- United States

- /

- Consumer Services

- /

- NasdaqGS:APEI

Improved Revenues Required Before American Public Education, Inc. (NASDAQ:APEI) Stock's 27% Jump Looks Justified

Despite an already strong run, American Public Education, Inc. (NASDAQ:APEI) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 191% following the latest surge, making investors sit up and take notice.

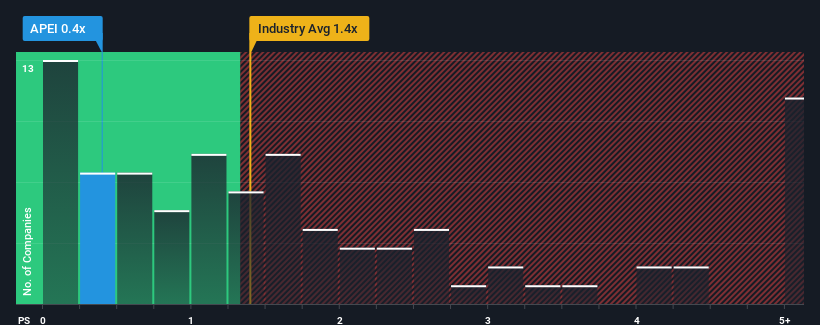

Although its price has surged higher, when close to half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider American Public Education as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for American Public Education

What Does American Public Education's P/S Mean For Shareholders?

American Public Education could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think American Public Education's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, American Public Education would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 87% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 2.3% over the next year. With the industry predicted to deliver 16% growth, the company is positioned for a weaker revenue result.

With this information, we can see why American Public Education is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On American Public Education's P/S

Despite American Public Education's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of American Public Education's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with American Public Education, and understanding them should be part of your investment process.

If you're unsure about the strength of American Public Education's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:APEI

American Public Education

Provides online and campus-based postsecondary education and career learning in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives