- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

Is Greater Operational Efficiency at United Natural Foods (UNFI) Enough to Reshape Its Long-Term Narrative?

Reviewed by Sasha Jovanovic

- United Natural Foods, Inc. recently reported earnings for the fiscal year ended August 2, 2025, with annual sales reaching US$31.78 billion and a net loss of US$118 million, while the fourth quarter saw revenues of US$7.7 billion amid operational challenges, including a cyber incident.

- Management raised fiscal 2026 guidance, projecting net sales between US$31.6 billion and US$32.0 billion and strong momentum in initiatives to improve operational efficiency, debt reduction, and strategic partnerships across its distribution network.

- We'll examine how United Natural Foods' improved earnings outlook and operational resilience could shift its long-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

United Natural Foods Investment Narrative Recap

To be a shareholder in United Natural Foods today, you need confidence that the company can sustain momentum in operational efficiency and margin improvement despite industry competition and heightened cost pressures. The latest earnings report, with raised fiscal 2026 guidance, shows the management’s belief in their ability to overcome recent setbacks, but the lingering effects of the recent cyber incident, while seemingly contained, still shape short-term performance and amplify ongoing risk tied to IT and supply chain security.

One announcement standing out against this backdrop is UNFI’s new labor contract with Atlanta Teamsters, ensuring 30% wage increases and expanded benefits for warehouse staff. While agreeing to improved compensation may support labor stability and operational continuity following a tumultuous year, it also signals rising cost pressures at a time when margin protection is a key focus for investors mindful of both short-term catalysts and competitive threats.

Yet, in contrast, investors should be keenly aware of...

Read the full narrative on United Natural Foods (it's free!)

United Natural Foods' outlook anticipates $32.5 billion in revenue and $107.8 million in earnings by 2028. This forecast assumes a -0.3% annual revenue decline and a $175.8 million increase in earnings from the current -$68.0 million.

Uncover how United Natural Foods' forecasts yield a $29.00 fair value, a 28% downside to its current price.

Exploring Other Perspectives

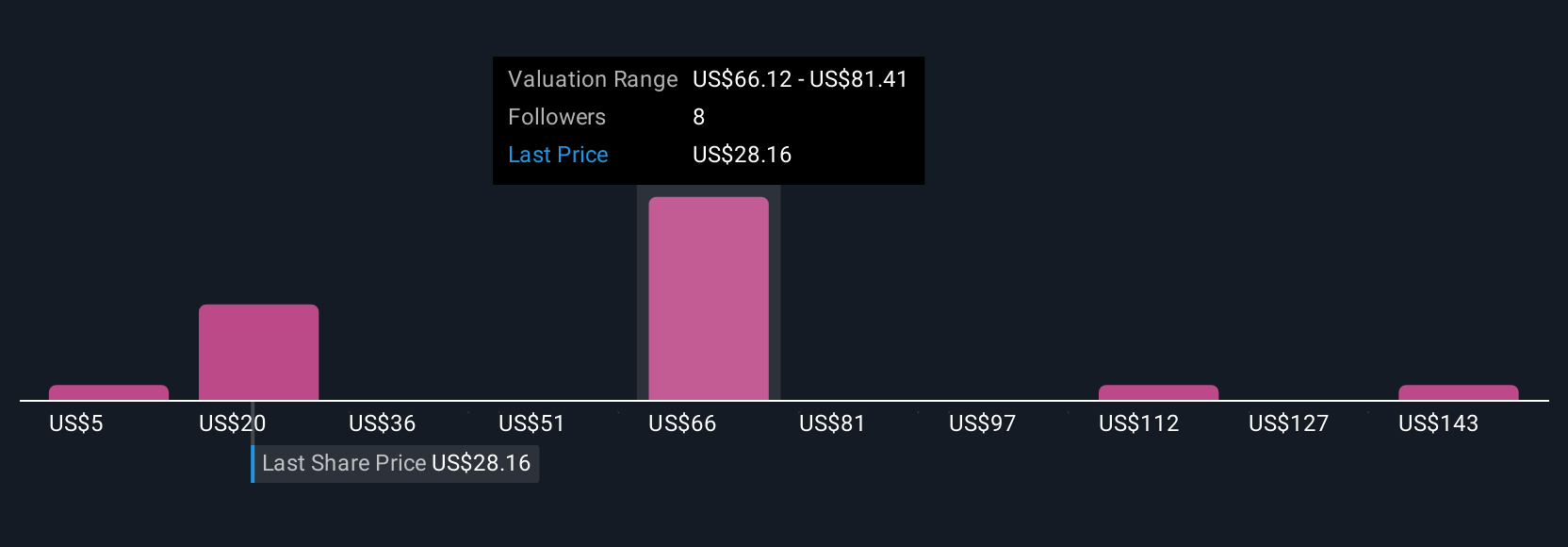

Simply Wall St Community fair value estimates for UNFI span from US$5 to US$157.81 across five individual views. Some see current automation and supply chain initiatives as supporting long-term growth, while others remain cautious given persistent risks to profitability and margin expansion.

Explore 5 other fair value estimates on United Natural Foods - why the stock might be worth less than half the current price!

Build Your Own United Natural Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Natural Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Natural Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Natural Foods' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNFI

United Natural Foods

Engages in the distribution of natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives