- United States

- /

- Hospitality

- /

- NasdaqGS:CHDN

Is Now The Time To Put Churchill Downs (NASDAQ:CHDN) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Churchill Downs (NASDAQ:CHDN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Churchill Downs with the means to add long-term value to shareholders.

Our analysis indicates that CHDN is potentially undervalued!

How Fast Is Churchill Downs Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Churchill Downs has achieved impressive annual EPS growth of 42%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Churchill Downs shareholders can take confidence from the fact that EBIT margins are up from 18% to 22%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

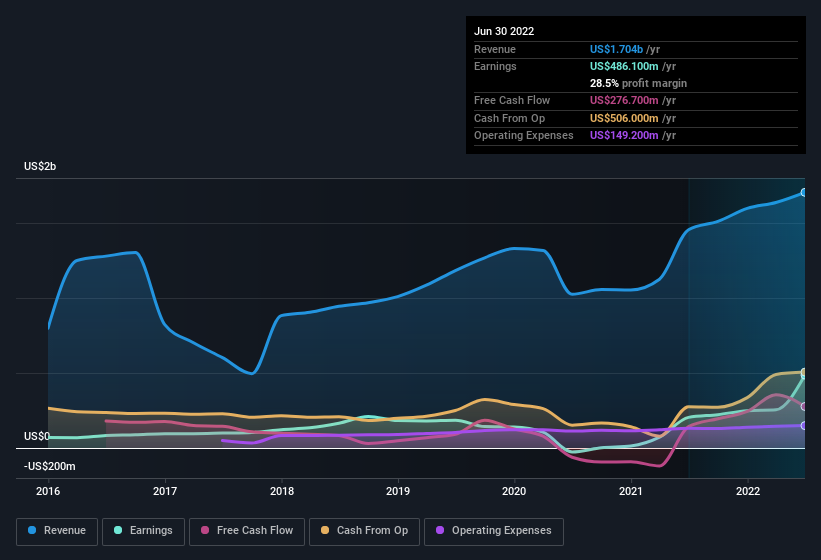

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Churchill Downs' future profits.

Are Churchill Downs Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Chairman of the Board, R. Rankin, paid US$93k to buy shares at an average price of US$177. Strong buying like that could be a sign of opportunity.

Along with the insider buying, another encouraging sign for Churchill Downs is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$352m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Is Churchill Downs Worth Keeping An Eye On?

Churchill Downs' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Churchill Downs belongs near the top of your watchlist. Still, you should learn about the 2 warning signs we've spotted with Churchill Downs (including 1 which shouldn't be ignored).

Keen growth investors love to see insider buying. Thankfully, Churchill Downs isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHDN

Churchill Downs

Operates as a racing, online wagering, and gaming entertainment company in the United States.

Good value with moderate growth potential.