- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Assessing Airbnb’s Value Amid Travel Demand Shifts and Regulatory Changes in 2025

Reviewed by Bailey Pemberton

- Wondering if Airbnb stock is a value opportunity, overhyped, or somewhere in between? Let’s dive beyond the headlines to see what the numbers reveal.

- The stock has seen some ups and downs, rising 0.5% in the past 7 days, but dropping 1.4% over the past month and down 7.8% year-to-date.

- Recent news around changes in travel demand and Airbnb’s ongoing regulatory challenges have fueled debate on the company’s future growth. Headlines highlighting new product launches and evolving government rules are giving investors plenty to digest as they eye the stock’s next move.

- When we run Airbnb through our standard valuation checks, it gets a 4 out of 6 for being undervalued. This suggests there’s value here but also a few yellow flags, so let’s break down those checks and then explore a more insightful way to assess what Airbnb is really worth.

Find out why Airbnb's -9.9% return over the last year is lagging behind its peers.

Approach 1: Airbnb Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth by forecasting its future cash flows and discounting them back to their value today. For Airbnb, this approach projects free cash flows over the coming decade and accounts for expected growth and future uncertainties.

Airbnb’s most recent annual Free Cash Flow stands at $4.6 Billion. Analyst estimates extend out five years, after which cash flow projections are extrapolated. By 2029, Airbnb’s Free Cash Flow is projected to reach approximately $6.8 Billion, with a steady growth trend expected to continue toward 2035. These forecasts are based on a 2 Stage Free Cash Flow to Equity model that incorporates both analyst insights and ongoing estimates from Simply Wall St.

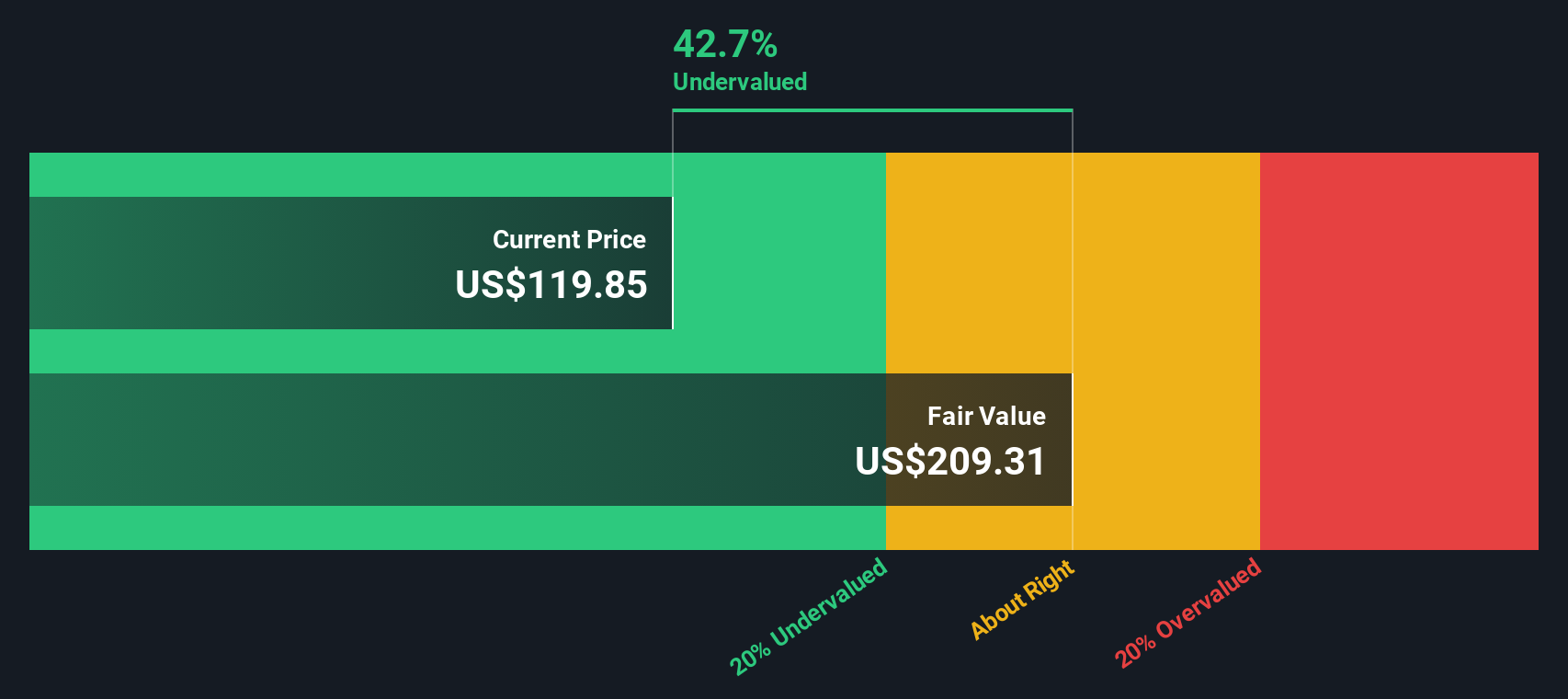

Based on these projections, the DCF model calculates Airbnb’s intrinsic value at $220.35 per share. Compared to current market pricing, this represents a 45% discount. This suggests that Airbnb’s stock is significantly undervalued at its current level.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbnb is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: Airbnb Price vs Earnings

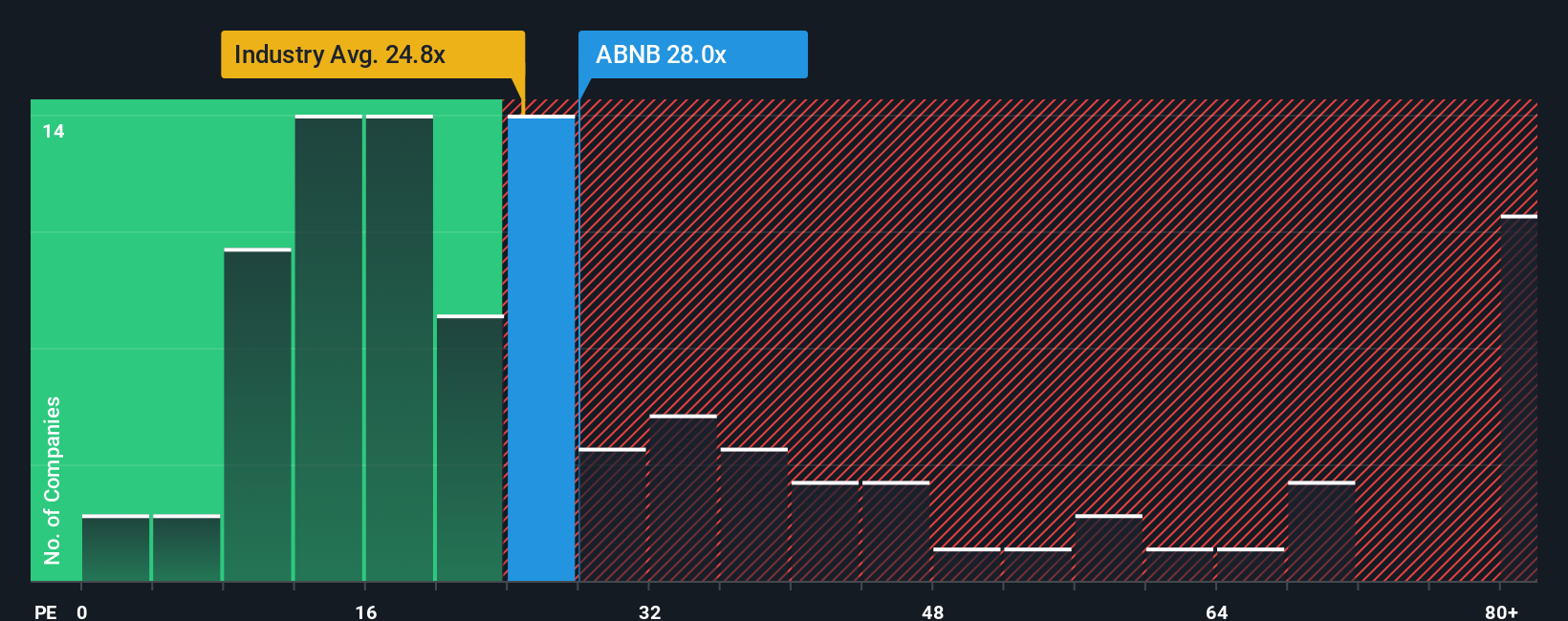

For companies like Airbnb that are consistently profitable, the Price-to-Earnings (PE) ratio is a well-established and meaningful valuation metric. It helps investors gauge how much they are paying for a company’s current earnings, making it particularly relevant for mature businesses with a solid track record of profitability.

Growth prospects and perceived risk play a big part in what investors consider a “normal” or fair PE ratio. Companies with higher growth potential often command higher PE multiples, while greater risk tends to push them lower. Market sentiment, industry trends, and economic conditions also shape how investors view these benchmarks.

Looking at Airbnb’s numbers, the stock currently trades at a PE ratio of 27.9x. This sits above the hospitality industry average of 21.4x, but slightly below the average for its peers, which comes in at 29.2x. Simply Wall St’s proprietary “Fair Ratio” for Airbnb stands at 29.7x, taking into account the company’s unique blend of growth, margins, scale, and risk profile.

The value of the Fair Ratio is that it goes beyond surface-level comparisons to industry or peers. Instead, it weighs a company’s own growth expectations, risk factors, profit margins, and competitive position, providing a more tailored and insightful benchmark for valuation.

Since Airbnb’s market PE is close to its Fair Ratio, the stock appears to be trading at about the right price for its earnings power today.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbnb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful and intuitive method that lets you explore the “story” behind Airbnb’s financials and assumptions.

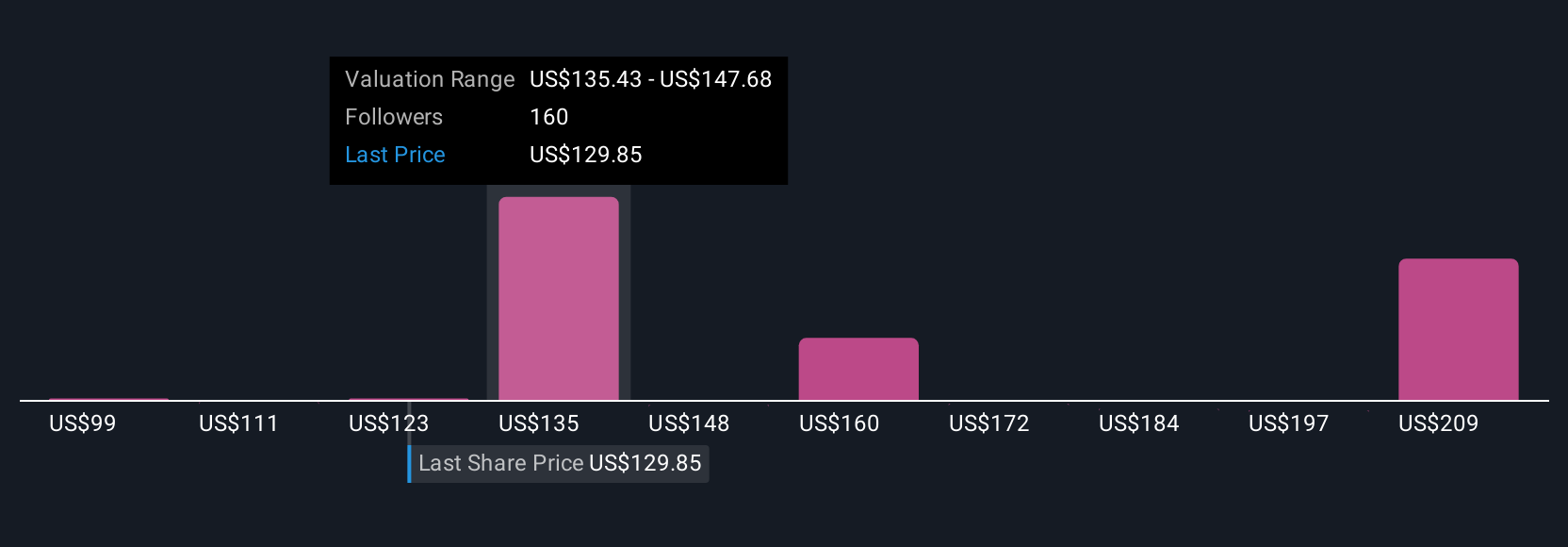

A Narrative is your perspective on Airbnb’s future, taking into account the company’s story, such as growth in international markets, new products, regulatory risks, or the impact of AI, along with your own estimates of revenue, profit margins, and a “fair value” for the stock.

Narratives connect the dots: they link your view of Airbnb’s real-world opportunities and challenges to a financial forecast, then compute a fair value so you can easily compare it with the current market price.

This makes Narratives an accessible and practical tool on Simply Wall St’s Community page, used by millions of investors to quickly see how different expectations translate into actionable investment decisions.

Because Narratives are dynamic, they update as soon as new information like news or earnings reports becomes available, helping you stay agile as conditions change.

For example, one Airbnb Narrative might assume international expansion and AI-driven improvements will lift fair value to $181.23. Another, more cautious investor might assume regulatory and competitive challenges will weigh the stock down toward $98.00.

Do you think there's more to the story for Airbnb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives