Key Takeaways

- The U.S. Dollar has risen, with the U.S. Dollar Index reaching its highest levels since 2002.

- A strong dollar means that imported goods are cheaper to buy, so companies selling imported goods to the domestic market should see margins strengthen

- U.S. based multinationals that have significant market share outside of the States will see a drop in earnings.

The U.S. dollar is considered the foundation of the global economy and a reserve currency for international trade and finance. Recent global economic slowdown has caused the dollar to rise as investors seek a relative safe-haven in the U.S.

The U.S. Dollar index , which tracks the performance of the dollar against 6 other currencies, reached a 20 year high earlier this month, up 13% for the year. This appreciation of the dollar stems rise in demand for the currency from foreign investors.

A rising US dollar generally has a negative impact on earnings for US based companies, as the dollar value of foreign earnings is reduced but some businesses do happen to benefit from the greenback’s strength.

Latest Developments: The Japanese Yen Falls

A rising U.S. Dollar isn’t the only currency move impacting American businesses. The Japanese Yen has fallen to its lowest level since 1998 , as the Bank of Japan goes against the grain and holds interest rates at -0.10%. While the rest of the world is battling inflation figures well beyond their targets, Japan’s 1.9% inflation is still below the Bank of Japan’s target rate of 2.0% and so interest rates remain low in an effort to encourage consumer spending.

A slightly weaker Yen is generally regarded as being beneficial to Japan’s economy as it makes exports more affordable for consumers in other countries. American businesses importing Japanese goods are set to benefit greatly as the disparity between the U.S Dollar and the Yen grows. One such company on our radar is Best Buy.

Best Buy Co

Best Buy (NYSE:BBY) is a leading electronic goods retailer operating in Canada and the United States. The company has faced headwinds in recent times as growing competition from online retailers like Amazon has impacted sales, but Best Buy's tech support services segment has helped maintain some revenue support as competition in the industry heats up.

While consumer experience is trending towards online shopping, Best Buy’s online revenue accounted for just over 30% of sales, indicating there is still a place for brick and mortar stores where customers can interact with knowledgable salespeople before making a purchase.

Compared to the same quarter last year, Best Buy is feeling a little worse for wear, experiencing an 8% decline in comparable sales. Largely caused by increasing competition and tougher macro-economic conditions like supply chain shortages and increased pressure on household budgets due to inflation.

Recent guidance from Best Buy's CFO Matt Bilunas suggests that the macro-economic conditions that have negatively impacted Best Buy's most recent quarter will persist. The company updates their FY23 outlook to a 3.0% to 6.0% comparable sales decline. A slightly worse outlook than the 1.0% to 4.0% comparable sales decline that was originally anticipated.

While the macro-economic environment does pose some issues for a lot of businesses, Best Buy should be able to weather the storm better than others.

Here’s why a rising U.S. Dollar and a declining Japanese Yen is great news for Best Buy:

- Japan’s consumer electronics sector is one of its largest industries. Brands like Canon, Nikon, Nintendo, Panasonic, Sony and Yamaha are all exported from Japan for sale globally. Electronic goods retailers in North America like Best Buy will be able to import these electronics at a far more advantageous price point if the U.S Dollar continues its upwards trend and the Yen continues to exhibit a decline. Profit margins on these goods will see an uplift and should help to offset some of the impacts caused by tougher economic conditions.

Shareholders of Best Buy will be pleased to know that analysts forecast Earnings Per Share (EPS) to grow beyond 2023. If you want a further breakdown of the company's future growth prospects, we encourage you to check out Best Buy's Future Growth summary on Simply Wall St.

The Companies That Thrive as the U.S. Dollar Strengthens

Walmart

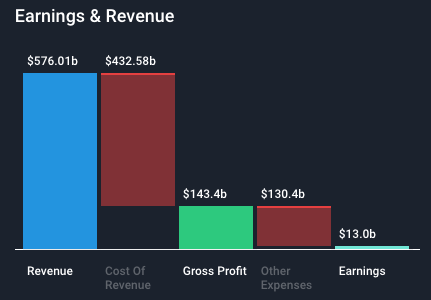

Walmart (NYSE:WMT) is a behemoth of American industry. The retailer employs upwards of 2.3 million people and brings in close to US$570 Billion in net sales each year. A company of this magnitude and staying power is well prepared to weather the headwinds of an economic slowdown. However, Walmart in particular has reasons to be assured by the comparative strength of the U.S. currency. In 2020, Walmart topped the list of American companies by import volume , importing approximately 930,000 twenty-foot container equivalent units (TEU) of merchandise. Despite commitment from the company to invest US$350B in U.S. manufacturing , Walmart sources much of its merchandise from overseas where the costs are lower and margins are higher - although this isn’t necessarily a bad thing.

Here’s why Walmart is expected to benefit from the rising U.S. dollar:

- When the U.S Dollar is strong, it is relatively more affordable to purchase and import foreign goods to the United States because each dollar has more purchasing power per unit of the foreign currency. Walmart’s huge reliance on imports will mean that - ignoring logistics costs - the profit margin on each imported item sold increases.

An analysis of Walmart has revealed that there has been significant selling from the Walton Family and other insiders. To find out more about recent insider transactions, head to the Ownership section of our Walmart Company Report .

United Parcel Service

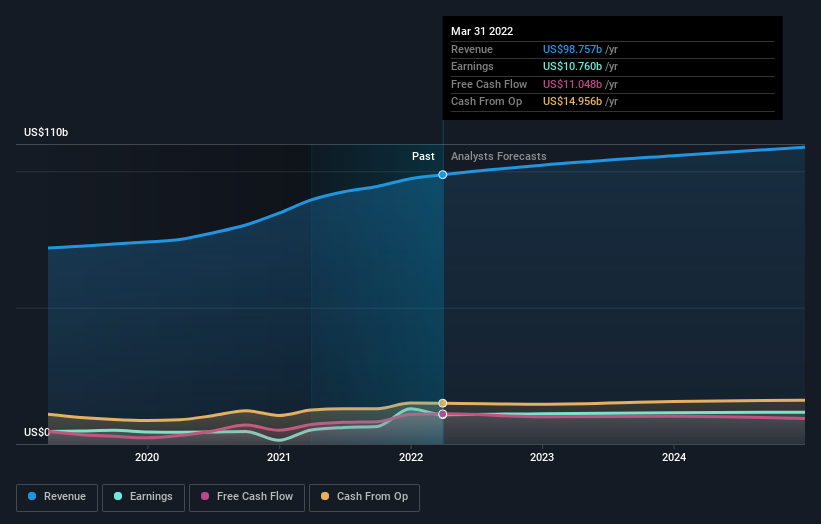

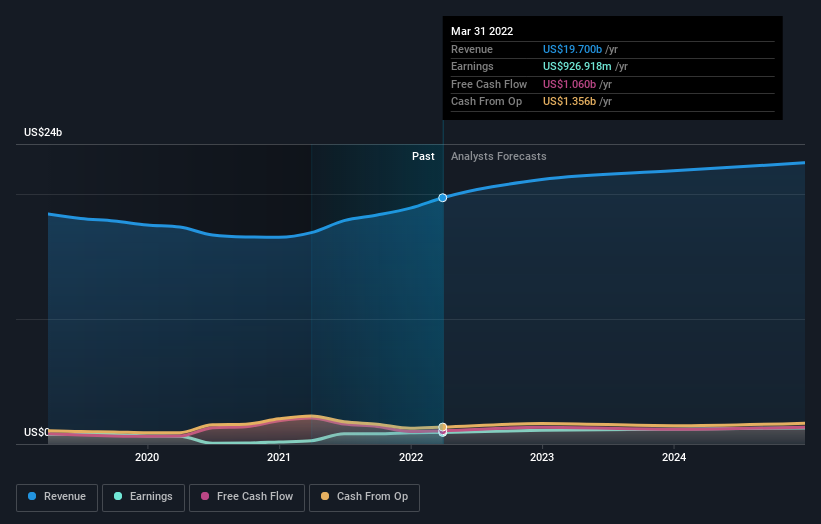

While logistics companies aren’t a traditional beneficiary of a rising U.S. dollar, there is scope for companies like United Parcel Service (NYSE:UPS) to see a flow-on effect. UPS is the largest package delivery company in the world. The first quarter of 2022 alone saw 23.3M packages being handled daily. UPS strength is apparent in its financial performances with first quarter revenues reaching US$24.4 Billion - a 6.4% increase over the corresponding period in 2021. True understanding of its strength lies in its 17.6% increase in quarterly operating profit to US$3.3B, despite facing the headwinds of increased oil prices impacting transportation costs. UPS’ financial strength has contributed to solid returns recently as the company has outpaced its peers and the wider market over the past 7 days.

Here’s the biggest advantage for UPS as the dollar continues to rise:

- A strong U.S. dollar means that American consumers are able to purchase foreign goods at a relatively lower price. With inflation already putting stress on household finances, consumers may look to foreign markets for their online shopping needs as exchange rates work in their favor. UPS and its peers should see an increase in shipments to American consumers, with receipts in U.S. dollars being an added bonus.

The consensus from analysts covering UPS is that earnings are forecasted to grow at 2.7% on an annual basis. This comes in lower than the average for its peers in the U.S. logistics sector. To find out more on the company’s prospects in the near-term, head to our Future Growth Analysis for UPS on our website.

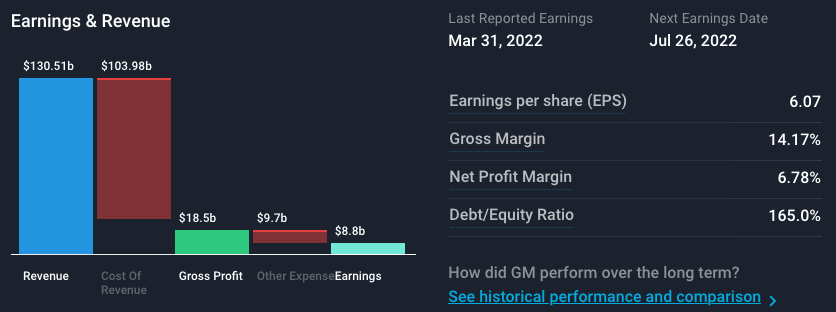

General Motors

Despite losing its crown to Toyota for the first time ever, General Motors (NYSE:GM) remains an incredibly strong performer in the automotive industry. In the midst of supply chain issues and inventory shortages that tapered sales in the last year, GM was still able to post solid results in their quarterly earnings report.

The company is well positioned to navigate a rapidly changing environment, targeting production of 400,000 all-electric vehicles over the course of 2022 and 2023 , which is a good look as increased oil prices drive consumers to look for battery-powered alternatives. Looking forward to the remainder of 2022, the issues with l ow inventory and production delays due to chip shortages are resolving themselves but economic slowdown could lead to a slight decline in global sales. However, GM could be able to offset this as the dollar rises.

Here is why General Motors should see some advantages in the rising dollar:

- While General Motors manufacture their cars domestically, many of the electrical components and raw materials are sourced from foreign markets and imported to the States. A stronger U.S. dollar means these raw materials should be able to be sourced at a competitive price, improving margins at a time where the company may see a decline in vehicle exports owing to the exchange rate increasing costs for foreign markets.

A look at GM’s financial health has highlighted significant risks associated with its high levels of debt. If you want to find out more about the company’s ability to cover its liabilities, you can do so for free on our website .

Genuine parts

Genuine Parts (NYSE:GPC) is a distributor dealing in automotive and industrial parts. With a global footprint, Genuine Parts’ automotive parts division is the largest part of the business accounting for 66% of net sales. Primarily sold under the NAPA brand throughout North America. While some of Genuine Parts’ business will be impacted by the rising dollar due to unfavorable exchange rates impacting sales in Europe and Australasia, the company should find its feet in the domestic market.

Here’s where Genuine Parts should benefit most from the rising U.S. dollar:

- Much like Walmart, any goods imported for sale within the United States should see slightly improved profit margins thanks to the rise in the dollar. Considering 75% of Genuine Parts’ business by revenue is U.S. domestic, they should see quantifiable benefits on the sales of their imported products offered through their 5,988 NAPA Auto Parts stores.

An analysis of General Part’s financial health has highlighted a high level of debt to equity. If you’re an investor that heeds caution in high debt levels during a period of increasing interest rates, then check out our Debt to Equity analysis for General Parts for free on our website .

Cautionary Tales

A rising dollar isn’t always a hallmark of success for American businesses. More often than not, a strong U.S. dollar can actually weaken the stock market. Large multinational corporations are some of the heaviest hit during these times as their considerable overseas revenues take a hit when converted back to U.S. dollars come reporting time. Here’s how we see some of the U.S. majors being impacted.

McDonald’s

McDonald’s (NYSE:MCD) is a prime example of a business facing the impacts of the gaining dollar. McDonald’s has expansive overseas operations and you’d be hard-pressed to find a continent on earth that isn’t sporting the golden arches. The company has performed well nonetheless with global sales up nearly 12% this quarter , compared to the same period of the previous year, this was mainly spearheaded by an incredibly strong increase in sales in international markets which saw a 20.4% rise. The next few months are important for McDonald’s as they navigate the effects of their recent exit from Russia and face the continued impacts of supply chain disruptions.

Here’s where the rising U.S. dollar might impact McDonald’s the most:

- While the increase in international market sales will help offset the foreign exchange headwinds, the fact is that a rising dollar has caused the value of these revenues and earnings to decline in U.S. dollar terms. Should the sale price of menu items rise, McDonald’s will face tightened competition from local chains.

An analysis of McDonald’s has indicated strength in its dividend yield and its dividend per share is set to grow into the future. To find out how McDonald’s stacks up to the rest of the market, we encourage you to take a look at our Dividend Analysis on our website.

Apple

Apple’s (NYSE:AAPL) firm grasp on the mobile device market means that its presence iOS users account for over 35% of mobile phone users globally . Foreign currency movements in Europe, Japan and the rest of Asia Pacific bore unfavorable results as net sales declined across all markets. Recent guidance from Apple on their quarterly performance to June 30 2022 is indicating the expectation of unfavorable exchange rates continuing to impact sales figures.

Here’s why the strengthening dollar might cause issues for Apple:

- Apple’s overseas business will be negatively impacted from a pure earnings standpoint as foreign currencies continue to be weak against the U.S. dollar. Increasing materials costs and logistics costs will compound this effect as foreign consumers will see the price of the iPhone, iPad and Mac devices rise, potentially pushing them towards cheaper alternatives.

Following the recent market decline, Apple is now trading at a 12.9% discount relative to our assessment of its fair value. To see how Apple stacks up compared to its peers in a number of different valuation metrics, head to Simply Wall St’s Apple Valuation Analysis .

The Bottom Line

Rising treasury yields have been a boon for the dollar which look to see continued strength into the coming months. While the rising dollar does have its drawbacks, it is helping fight inflation by slowing exports, weighing down inflation on a trade-weighted basis. Should these economic conditions continue for the long-term, the U.S. should expect to see large inflows in investment capital. This is primarily due to their ability to be self-sustaining and the increasing reliance on their oil and agricultural industries, spurred on by the conflict between Russia and Ukraine. For more opportunities in North America, check out our article on the companies benefiting most from the rising oil prices.

We are looking for feedback on this article. HERE is a short survey you can complete to let us know how we did.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives