- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT): Rethinking Valuation After a Strong Multi‑Month Share Price Rally

Reviewed by Simply Wall St

Walmart (WMT) has been quietly grinding higher, with the stock up around 12% over the past month and roughly 14% in the past 3 months, easily outpacing the broader retail space.

See our latest analysis for Walmart.

Zooming out, the stock’s roughly 27% year to date share price return, on top of a 21% one year total shareholder return, signals steady momentum as investors warm to Walmart’s scale, resilience, and consistent earnings delivery.

If Walmart’s recent strength has you rethinking where retail fits in your portfolio, it could be worth exploring fast growing stocks with high insider ownership for other under the radar ideas with aligned insiders.

But with shares hovering near record highs and trading only slightly below Wall Street’s price targets, investors face a key question: Is Walmart still undervalued, or is the market already pricing in years of steady growth?

Most Popular Narrative: 3.4% Undervalued

With Walmart last closing at $114.41 against a most popular narrative fair value near $118, the story implies modest upside driven by steady, compounding fundamentals.

Expansion of high margin business streams Walmart Connect, marketplace, and Walmart+ memberships is diversifying Walmart's income base beyond retail, gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time.

Curious how a mature retailer earns a growth style valuation, while still leaning on everyday low prices? The secret mix is margin rich, globally scaled, and very deliberate. Want to see which long range revenue and profit assumptions power that fair value, and why the projected earnings multiple looks more like a software name than a supermarket chain?

Result: Fair Value of $118.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could be derailed by stubborn e commerce losses, as well as rising wage and claims costs, which may compress margins faster than efficiency gains materialize.

Find out about the key risks to this Walmart narrative.

Another View: Earnings Multiple Sends a Caution Flag

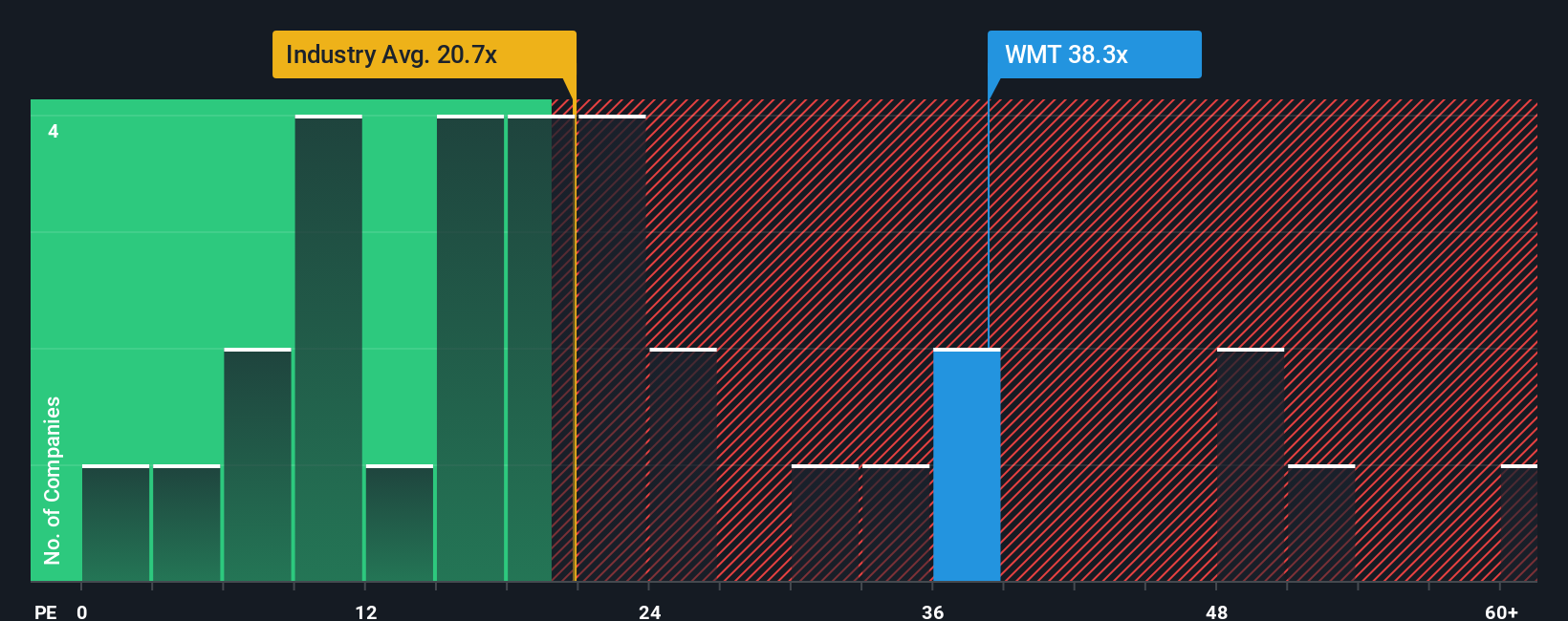

Look past that modest 3.4% upside and the picture feels less comfortable. Walmart trades on a rich 39.8x earnings ratio, well above the US consumer retailing average of 20.7x, its peer average of 25.6x, and even our fair ratio of 37x, leaving little room for execution slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If this framing does not quite match your view, or you would rather test your own assumptions, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Before you log off, you can use the Simply Wall St Screener to explore companies that may complement or diversify a portfolio that already includes Walmart.

- Explore potential long term opportunities by searching for quality bargains within these 912 undervalued stocks based on cash flows that the market may not have fully priced in.

- Gain exposure to innovation by looking into these 27 quantum computing stocks that are involved in emerging areas of computing.

- Review these 14 dividend stocks with yields > 3% that may help support a passive income stream during different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026