- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

The Implications of Reduced Earnings for Walmart's (NYSE:WMT) Stock Price

Summary:

- WMT announced an expected decline in Q2 and FY2023 earnings of 11%-13%, implying a net income of around $12.16b, a reduction of 24% from prior analysts' estimates.

- The market may find it harder to justify the prior 27.8x premium PE, and the stock may converge closer to the market average of 22.8 PE.

- The main cited reason for the earnings erosion is inflation, with the apparel segment being the hardest hit.

Walmart (NYSE:WMT) announced that they are cutting their Q2 and 2023 earnings estimates to a decline between 11% and 13%. Practically, as earnings are expected to decline around 11% for the FY2023, then the company should make around $12.16b, down 24% from the $16b that analysts were estimating for 2023. This 24% drop in expected earnings is the main reason for the correction of the stock price after the announcement.

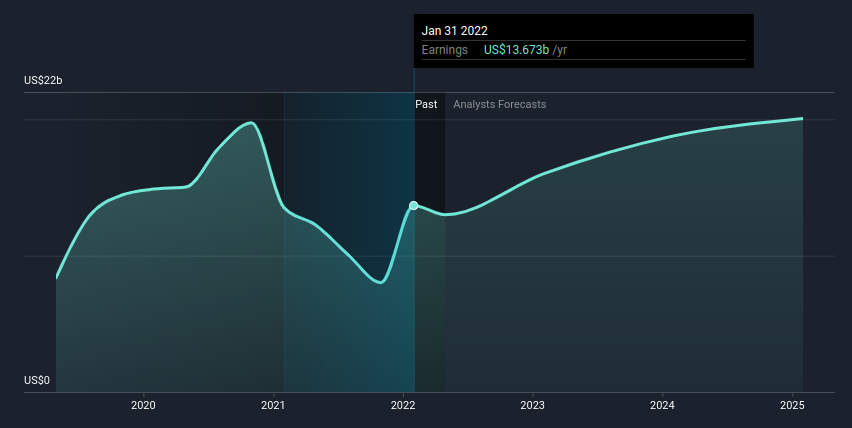

In the chart below, we can see the analysts' expectations prior to the cut in future earnings:

See our latest analysis for Walmart

After analysts update their forecasts, we can expect quite a different picture for Walmart's future earnings. Since the announcement broke, analysts have been asking "if and to what extent" this inflation based erosion will impact other retailers. This is something investors may want to re-evaluate, as Walmart is one of the stronger companies, while others may suffer even more.

Other Walmart Announcement Highlights

- Expected Q2 sales growth of 7.5% or $152.19b.

- Estimated Q2 operating margin of 4.2%, adding up to $6.39b.

- Q2 adjusted EPS is expected to decline around 8.5% resulting in an estimated $1.19 (down from $1.3).

Currently, the last 12-month operating income is $24,351b and a margin reduction from 4.2% to 3.9% would imply $22.6b.

Sales are expected to be higher in FY23, but this is almost entirely the effect of inflation. Investors may have a difficult time with inflation, as it boosts sales but erodes profits. We should also keep in-mind that Walmart is a $330 market cap retail giant, with significant pricing power, indicating that the company may have used-up a large portion of their tools and is still suffering the effects of inflation.

The company stressed that their food inflation numbers are double-digit and higher than in Q1. On their side, the category that is "hardest-hit" by inflation is apparel.

What Does the Change in Earnings Estimates Mean for Walmart's Stock

Walmart was trading at a higher Price to Earnings (27.8x since last close) than both the general market (22.8x) and retail sector (18.9x). In order for this to be sustainable, a company needs to have high growth implications, high returns on capital and low risk. When these assumptions become shaky, investors may start pricing the stock from "what it could be", to how it actually performs today. This is partly why so many growth stocks have been declining in the past two quarters - growth expectations decreased, and market risk increased. For Walmart, investors may find that the future growth expectation can no longer justify a premium PE, and the stock may converge between the retail and market PE. Note that the company still has higher returns on capital than its cost of capital, and the pricing may keep changing until we can get a predictable (not necessarily lower) handle on inflation.

If we consider this scenario, we see that the stock is 18% exposed to a downturn relative to the general market PE of 22.8x. This would imply a price reduction from $132 (since yesterday's close) to about $108, or a market cap drop from $362.4b to $297b. As you can see, this is just a bearish scenario and the stock has built-in value and stability advantages that are not factored in our analysis, which may shield the company from larger declines.

Conclusion

Walmart's reduction on future earnings estimates is likely material to the company's stock price. While the effect may not be long term, the market seems to have responded fairly to the news, and it may take longer for the company to recover to previous levels.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives