- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

US Foods Holding (USFD): Is the Stock’s Valuation Overlooked After a Year of Strong Gains?

Reviewed by Simply Wall St

See our latest analysis for US Foods Holding.

This year has seen US Foods Holding’s steady price return attract attention, with momentum building even as the stock consolidated in recent weeks. While its share price recently cooled off slightly, the company’s 23.86% total shareholder return over the past year and 255.63% over five years reflect strong long-term performance. This is driven by operational progress and renewed confidence in its outlook.

If you’re interested in widening your search beyond just US Foods Holding, this could be the perfect time to discover fast growing stocks with high insider ownership.

But with shares still trading nearly 22% below average analyst price targets and over 60% below estimates of intrinsic value, is US Foods Holding presenting an overlooked buying opportunity, or has the market already priced in most of its growth?

Most Popular Narrative: 18% Undervalued

With a narrative fair value of $92.40 set against a last close of $75.75, the market appears to be lagging behind bullish valuation expectations. This backdrop sets up the catalyst that is driving analyst enthusiasm for the company’s future returns.

The company's strong focus on private label and value-added offerings, with penetration now exceeding 53% among independent restaurants, enhances gross margins and provides insulation from input cost pressures, driving steady EPS accretion.

Ever wondered what is behind this confident valuation call? The real intrigue lies in a blend of future earnings upgrades and margin expansion, unlocked by strategic business pivots. The narrative is built on bold forecasts and a financial blueprint not usually seen for a company in this space. Want to know which specific financial drivers set analysts’ fair value so far above today’s stock price? Uncover the details that could reshape your view of US Foods Holding.

Result: Fair Value of $92.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued softness in restaurant demand and uncertainties around mergers could quickly challenge the positive outlook for US Foods Holding’s growth trajectory.

Find out about the key risks to this US Foods Holding narrative.

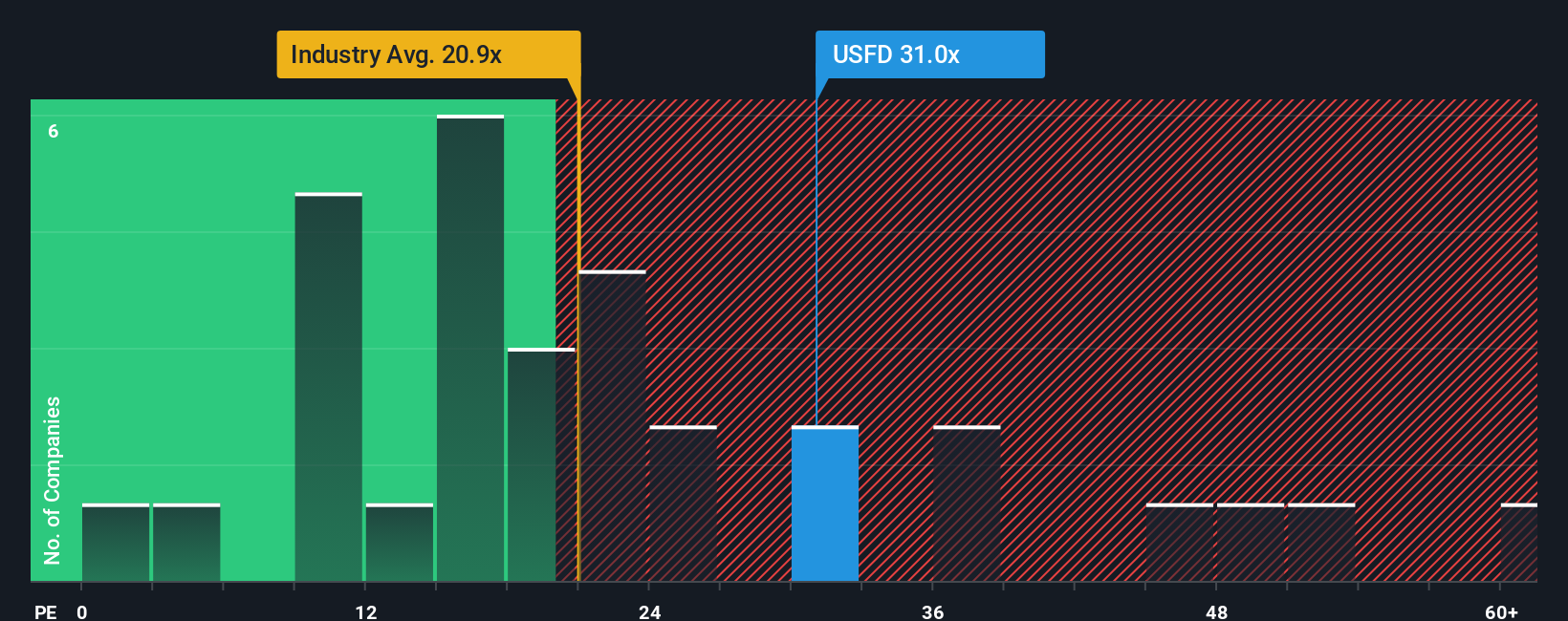

Another View: Market Ratios Signal Valuation Caution

Looking at valuation from a different angle, US Foods Holding’s price-to-earnings ratio stands at 30.8x, which is notably higher than both the US Consumer Retailing industry average of 21.2x and its peer average of 30.4x. The fair ratio suggested by our analysis is 26.1x, signaling that the market currently values US Foods at a premium. This premium could mean investors are pricing in continued strong growth, but it might also point to increased valuation risk if results do not meet expectations. Are these high multiples justified, or is optimism running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own US Foods Holding Narrative

If the prevailing outlook does not align with your perspective or you prefer a hands-on approach, you can examine the numbers and craft your own analysis in just a few minutes. Do it your way.

A great starting point for your US Foods Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Smart Investment?

Give yourself an advantage by checking out opportunities that go beyond just big names. The right screeners highlight trends and companies that most investors miss.

- Cement your portfolio’s resilience by targeting high-yield opportunities with these 17 dividend stocks with yields > 3%. These offer superior income earning potential.

- Catch the next wave of game-changing innovation through these 26 AI penny stocks, which are leading the artificial intelligence surge with transformative technologies.

- Tap into untapped value by pinpointing overlooked gems among these 871 undervalued stocks based on cash flows, which are ready to outpace the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives