- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Does Walmart’s Strong 2025 Rally Still Leave Room for Long Term Growth?

Reviewed by Bailey Pemberton

How Has Walmart Stock Been Performing Lately?

Walmart has quietly become one of the market's sturdier long term performers, and with the stock up 3.0% over the last week, 10.7% over the past month, 24.9% year to date, 20.2% over the last year, 135.0% over three years, and 143.8% over five years, many investors are wondering whether that strength is already fully priced in.

This strong and fairly consistent performance has shifted how the market thinks about Walmart, with the stock increasingly seen as a blend of defensive stability and structural growth exposure rather than a slow moving retail giant.

Recent headlines have focused on Walmart's push deeper into higher margin areas such as advertising, marketplace services, and memberships, along with ongoing investments in automation and supply chain technology. All of this helps explain why investors have been willing to pay up for the stock.

At the same time, developments such as its expanding third party marketplace and healthcare partnerships are reinforcing a narrative that Walmart is steadily evolving beyond traditional brick and mortar retail. This can justify a premium in the eyes of many market participants.

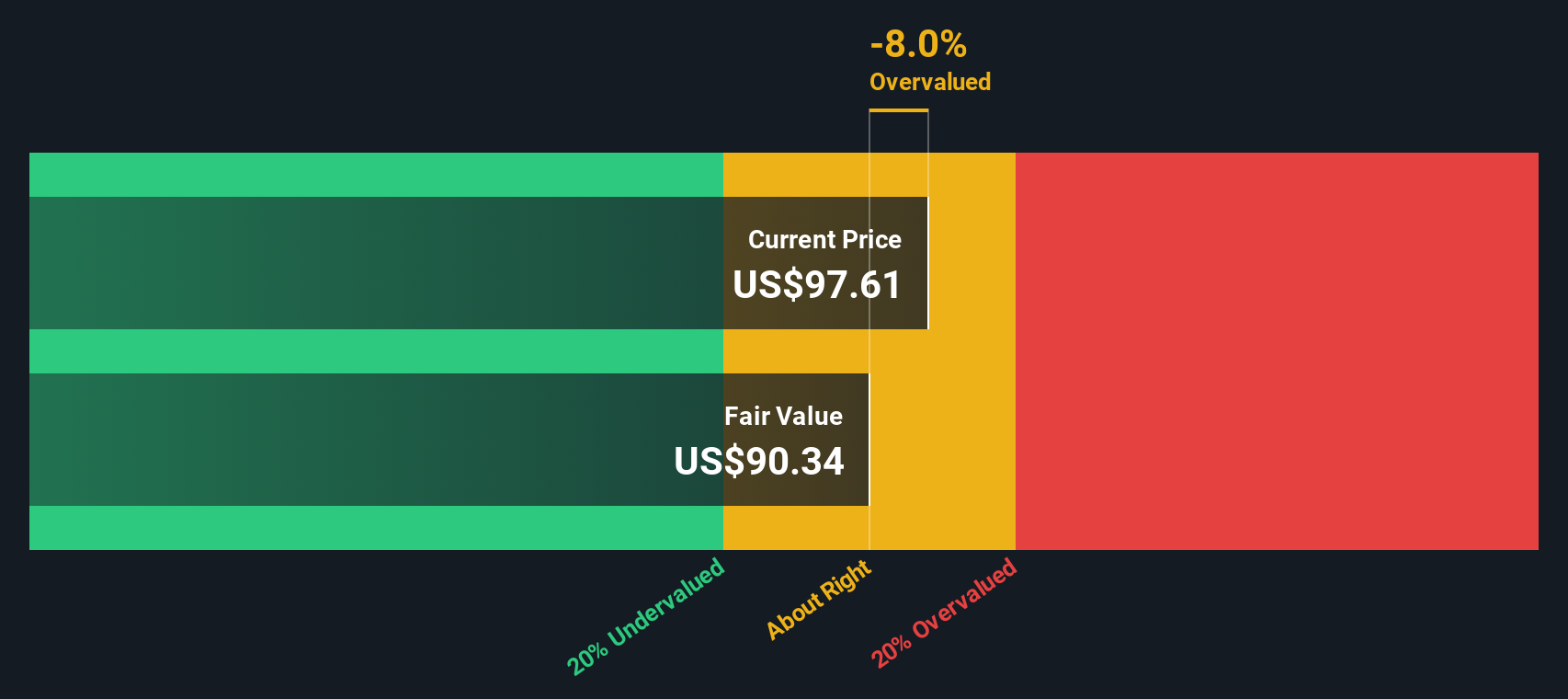

Despite that, Walmart only scores 1 out of 6 on our valuation checks for undervaluation, suggesting the stock screens as fully to slightly overvalued on most conventional metrics, even if it still looks attractive on one measure.

In the next sections we will walk through those different valuation approaches, then finish by exploring a more holistic way to think about Walmart's value that goes beyond the standard checklist style models.

Walmart scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Walmart Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today in dollar terms. For Walmart, the model starts with last twelve month Free Cash Flow of about $17.3 billion and then applies a 2 Stage Free Cash Flow to Equity framework, where near term analyst forecasts are followed by longer term extrapolations.

Analysts see Walmart’s annual Free Cash Flow rising steadily, with projections reaching around $31.5 billion by 2030, and then continuing to grow at moderating rates thereafter. Simply Wall St extends these analyst inputs to build a 10 year cash flow path, then discounts those future dollar cash flows back to the present to arrive at an estimated intrinsic value per share of $112.95.

On this DCF view, Walmart screens as roughly 0.5% undervalued, which is effectively in line with the current share price rather than a clear bargain or a bubble.

Result: ABOUT RIGHT

Walmart is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Walmart Price vs Earnings

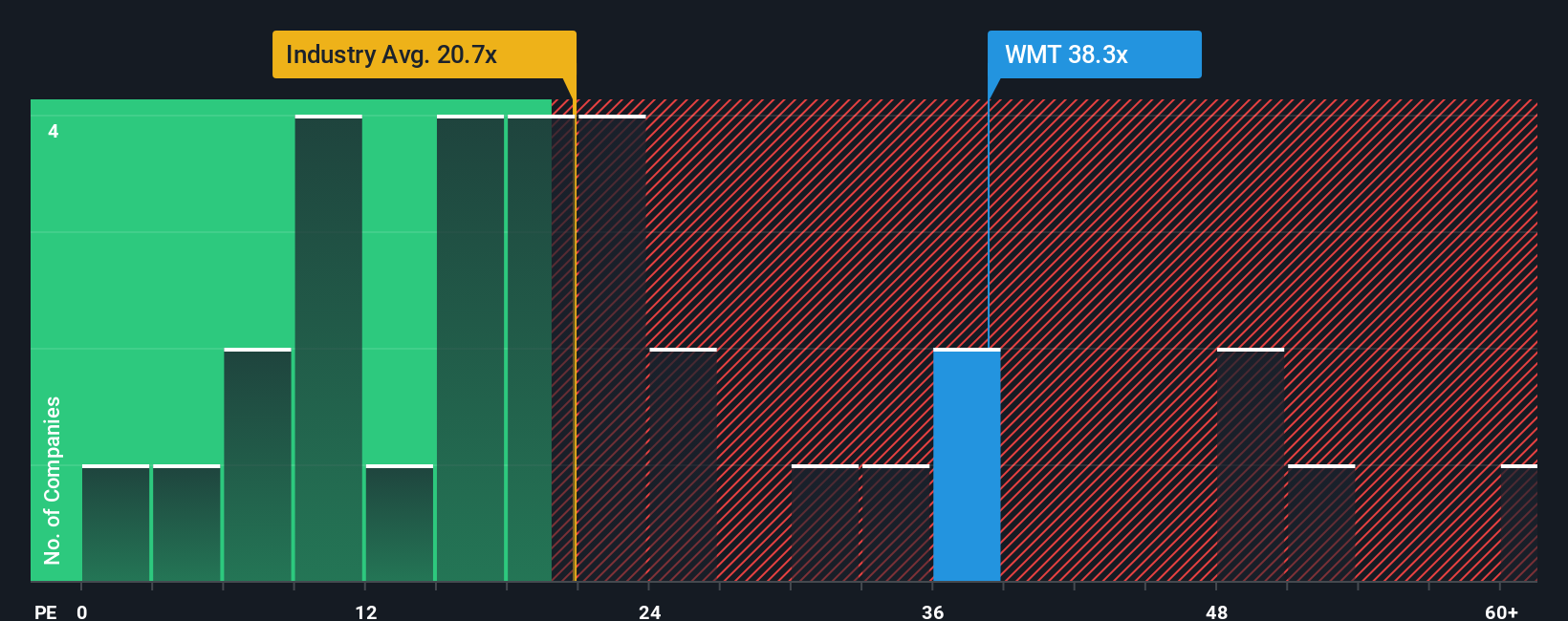

For a mature, profitable business like Walmart, the Price to Earnings ratio is a practical way to judge valuation, because it directly links what investors pay today to the company’s current profit stream. In general, higher growth and lower risk justify a higher PE, while slower growth or greater uncertainty usually warrant a lower, more conservative multiple.

Walmart currently trades on about 39.1x earnings, which is well above both the Consumer Retailing industry average of roughly 20.0x and the broader peer group at around 25.4x. That headline premium suggests investors are already paying up for Walmart’s scale, resilience and growth initiatives.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what PE Walmart should trade on after adjusting for its earnings growth outlook, profit margins, industry positioning, market cap and risk profile. This produces a Fair Ratio of 36.7x, which is more tailored than a simple industry or peer average because it bakes in company specific strengths and vulnerabilities rather than assuming all retailers deserve similar valuations. Compared with Walmart’s actual 39.1x, the stock looks somewhat expensive on earnings, pointing to a mildly stretched valuation.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

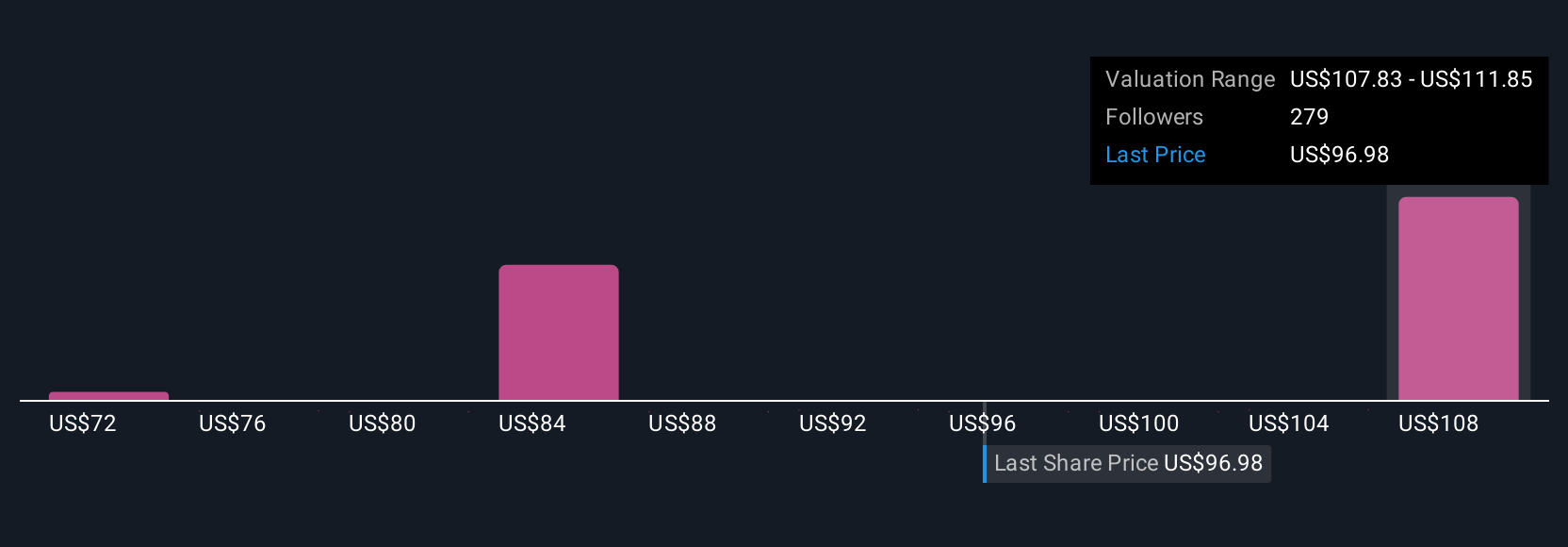

Upgrade Your Decision Making: Choose your Walmart Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Walmart’s story with a concrete financial forecast and a clear fair value, all within the Simply Wall St Community page that millions of investors already use. A Narrative is your story behind the numbers, where you set assumptions for Walmart’s future revenue, earnings and margins, then see how those assumptions translate into a fair value you can compare with today’s share price to decide whether it looks like a buy, hold or sell. Because Narratives on the platform update dynamically when new information arrives, such as Sparky’s AI shopping rollout, fresh earnings or CEO changes, your fair value view can evolve in real time rather than staying frozen in a static model. For example, one investor might plug in the higher end analyst expectations and arrive at a Walmart fair value closer to $127, while another might lean on more cautious assumptions that point to a value nearer $64. Both can clearly see how their different stories drive those very different price targets.

Do you think there's more to the story for Walmart? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026