- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (NYSE:WMT) Sales Jump 5% But Stock Slips 9%

Reviewed by Simply Wall St

Walmart (NYSE:WMT) recently unveiled Dwell212, a wellness-inspired body care line introduced by Harry Slatkin, priced under $10, and partnered with California Water Service to expand their service offerings. Both initiatives aim to enhance their market presence. Despite these positive developments, Walmart's share price declined by 9% over the last quarter. Notably, during the same period, the company experienced a 5% increase in total sales and an annual cash dividend increase by 13% to $0.94 per share. This occurred amidst a broader market decline, with the S&P 500 down 9% from its recent peak. Various factors could have influenced Walmart's share price, including broader market dynamics with major indices experiencing downturns, as evidenced by the drop in Dow Jones owing to a slump in big tech stocks like Tesla and announcements from other companies, such as Adobe, which issued a disappointing outlook affecting investor sentiment broadly.

Discover the key vulnerabilities in Walmart's business with our detailed risk assessment.

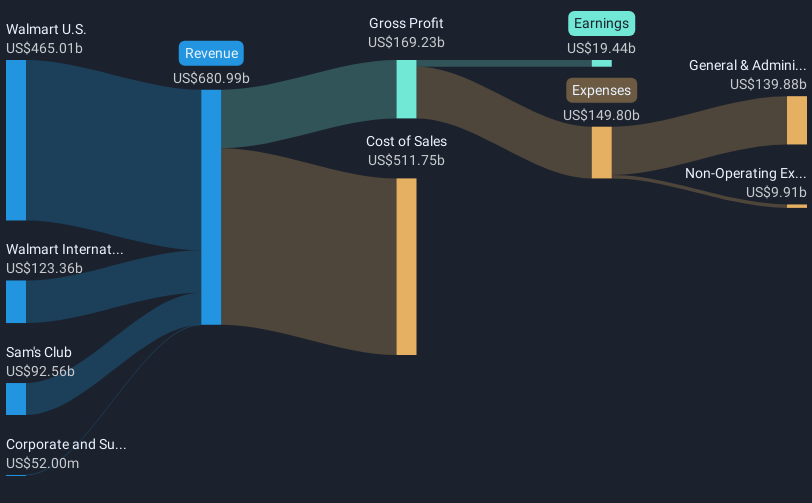

Over the past five years, Walmart's total shareholder return, which includes both share price appreciation and dividends, reached a substantial 124.75%. This substantial performance can be attributed to several key developments. In September 2020, Walmart partnered with Microsoft to bid for TikTok's U.S. operations, signaling strategic expansion efforts. The successful launch of healthcare services in new locations, such as the Newnan, GA health center in September 2020, broadened Walmart's reach. The company also marked impressive revenue increases, reporting US$681 billion recently, up from US$648.1 billion. Furthermore, the company fulfilled a US$20 billion share buyback plan initiated in November 2022, indicating robust shareholder value initiatives.

Walmart's financial metrics show improvement over the years, with profits recording a 25.3% growth over the past year, outperforming its historical trends. The completion of a new home office campus in January 2025 further underscores Walmart's commitment to enhancing worker well-being and operational efficiency. Throughout the last year, Walmart notably outperformed the US Consumer Retailing industry, which had a 20.1% return, and the broader US market with a 7.5% return. This steady growth trajectory underscores Walmart's resilient business model amidst market challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Walmart, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives