- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (NYSE:WMT) Expands Allergen-Free Snacks With LK Meat Sticks In 2,800 Locations

Reviewed by Simply Wall St

Walmart (NYSE:WMT) experienced an 18% price increase over the past month, largely paralleling broader market gains. The company's recent retail expansions, including LK's product rollout across over 2,800 Walmart locations, may have reinforced investor confidence. These expansions, alongside partnerships like Jumex Hard and Womaness, potentially contributed to the positive price movement. Meanwhile, developments such as the opening of a new distribution center and various product launches could have further supported this trend. As the market remained mixed amid economic discussions on tariffs and Federal Reserve adjustments, Walmart's initiatives possibly offered a counterbalancing strength to support investor sentiment.

Walmart has 1 possible red flag we think you should know about.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent developments within Walmart, such as its extensive retail expansions and partnerships, could complement the anticipated growth in higher-margin ventures and operational efficiencies. These initiatives might positively impact revenue projections by enhancing customer engagement across newer, more profitable avenues like membership and marketplace offerings. Meanwhile, investments in supply chain automation and the impending PhonePe IPO are likely to play crucial roles in underpinning earnings forecasts, contributing to operational efficiency and potential new revenue streams. The ongoing expansion efforts align with Walmart's broader strategic imperatives of boosting profitability, an important factor as the industry contends with digital transition expenses and inflation pressures.

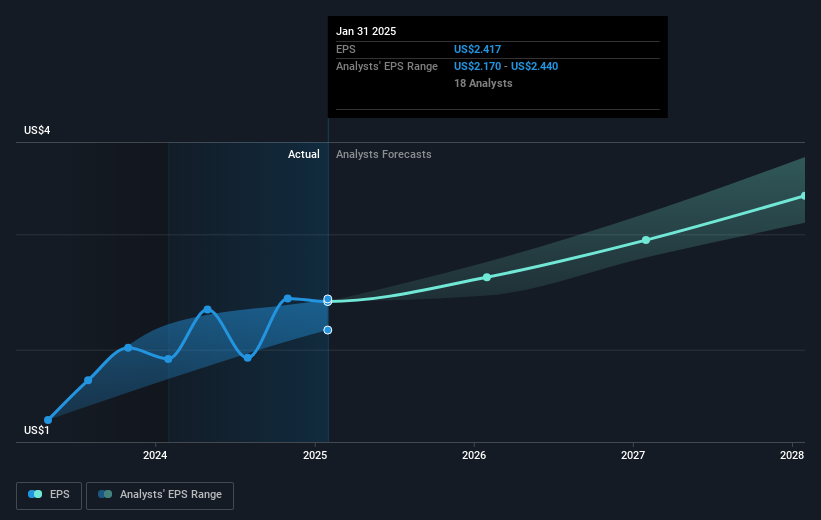

Over the past five years, Walmart's total return, including share price and dividends, reached a noteworthy 155.89%. This demonstrates strong long-term performance, providing a broader context to the recent price trends. In the past year, Walmart's performance outpaced the US Consumer Retailing industry, which saw a return of 34.8%, indicating its resilience amid sector-wide challenges. With the current share price at US$96.04 and the consensus price target of US$107.08, there exists a moderate upside potential of 10.3% based on market expectations. Analysts' views suggest that the company's strategic focus areas could drive Walmart's valuation in the near future.

Assess Walmart's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives