- United States

- /

- Food and Staples Retail

- /

- NYSE:WMK

Weis Markets (WMK): Assessing Valuation in Light of New PromoAI Technology Rollout

Reviewed by Kshitija Bhandaru

Weis Markets (WMK) is making headlines with its latest decision to roll out Cognira’s PromoAI platform in all of its stores and digital channels. The move is focused on boosting promotion planning and signals a continued focus on operational innovation.

See our latest analysis for Weis Markets.

While rolling out PromoAI marks a strong step forward for Weis Markets, the stock itself has seen some recent turbulence, with a 1-day share price return of -1.14% and a 7-day dip of -4.40%. Yet, despite recent choppiness, long-term shareholders still enjoy a 6.98% total return over the past year and a nearly 50% total return over five years. This underscores how steady performance and new initiatives continue to shape the bigger picture.

If you’re eager to discover more companies making bold strategic moves, it’s a great time to broaden your investing search and check out fast growing stocks with high insider ownership

But with shares pulling back recently, investors may be wondering if Weis Markets is undervalued after this operational push, or if the market is simply pricing in all future growth already.

Price-to-Earnings of 15.8x: Is it justified?

Weis Markets shares currently trade at a price-to-earnings ratio of 15.8x, noticeably below both its peer group average and the broader market. This relatively modest multiple follows the recent operational push and recent share price pullback.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of the company’s earnings. For a grocery retailer like Weis Markets, it reflects investor expectations for future profit growth, efficiency, and resilience in a competitive sector. A lower-than-average P/E could suggest the market is skeptical about future earnings growth or simply undervaluing the company’s earning power.

Compared to its peers and industry, Weis Markets looks inexpensive. Its P/E of 15.8x is below the US market P/E of 19.2x, well below the Consumer Retailing industry average of 20.5x, and even more attractive next to the peer group average of 61.8x. The current market price implies a discount to sector optimism or perhaps lower growth expectations, but the competitive multiple stands out.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 15.8x (UNDERVALUED)

However, slowing recent returns and a lack of clear annual growth in revenue or profit could pose fresh challenges for Weis Markets in the future.

Find out about the key risks to this Weis Markets narrative.

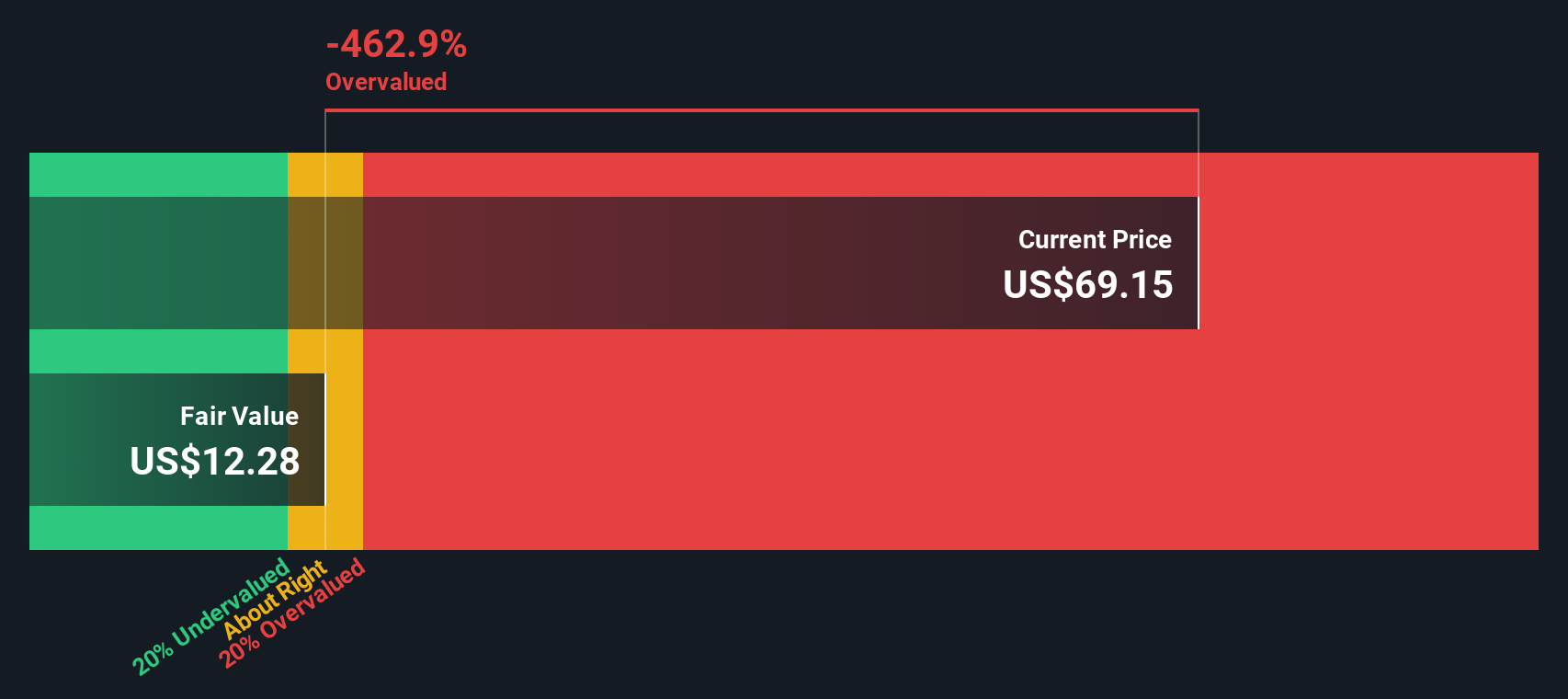

Another Perspective: Discounted Cash Flow Tells a Different Story

While Weis Markets appears undervalued when looking at its price-to-earnings ratio relative to peers, the SWS DCF model presents a different perspective. According to our DCF analysis, shares are actually trading above our fair value estimate, suggesting they may be overvalued right now. Should investors put more weight on market optimism or the cash flow fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Weis Markets for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Weis Markets Narrative

If you have a different perspective or feel inspired to dive deeper into the numbers yourself, consider building your own view of Weis Markets. Create and share your own take in just minutes. Do it your way

A great starting point for your Weis Markets research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to discover stocks with strong upside or unique potential beyond Weis Markets. Broaden your perspective and power your next move with these hand-picked tools:

- Supercharge your portfolio with reliable income by targeting opportunities offering above-average yields in these 19 dividend stocks with yields > 3%.

- Ride the momentum in artificial intelligence by focusing on the most promising businesses driving innovation through these 25 AI penny stocks.

- Capitalize on tomorrow's technology as quantum breakthroughs begin to reshape industries, all within these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weis Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMK

Weis Markets

Engages in the retail sale of food through a chain of supermarkets in Pennsylvania.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives