- United States

- /

- Hospitality

- /

- NasdaqGS:CZR

Caesars Entertainment (CZR): Ongoing Loss Reduction and Valuation Discount Shape Investor Optimism

Reviewed by Simply Wall St

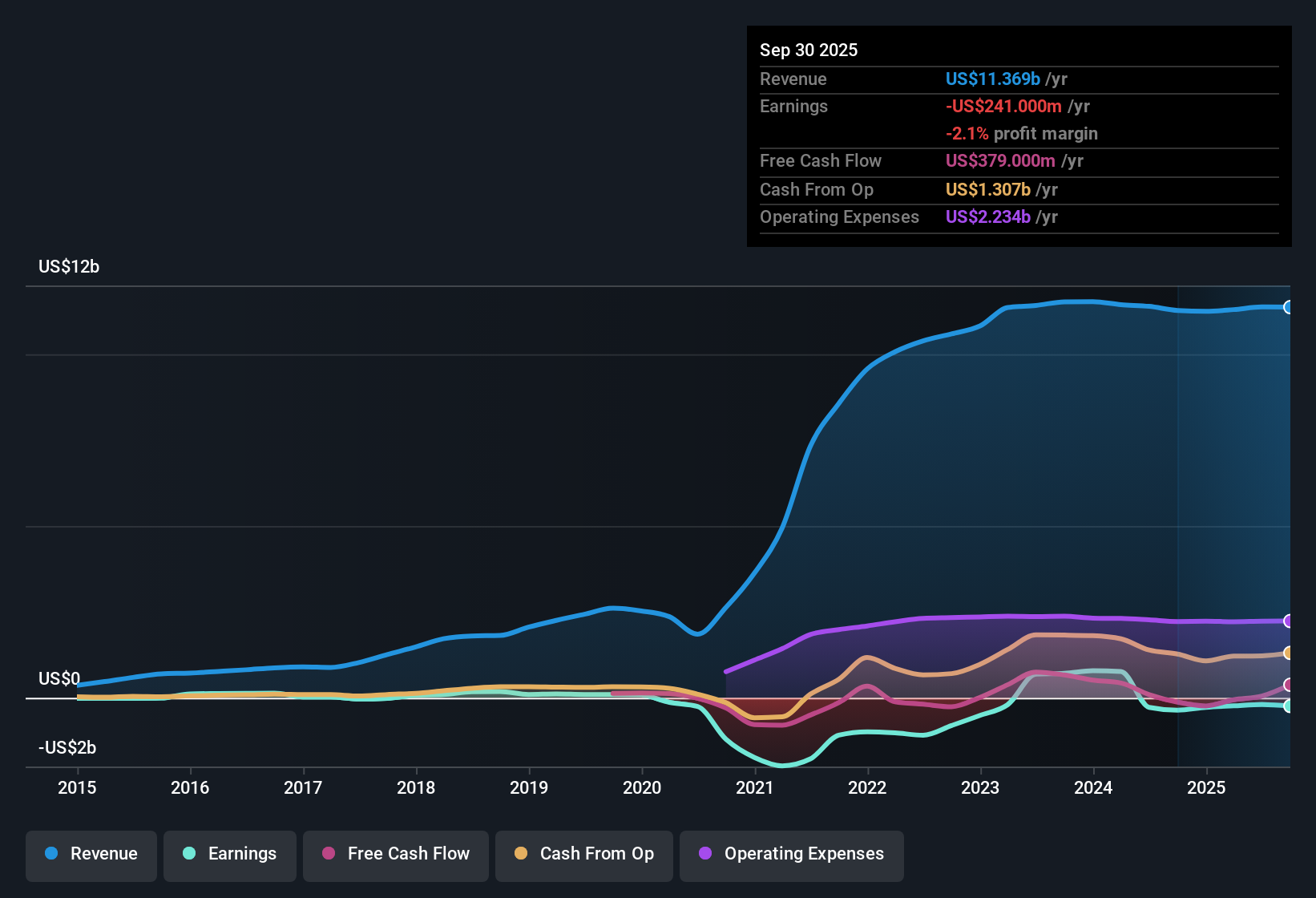

Caesars Entertainment (CZR) is currently unprofitable, but over the past five years the company has slashed losses at an annual rate of 47%. Earnings are forecast to climb at 67.44% per year, with Caesars expected to reach profitability within the next three years, a pace that outstrips the average in the broader market.

See our full analysis for Caesars Entertainment.Next up, we’ll see how these results compare to the main narratives shaping investor sentiment, and where the company’s trajectory might surprise or disappoint the consensus view.

See what the community is saying about Caesars Entertainment

Margins Projected to Swing From Loss to Gain

- Analysts estimate profit margins will improve from -1.7% today to 4.3% within three years, reflecting a meaningful turnaround.

- According to the analysts' consensus view, they see margin expansion as the result of strategic digital growth and loyalty initiatives fueling higher recurring revenue. However, they also point to risks that could limit gains:

- Enhanced loyalty programs and targeted marketing through Caesars Rewards are expected to boost customer retention and grow long-term net margins.

- On the flip side, analysts caution that rising labor, debt, and promotional costs could erode operating margins if not offset by stronger revenue or cost controls.

- The current share price of $18.73 is well beneath DCF fair value of $62.71, suggesting that ongoing improvement in margins could close this gap if the forecasts are achieved. See how the consensus view weighs all the angles in the full analyst narrative. 📊 Read the full Caesars Entertainment Consensus Narrative.

Digital Segment and Property Upgrades Fuel Growth Bets

- Revenue from Caesars' digital segment and investments into property upgrades are underlying drivers analysts expect will lift total company revenue by 3.4% per year over the next three years, even as leisure demand shows signs of softness.

- The consensus narrative points to two powerful themes shaping this bullish outlook:

- Expansion of digital and mobile gaming, including online casino and sports betting, creates new, higher-margin recurring revenue streams, which analysts believe supports both top-line resilience and EBITDA margin growth.

- Strategic property renovations and new amenities, such as upgrades to major Las Vegas assets and slot machine enhancements, are already producing positive returns and are expected to unlock incremental revenue and further margin expansion despite some risks from remodeling costs.

Undervalued Multiple Versus Industry and DCF Fair Value

- Caesars trades at a price-to-sales ratio of 0.3x, well below both the US Hospitality industry average of 1.7x and its sector peers. This highlights a sizable valuation gap for investors tracking relative value.

- The analysts' consensus notes a striking upside scenario: the DCF fair value stands at $62.71, and analyst price target is $36.24, both well above the current $18.73 share price.

- This sizable divergence signals that if forecast margin and revenue growth are realized, and cost risks contained, there is ample room for multiple expansion and re-rating in line with industry and DCF benchmarks.

- Still, consensus cautions that ongoing debt, required capital investments, and the need to sustain digital momentum could keep valuation lower unless the bullish profitability targets come through.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Caesars Entertainment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the numbers? Put your insights to work and craft a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Caesars Entertainment.

See What Else Is Out There

While Caesars is making progress on profitability, its heavy debt load and ongoing need for capital investments add financial pressure and uncertainty going forward.

If you want to focus on companies with lower leverage and healthier liquidity designed to handle stress, check out our solid balance sheet and fundamentals stocks screener (1980 results) selection today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CZR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives