- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Booking Holdings (NasdaqGS:BKNG) Engages Multiple Underwriters for €493 Million Fixed-Income Offering

Reviewed by Simply Wall St

Booking Holdings (NasdaqGS:BKNG) recently adjusted its underwriting team for a €493 million fixed-income offering, a decision that aligns with the company’s price move of 21% over the past month. This strategic reshuffling, alongside the launch of Priceline's new AI-infused travel tools, appears to support its stock performance amidst a mixed market backdrop. Earnings announcements highlighted revenue growth but a decline in net income, factors which may have countered broader market optimism. Meanwhile, the stock buyback completion may have bolstered investor confidence, offsetting potential volatility as markets await the Federal Reserve's rate decision.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent adjustments at Booking Holdings, including the revamp of its underwriting team and the introduction of AI-enhanced travel tools, could significantly influence the company's strategic growth narrative. These initiatives align with the company's focus on technology integration and expanding its travel offerings, potentially leading to improved customer retention and increased revenue. Moreover, the stock buyback completion and adaptation to broader market conditions might further solidify investor confidence, despite uncertainties surrounding the Federal Reserve's upcoming rate decision.

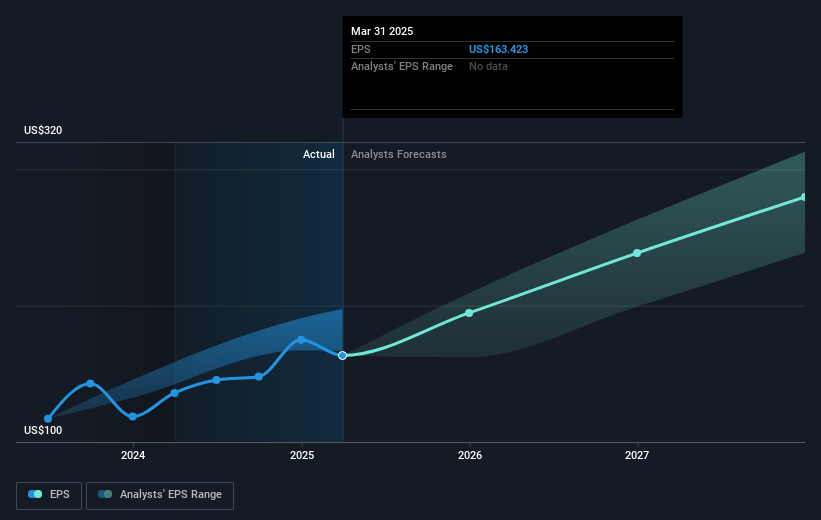

In terms of market performance, Booking Holdings' shares have delivered a total return of 276.56% over the past five years, highlighting its robust growth trajectory. Over the last year, the company's earnings growth of 13.3% exceeded the US Hospitality industry's 2.5%, showcasing its competitive advantage. While the one-month price increase of 21% underscores strong investor sentiment, it brings the stock's current price to US$4909.23, which remains approximately 9.1% below the consensus analyst price target of US$5401.81. This price target suggests that analysts foresee continued upside potential based on expected revenue and earnings growth.

The recent company actions are likely to impact revenue and earnings forecasts positively by enhancing the customer experience and operational efficiency. With analysts predicting these initiatives will contribute to an estimated revenue growth of 7.8% annually over the next three years, and anticipated improvement in net margins from 24.8% to 28.5%, expectations remain optimistic. However, potential economic and geopolitical challenges could still pose risks to these projections, albeit mitigated by the company's strategic partnerships and diversification efforts.

Dive into the specifics of Booking Holdings here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives