- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

How Apartment List's Airbnb-Friendly Integration Could Shape Airbnb's (ABNB) Long-Term Hosting Strategy

Reviewed by Sasha Jovanovic

- Earlier this month, Apartment List announced the integration of Airbnb-friendly apartments into its platform across 25 cities, enabling renters to easily find properties that permit short-term hosting via a dedicated filter and amenity badge.

- This move highlights the growing appeal of lifestyle flexibility, particularly for Gen Z renters, with more than 60% valuing the opportunity to rent out their homes for added financial benefit.

- We'll explore how Airbnb's partnership to broaden hosting opportunities for renters may influence the company's multi-year investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Airbnb Investment Narrative Recap

To be an Airbnb shareholder, you have to believe in the company's ability to lead alternative accommodations, capture shifting travel trends, and innovate in the hosting space. The Airbnb-friendly partnership with Apartment List supports user growth and financial flexibility for renters, but is unlikely to significantly change the biggest short-term catalyst, international market expansion, or outweigh the ongoing risk of stricter local regulations on short-term rentals in core urban markets.

Of the recent announcements, the launch of Airbnb-friendly apartments is especially relevant, as it directly enables a new segment of flexible renters to become hosts and could incrementally add to Airbnb’s user base. This complements ongoing product and market expansion efforts, but the immediate impact on revenue or overall host growth appears limited against the backdrop of much larger macro and regulatory challenges.

By contrast, investors should be aware that surging anti-tourism sentiment and new regulatory actions in major cities could sharply impact Airbnb’s growth strategy if...

Read the full narrative on Airbnb (it's free!)

Airbnb's narrative projects $15.4 billion in revenue and $3.7 billion in earnings by 2028. This requires 10.0% yearly revenue growth and a $1.1 billion increase in earnings from the current $2.6 billion.

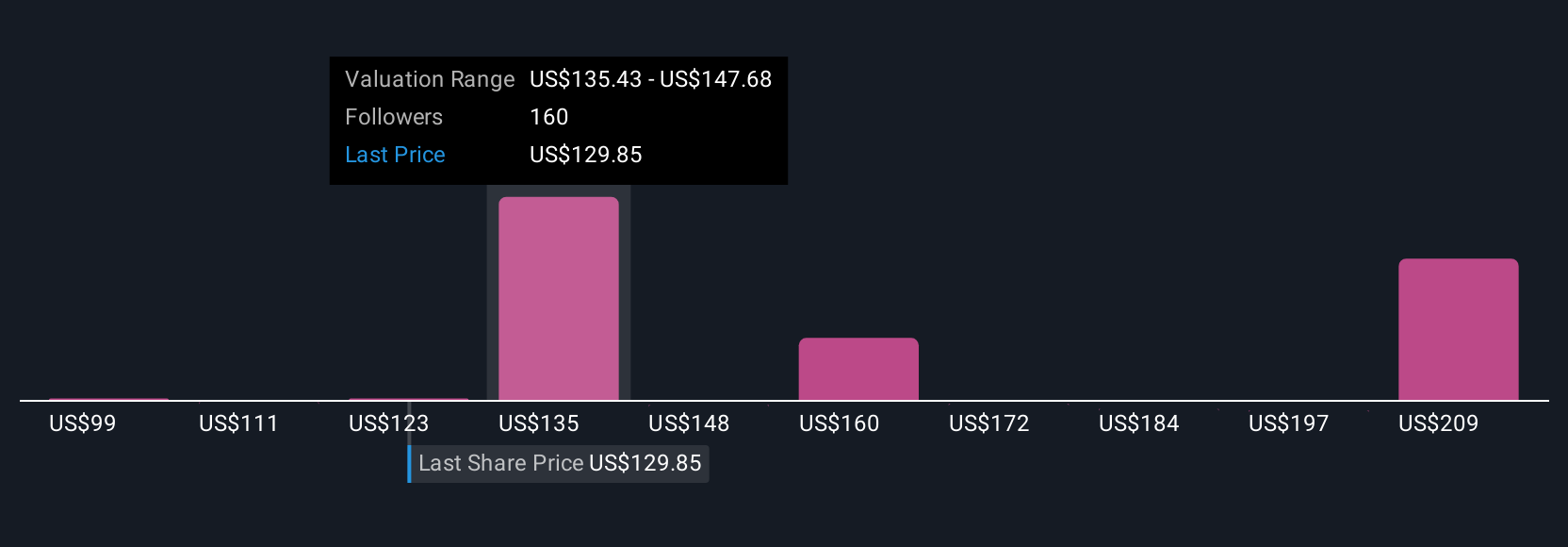

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 13% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts see Airbnb’s international gains and new services as opportunities for much faster revenue growth, projecting up to US$16.5 billion in annual sales and US$4.3 billion in earnings by 2028. Compared to the consensus, these forecasts reflect a far more optimistic view of the company’s ability to outpace risks. With the recent news, now is a good time to consider how these differing outlooks might evolve.

Explore 25 other fair value estimates on Airbnb - why the stock might be worth 18% less than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives