- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Is Airbnb Set for a Rebound After Recent Share Price Slide in 2025?

Reviewed by Bailey Pemberton

If you own Airbnb stock or are thinking about diving in, you are in good company. The short-term numbers may give pause, with shares down 2.2% over the past week and 2.9% over the last month, but long-term holders have still seen an 8.3% bump over three years. Year-to-date, Airbnb is off by 8.6% and is trading close to $120. Is this recent dip a buying opportunity or a sign to steer clear?

Airbnb’s price forecast seems to ride the same wave as the broader market, swaying with travel sector optimism or cooling off as risk sentiment shifts. While big swings can grab headlines, savvy investors know to look past the short blips and focus on the actual value behind the numbers.

That is where valuation analysis comes in, and Airbnb’s scorecard is looking intriguing. The company clocks in at 4 out of 6 on our undervaluation checks. Not perfect, but certainly not one to dismiss. Does this mean Airbnb is a hidden gem or fairly priced by the market?

Let’s dig into each valuation approach and see how this high-profile stock stacks up across the metrics. And just when you think you have the full picture, we will reveal a smarter way to make sense of Airbnb’s true worth.

Why Airbnb is lagging behind its peers

Approach 1: Airbnb Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and then discounting them back to today's dollars. This technique helps investors understand what a business may be worth based on its real cash-generating power over time, rather than just as a reflection of recent trends or headlines.

For Airbnb, the DCF model used here is based on a two-stage Free Cash Flow to Equity approach. The company reported trailing twelve-month Free Cash Flow of $4.3 billion, all figures in USD. Analyst projections expect Airbnb to generate roughly $6.8 billion in free cash flow by 2029. While direct analyst forecasts only reach out five years, estimates for the years beyond rely on extrapolations built from recent growth rates.

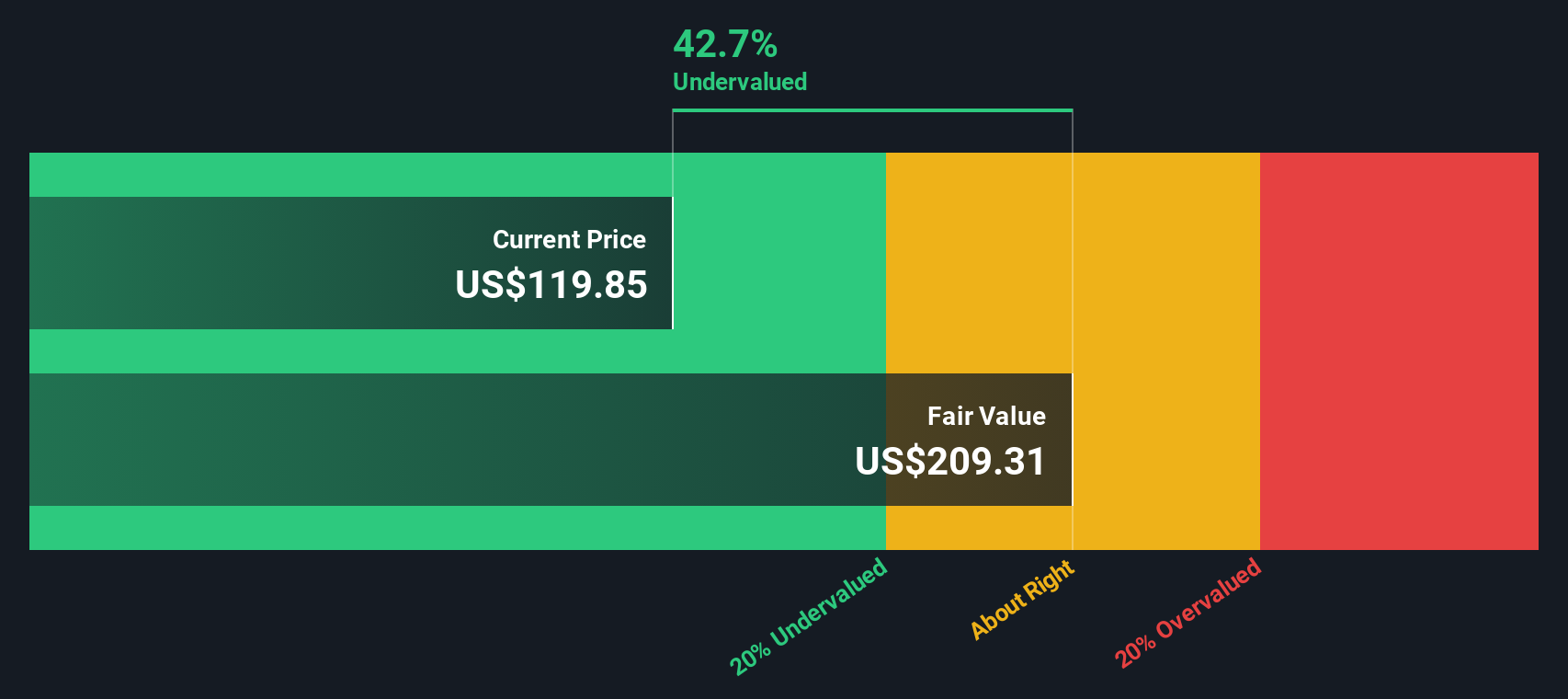

Based on this cash flow outlook, Airbnb's intrinsic value is estimated at $209.84 per share. This represents a notable 42.7% discount compared to the current price around $120, suggesting the stock is substantially undervalued according to the DCF framework.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbnb is undervalued by 42.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Airbnb Price vs Earnings (PE Ratio)

For profitable companies like Airbnb, the Price-to-Earnings (PE) ratio is often viewed as the gold standard for valuation. It efficiently captures how much investors are willing to pay for each dollar of current earnings, making it especially relevant when a business has steadily positive profits and established growth patterns.

The “normal” or “fair” PE ratio is influenced by factors such as growth expectations, profitability, and the perceived risk of the company or industry. Fast-growing, resilient businesses command higher PE ratios, while mature or riskier companies tend to see lower multiples. This means that a PE ratio should always be interpreted in context, not in isolation.

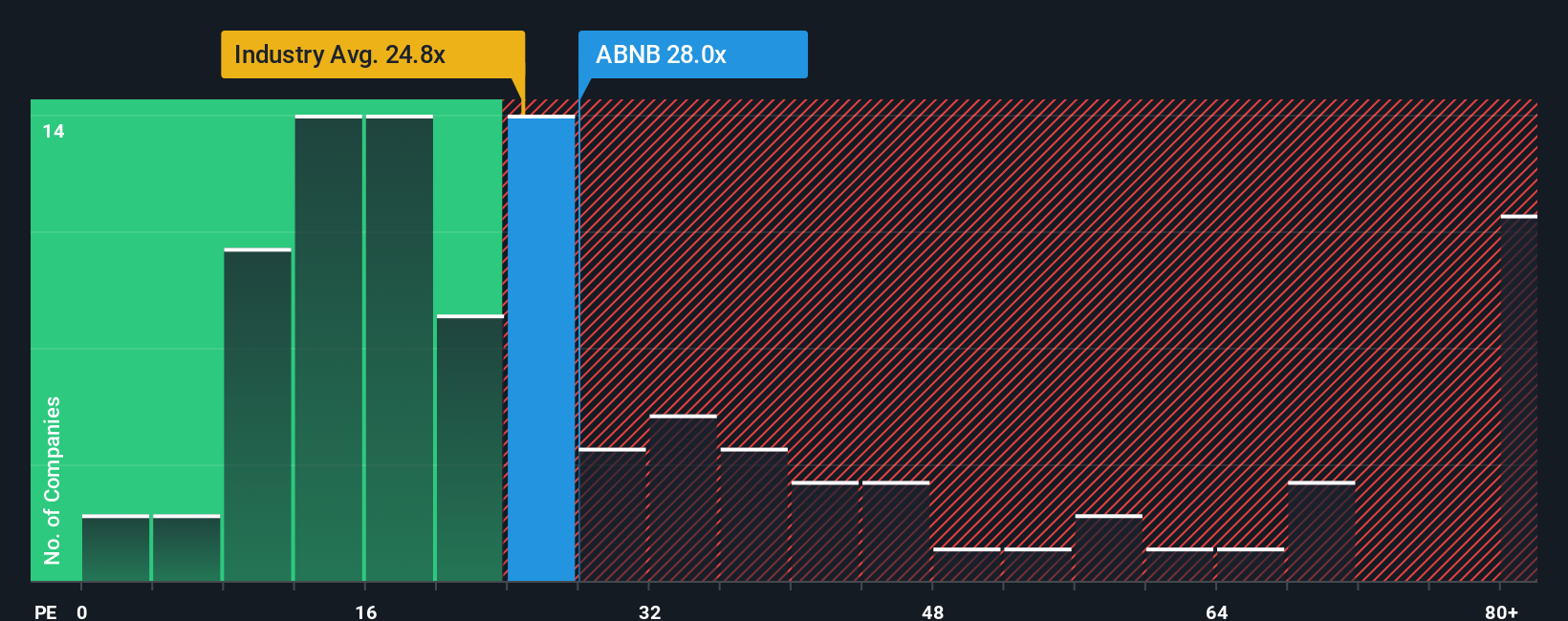

Airbnb is trading at a PE ratio of 28.0x. That is somewhat above the hospitality industry’s average of 24.4x, but notably below the peer group average of 32.0x. On top of these comparisons, Simply Wall St calculates a proprietary “Fair Ratio,” which considers not just industry averages, but also factors like Airbnb’s earnings growth, margins, market cap, and specific business risks. For Airbnb, the Fair Ratio is determined to be 31.1x, suggesting the company’s growth and margins justify a higher-than-average multiple.

This tailored Fair Ratio provides a more nuanced view than simply looking at industry or peers, by accounting for what actually makes Airbnb unique: its scale, margins, and future earnings potential. Compared to the Fair Ratio, Airbnb’s current PE of 28.0x is just below what is deemed fair. However, the difference is modest and within a reasonable range, signaling the stock is priced about right based on earnings power.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbnb Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple but powerful tool that helps investors put their own story and expectations about a company's future revenue, margins, or growth behind the numbers shown on a chart.

Every Narrative links a company's business story with a dynamic financial forecast and, ultimately, an estimated fair value. Instead of only reacting to past performance or analyst consensus, Narratives empower you to map out your own assumptions and see how those directly impact what a stock is worth. This user-friendly feature is available right now to millions of investors on Simply Wall St's Community page, making professional-grade scenario analysis more accessible than ever.

With Narratives, you can instantly compare your calculated Fair Value to where Airbnb is trading today, clarifying when to consider buying, holding, or selling. Even better, Narratives automatically update as fresh information such as new earnings reports or breaking news arrives, so your view stays relevant in real time.

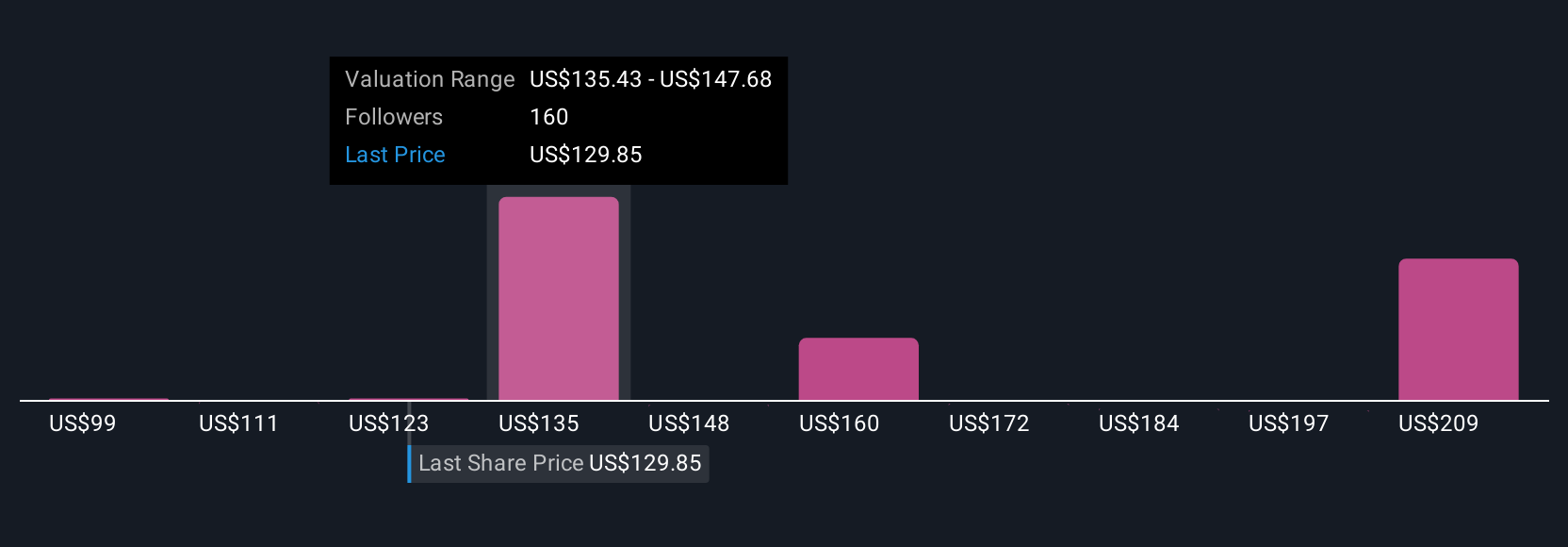

For Airbnb, this means one investor might be optimistic, believing fair value is above $180 because of global expansion and new products, while another might see just $98 based on rising risks. This makes it easy for you to understand the range of market perspectives and decide which story you believe.

Do you think there's more to the story for Airbnb? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success