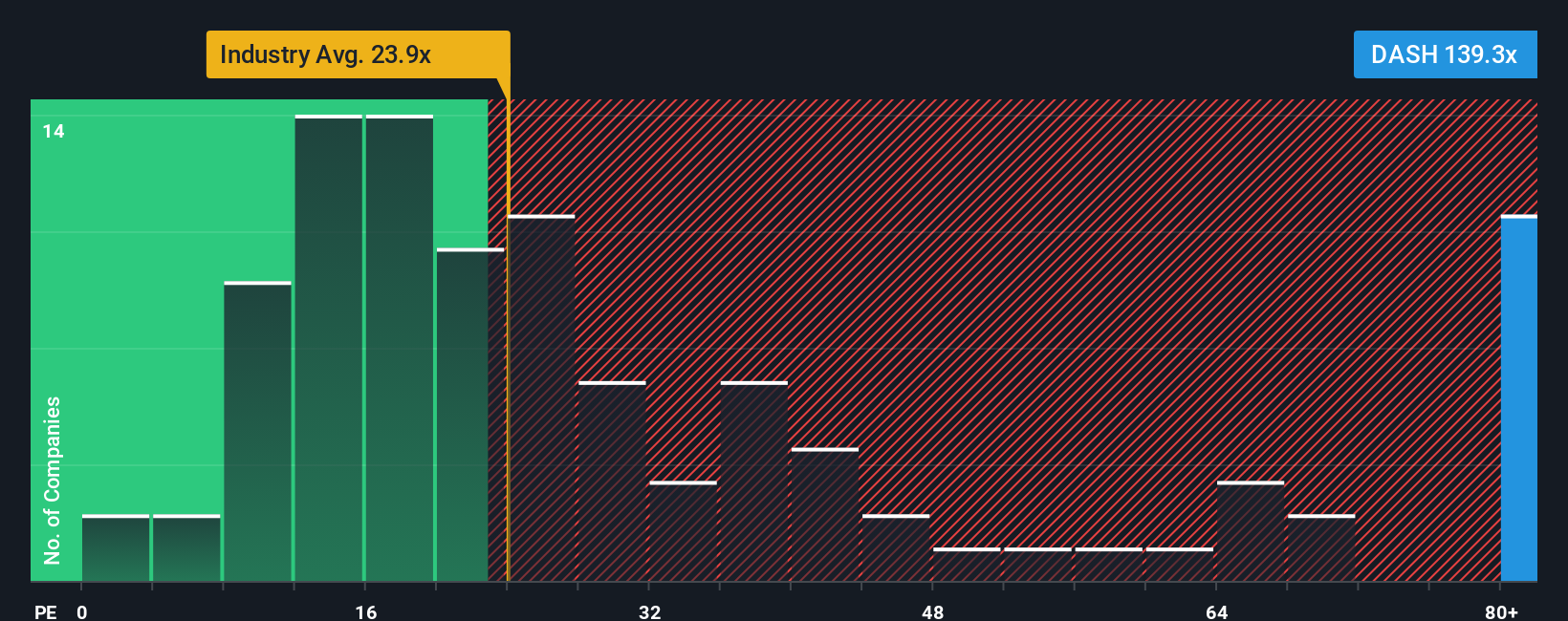

Another View: Price-To-Earnings Tells a Different Story

While DoorDash’s growth prospects have many analysts calling it undervalued, the market’s valuation paints a riskier picture. DoorDash is trading at a Price-To-Earnings ratio of 145.5x, far higher than its industry peers at 23.1x and the fair ratio of 51.5x. That gap suggests investors are paying a big premium for future growth, which could leave the stock exposed if results fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see things differently or want to dig deeper on your own terms, you can build your own DoorDash narrative from scratch in under three minutes. Do it your way

A great starting point for your DoorDash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the opportunity to get ahead of the market. These targeted stock lists can reveal high-potential companies most investors overlook. Make your next smart move.

- Capitalize on growth in artificial intelligence by evaluating the opportunities with these 24 AI penny stocks, which lead breakthroughs in automation, computing, and next-gen software.

- Strengthen your income strategy and lock in reliable cash flow by finding these 19 dividend stocks with yields > 3% that offer attractive yields above 3%.

- Tap into tomorrow’s digital economy by reviewing these 79 cryptocurrency and blockchain stocks at the frontier of blockchain innovation and secure, decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives