- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

Cheesecake Factory (CAKE): Is the Market Overlooking Value After Same-Store Sales Miss and Stock Drop?

Reviewed by Simply Wall St

Cheesecake Factory (CAKE) recently reported annual revenue growth of 5%, with earnings and profitability coming in above the high end of expectations. However, investors appeared unsettled after the company fell just short on same-store sales.

See our latest analysis for Cheesecake Factory.

Cheesecake Factory's share price has had a volatile stretch, sliding 16.3% over the past month after investors fixated on its same-store sales miss, even as earnings beat expectations. Still, the one-year total shareholder return sits at -1.8%. Looking longer term, its three-year total return of 45.6% highlights some staying power even through the recent challenges.

If the market’s reaction to a single metric has you curious, it could be the perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

With shares trading nearly 20% below recent highs and analysts’ targets suggesting upside, the question remains: are investors overlooking value in Cheesecake Factory, or has the market already priced in future growth?

Most Popular Narrative: 36.3% Undervalued

With Cheesecake Factory’s fair value estimated at $73.83 by the leading narrative, well above the recent $47 close, this viewpoint points to major upside potential. Investors are left to weigh whether the market’s caution is warranted or if there is a significant disconnect waiting to be closed.

This is one thing that I absolutely love about CAKE. Not only do they already have a large restaurant that is bringing in revenue for them, but they also have new concepts that are starting to spread nationally and are continually working to create even more for future growth. Especially from FRC, that is what one of the biggest benefits from that acquisition is, the fact that it is able to continue to test out new concepts and find something that sticks and then push it out nationally.

What exactly fuels this bullish narrative? It is not just about existing stores. There is a bold pipeline of new restaurant brands, scalable concepts, and ambitious long-term financial assumptions included in the fair value math. Want to see which future growth levers could propel CAKE to that target? See the underlying story inside the numbers.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or an unexpected slowdown in new restaurant growth could challenge these optimistic projections and limit upside for investors.

Find out about the key risks to this Cheesecake Factory narrative.

Another View: Is the Discount Real?

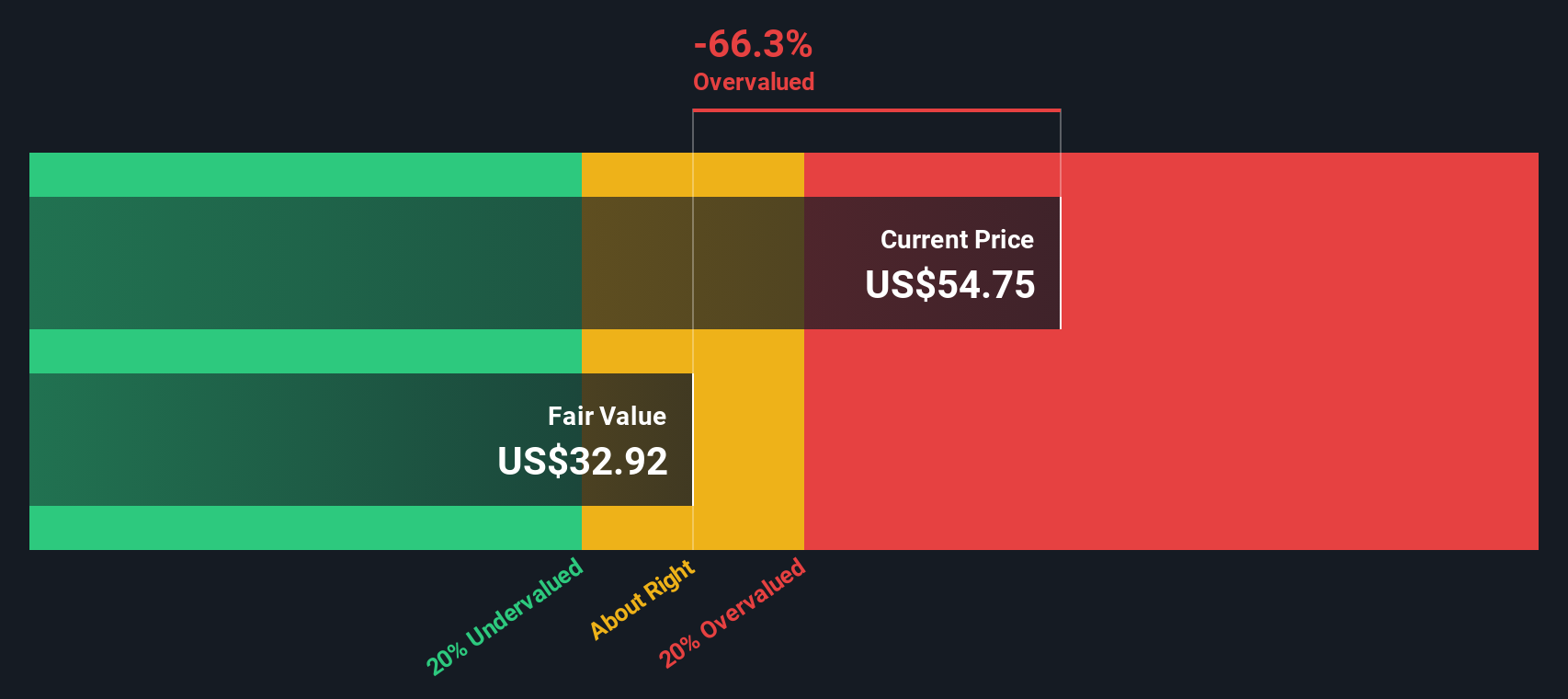

Looking through the lens of our DCF model, the story changes. It suggests Cheesecake Factory is trading above its estimated fair value of $29.63 per share. This implies that despite the apparent bargain from other measures, investors may be expecting more future growth than fundamentals support. Which method better captures the risks and rewards ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheesecake Factory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 935 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheesecake Factory Narrative

If you see things differently or want to dig into the details yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Cheesecake Factory research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your opportunity to get ahead. Simply Wall Street’s research tools make it easy to spot smart investments that others overlook. Don’t miss your chance to uncover unique market moves and fresh opportunities before everyone else.

- Start building wealth early by targeting value with these 935 undervalued stocks based on cash flows featuring solid fundamentals and attractive pricing.

- Capture future growth by browsing these 30 healthcare AI stocks focused on innovation and leadership at the intersection of technology and health.

- Pounce on tomorrow’s financial disruptors with these 81 cryptocurrency and blockchain stocks, where you’ll find stocks supporting blockchain, payments, and the next wave of digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success