- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Booking Holdings (BKNG) Margin Decline Challenges Bullish Valuation Narratives

Reviewed by Simply Wall St

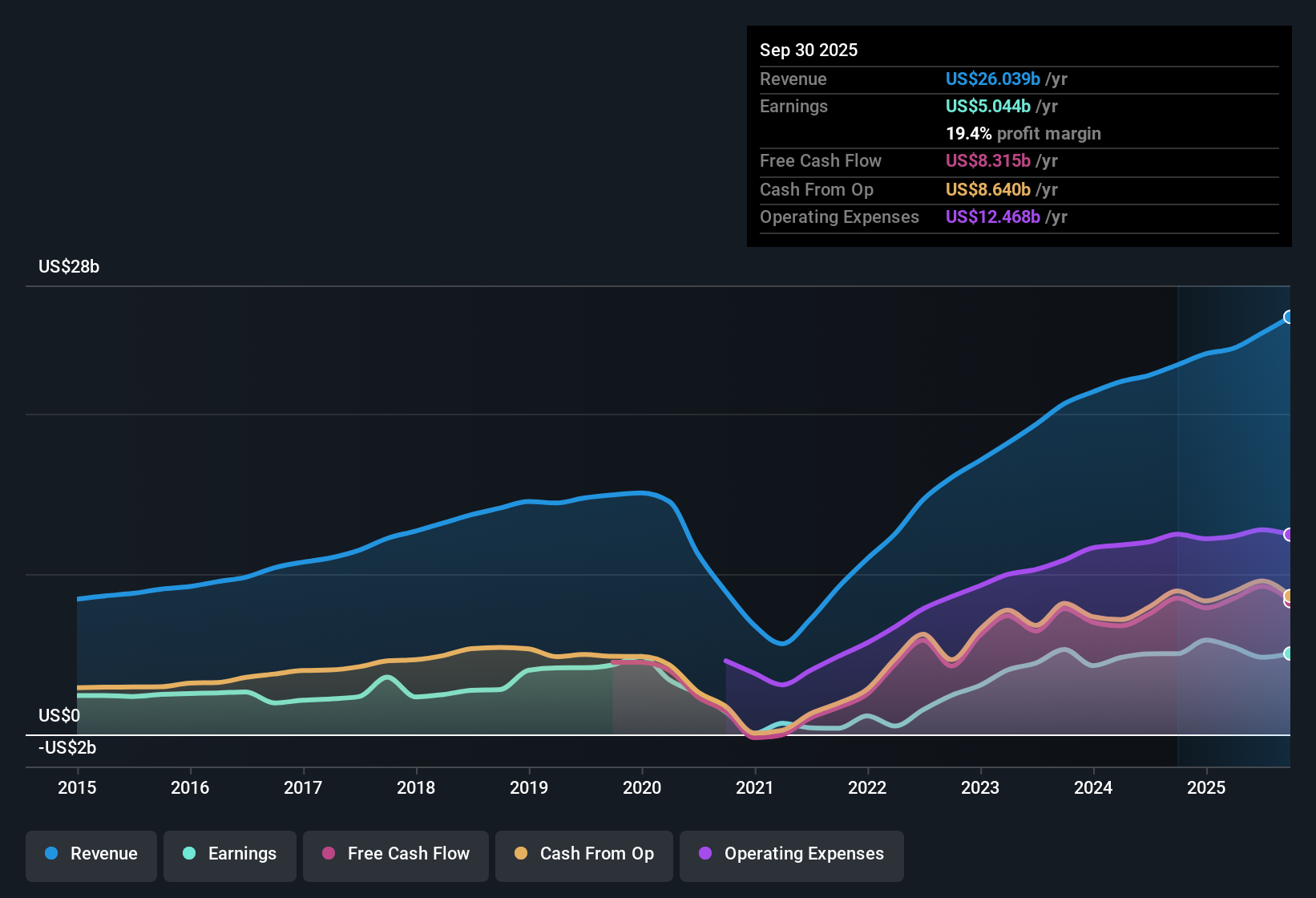

Booking Holdings (BKNG) delivered a notable earnings performance, with net profit margins at 19.4%, down from 21.8% a year ago, and annual EPS growth essentially flat at 0.2%. This is well below its robust five-year average of 39% per year. Looking ahead, management expects earnings to grow at roughly 20% per year, ahead of the broader US market’s 15.7% annual outlook, while revenue is projected to rise 8% per year compared to the market’s 10.3%. With a track record of outsized gains and an outlook for accelerated growth, the company’s latest results keep investors focused on both margin trends and the story told by future forecasts.

See our full analysis for Booking Holdings.Now let’s dive into how these numbers compare with the narratives investors are building around Booking Holdings. The next section explores where results reinforce the story and where they might prompt a re-think.

See what the community is saying about Booking Holdings

DCF Fair Value Suggests Upside

- Booking Holdings’ share price is $5,075.86, which is 30% below its DCF fair value estimate of $7,278.82. This highlights a notable valuation gap.

- According to the analysts' consensus view, the company’s future profit margins are projected to rise sharply from 19.2% to 29.2% over the next three years. This strong margin expansion could justify a higher fair value.

- Analysts forecast earnings to reach $9.5 billion by 2028, which would imply a forward PE ratio of 24.8x. This remains a premium to the current industry average of 23.9x.

- The difference between today’s share price and the consensus price target of $6,200.63 is 8.7%. This suggests the market is cautious about fully pricing in these optimistic forecasts.

- See how analysts blend strong margin forecasts and valuation gaps in their balanced take on where Booking Holdings could go next. 📊 Read the full Booking Holdings Consensus Narrative.

Premium Price-to-Earnings Ratio vs Peers

- The company’s PE ratio of 32.6x stands well above the peer group average of 28.4x and the US hospitality industry’s 23.7x. This signals that investors pay a significant premium for Booking Holdings shares.

- Based on the analysts' consensus view, some see this premium as justified due to strategic moves like AI integration and vertical expansion, while skepticism still persists.

- Booked revenue growth is projected at 8% annually in the coming years, which lags behind the 10.3% average annual growth forecast for the broader US market.

- To bring the PE ratio down to 24.8x by 2028, in line with profit growth, the company faces pressure for continued strong execution simply to maintain today’s valuation multiples.

Financial Strength Remains a Watchpoint

- Despite growing profits and revenue, Booking Holdings does not meet the criteria for a “strong” financial position at present. This raises questions about its flexibility in managing future risks.

- The analysts' consensus view notes that while diversification and expense discipline support margins, region-specific travel slowdowns and rising customer acquisition costs could challenge improvements in net margin.

- Sustained macroeconomic or geopolitical disruptions may quickly pressure both revenue and profits, especially if consumer spending shifts further toward lower-cost options.

- Stable leisure demand provides some buffer, but dependence on the pace of the Connected Trip rollout and marketing efficiency adds execution risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Booking Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the numbers? Share your perspective and craft your narrative in just a few minutes. Do it your way

A great starting point for your Booking Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Booking Holdings faces questions about its financial strength, with recent results highlighting concerns around flexibility, rising costs, and potential vulnerability to market downturns.

If you want to sidestep those risks, try solid balance sheet and fundamentals stocks screener (1980 results) to find companies with stronger financial foundations and lower debt exposure. These companies are built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives