- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Airbnb (NasdaqGS:ABNB) Completes Buyback of US$3.5 Billion; Q1 Earnings Decline

Reviewed by Simply Wall St

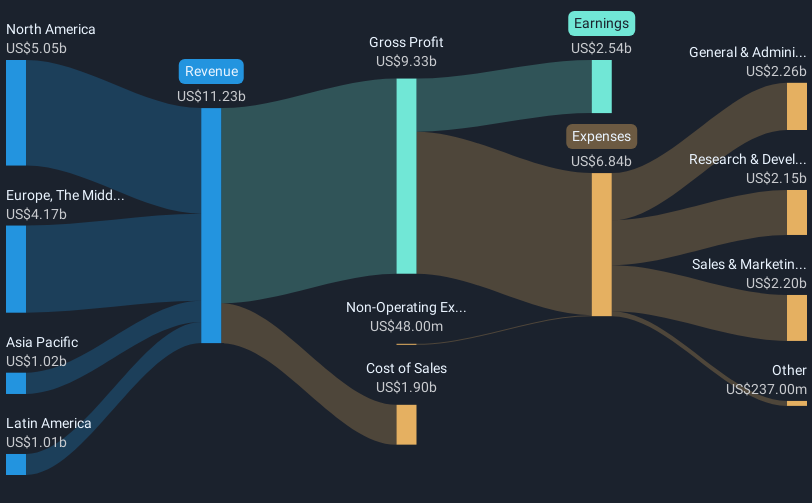

Airbnb (NasdaqGS:ABNB) experienced a price move of 2% over the past month, potentially driven by the company's update on their buyback program and mixed earnings results. Despite an increase in sales, net income and earnings per share decreased year-over-year, reflecting challenges within the financial performance. However, the broader market witnessed similar upward momentum fueled by strong job data and robust performances from major indices, suggesting the 2% move aligned with general market trends. The company's actions and results may have added weight to the broader market gains rather than being entirely independent influences.

Airbnb has 2 possible red flags we think you should know about.

The recent 2% price movement for Airbnb shares, amidst updates on its buyback program and mixed earnings results, indicates potential implications for its future operational strategy. As the company invests in platform technology upgrades and AI to enhance its service offerings, financial strains observed in the year-over-year declines in net income and earnings per share may reflect the cost of these advancements. While the immediate share price response aligns with broader market trends, the longer-term narrative suggests that these strategic initiatives could improve operational efficiency and revenue generation, although they also heighten short-term financial risk.

Over the past three years, Airbnb's total return, inclusive of share price and dividends, exhibited a 13.33% decline, reflecting challenges in maintaining consistent value growth. In the shorter term, the company underperformed the US market, which saw a 9.5% return over the past year. Compared to the US hospitality industry's 3.3% return, Airbnb's performance indicates relative weakness but also suggests room for potential rebound as it continues to focus on global market growth and new business investments.

The company's revenue forecast anticipates annual growth of 9.3%, with earnings expected to increase 12.87% per year. These projections are underpinned by the narrative of expansion into non-core markets and enhanced service capabilities. The share price's 2% move in context with an analyst consensus price target of US$146.72 reflects an 18.31% discount, underscoring potential market skepticism about whether forthcoming growth will meet or exceed these bullish expectations. Investors should weigh these forecasts against the operational and market challenges ahead.

Review our historical performance report to gain insights into Airbnb's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Airbnb, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives