- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

Cheesecake Factory (CAKE) Valuation Spotlight: Fresh Earnings, Cautious Guidance, and What’s Next for Investors

Reviewed by Simply Wall St

Cheesecake Factory (CAKE) investors digested a fresh round of quarterly earnings and some cautious guidance this week, as management highlighted both solid sales growth and a warning about government shutdown impacts on customer traffic.

See our latest analysis for Cheesecake Factory.

The recent volatility in Cheesecake Factory’s shares reflects a mix of upbeat earnings, resilient expansion efforts, and a dash of caution from management about near-term headwinds such as government shutdowns. While the 3-year total shareholder return is a robust 58%, recent months have seen momentum ease with a 90-day share price return of -22% and a 1-year total shareholder return just below flat. Long-term holders still sit on solid gains even as the mood has grown a bit more cautious in the short run.

If you’re curious what else is moving in the market, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 23% below analyst price targets and management pointing to both short-term headwinds as well as steady long-term growth, is Cheesecake Factory now undervalued, or is the market already pricing in its next move?

Most Popular Narrative: 34.7% Undervalued

Cheesecake Factory’s narrative fair value stands tall above the latest $48.20 close, hinting at investor optimism for a major upside. According to Zwfis, the company’s potential is not yet captured in its current market price, setting up anticipation for a growth-driven story.

This is one thing that I absolutely love about CAKE. Not only do they already have a large restaurant that is bringing in revenue for them, but they also have new concepts that are starting to spread nationally and are continually working to create even more for future growth. Especially from FRC, that is what one of the biggest benefits from that acquisition is, the fact that it is able to continue to test out new concepts and find something that sticks and then push it out nationally.

Ever wondered what bold projections could justify a valuation this far above the market? Delve into the blueprint where expansion plans, accelerating margins, and ambitious revenue goals combine. The narrative’s backstory will surprise you. Find out what’s fueling this confident price target.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor costs and any slowdown in new concept rollouts could easily dampen these growth expectations in the coming quarters.

Find out about the key risks to this Cheesecake Factory narrative.

Another View: What Does the DCF Model Say?

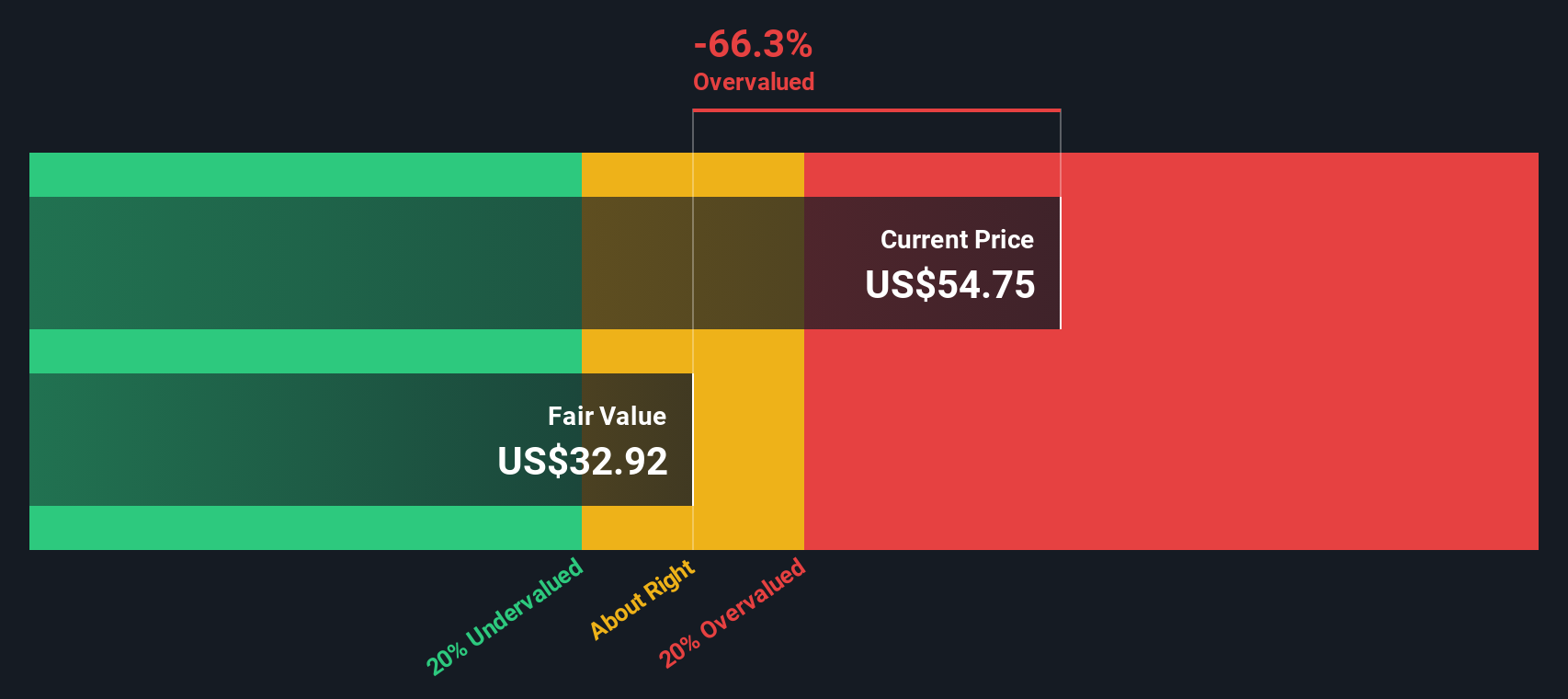

While narrative-driven and analyst estimates paint Cheesecake Factory as undervalued, our SWS DCF model lands on a different conclusion. According to this method, shares are actually trading above their estimated fair value of $29.78. This suggests investors may be pricing in more optimism than underlying cash flows support.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheesecake Factory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheesecake Factory Narrative

If you see things differently or want to dig into the numbers on your own terms, you can build a full narrative in just a few minutes. Do it your way

A great starting point for your Cheesecake Factory research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t watch top opportunities pass you by. Take the next step and sharpen your edge with unique stock ideas curated for today’s market trends.

- Boost your dividend income by checking out these 20 dividend stocks with yields > 3%, which offers yields above 3% and consistent payouts.

- Spot the tech breakthroughs that could power tomorrow’s portfolios with these 25 AI penny stocks, focused on artificial intelligence innovation.

- Unlock value opportunities others might overlook through these 836 undervalued stocks based on cash flows, identified as trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives