- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

How Walmart’s (WMT) Launch of Crypto Trading on OnePay Could Shape Its Digital Finance Future

Reviewed by Sasha Jovanovic

- Walmart-backed fintech OnePay will soon introduce Bitcoin and Ethereum trading and custody features to its mobile app, enabling users to buy, sell, and hold cryptocurrencies directly within the platform, integrating digital assets into everyday shopping and payment experiences at Walmart stores or online.

- This expansion highlights Walmart’s commitment to broadening its digital finance ecosystem and meeting increased consumer demand for crypto alongside its traditional retail and banking offerings.

- We’ll examine how Walmart’s move into cryptocurrency-enabled payments through OnePay could reshape its investment narrative and long-term digital growth potential.

Find companies with promising cash flow potential yet trading below their fair value.

Walmart Investment Narrative Recap

To be a Walmart shareholder today, you need to believe in the company’s ability to translate digital innovation and scale into lasting revenue growth, while navigating the pressures of rising costs and competitive intensity. The recent announcement of cryptocurrency trading in Walmart’s OnePay app is unlikely to materially shift near-term profitability or address the core challenge of international e-commerce losses, the most important catalyst remains improved economics in e-commerce and grocery delivery, with persistent cost pressures as the leading risk to the business.

One particularly relevant announcement is Walmart’s collaboration with Wiliot to deploy ambient IoT technology across its supply chain, which could help drive supply chain efficiency and reduce costs. In the context of ongoing logistics and digital transformation challenges, this stands out as a practical step toward tackling the margin and profitability issues critical to Walmart’s investment case.

However, keep in mind that while these digital efforts may curb some cost pressures, tariff impacts and wage inflation pose persistent risks investors should be aware of, particularly if...

Read the full narrative on Walmart (it's free!)

Walmart's narrative projects $789.9 billion in revenue and $27.4 billion in earnings by 2028. This requires 4.5% yearly revenue growth and a $6.1 billion increase in earnings from $21.3 billion today.

Uncover how Walmart's forecasts yield a $112.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

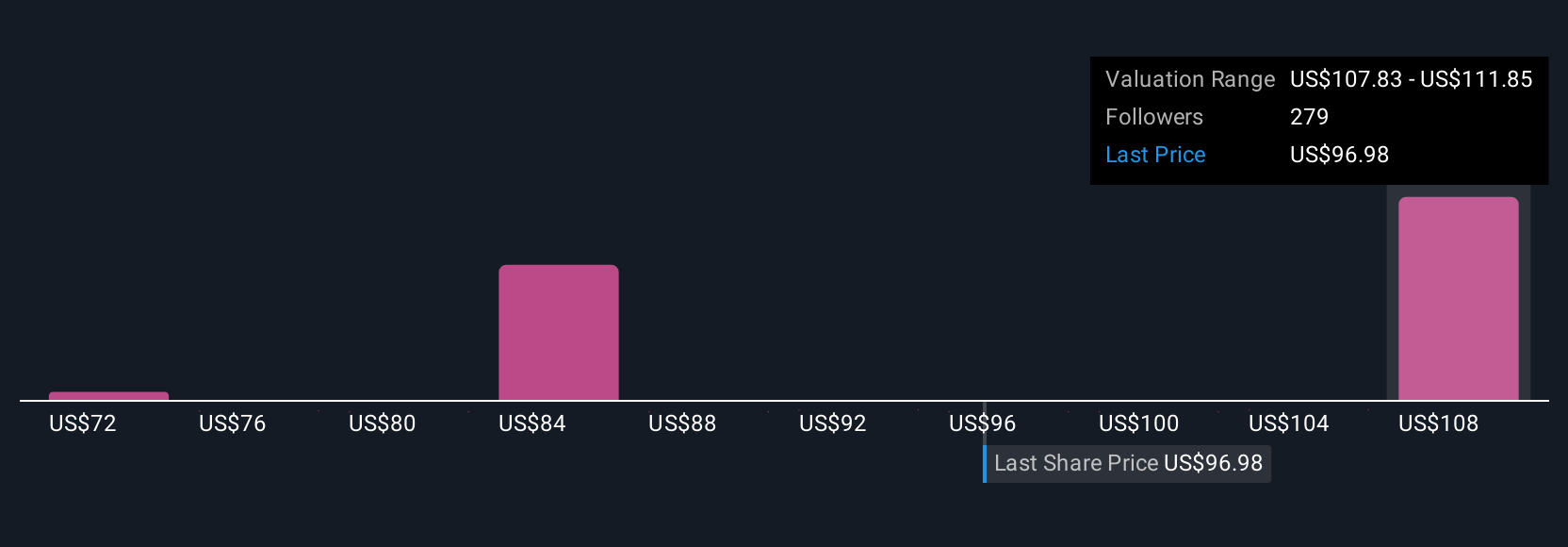

Simply Wall St Community members’ fair value estimates for Walmart range from US$71.70 to US$112 across 24 viewpoints. Rising supply chain and wage expenses could test optimism among those at the higher end of this spectrum, see how others weigh the risks and rewards.

Explore 24 other fair value estimates on Walmart - why the stock might be worth 30% less than the current price!

Build Your Own Walmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walmart's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives