- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Will Exclusive Wicked and Stranger Things Lines Shift Target's (TGT) Entertainment-Driven Growth Narrative?

Reviewed by Sasha Jovanovic

- In early October 2025, Target announced exclusive product lines inspired by Universal Pictures' "Wicked: For Good" and Netflix's final "Stranger Things" season, featuring nearly 200 new items and immersive in-store experiences leading up to the holiday season.

- These collaborations position Target as a destination for entertainment-themed merchandise, showcasing its focus on unique assortments and partnerships to drive customer engagement.

- We'll explore how these high-profile partnerships and new collections may influence Target's long-term growth narrative amid increased competition and operational challenges.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Target Investment Narrative Recap

To be a shareholder in Target, you need confidence in its ability to leverage its vast store network, digital strengths, and unique brand partnerships to capture consumer loyalty and steady revenue, despite increasing competition and changing shopping habits. The debut of high-profile merchandise linked to "Wicked: For Good" and "Stranger Things" could boost foot traffic and short-term sales, but is unlikely to materially offset ongoing challenges from soft discretionary spending and pressure on in-store traffic, which remains the primary near-term risk.

The rollout of Target’s accessible self-checkout solution, launched in late September 2025, is especially relevant as it highlights the company’s efforts to enhance in-store experiences and differentiate itself. As competition intensifies and consumer preferences evolve rapidly, initiatives like this could improve customer satisfaction, but the ultimate impact on margins and profitability will depend on successful execution and adoption.

However, just as these product launches grab attention, investors should also be aware of potential margin pressures from...

Read the full narrative on Target (it's free!)

Target's outlook projects $110.5 billion in revenue and $3.7 billion in earnings by 2028. This is based on annual revenue growth of 1.4% and a decrease in earnings of $0.5 billion from the current $4.2 billion.

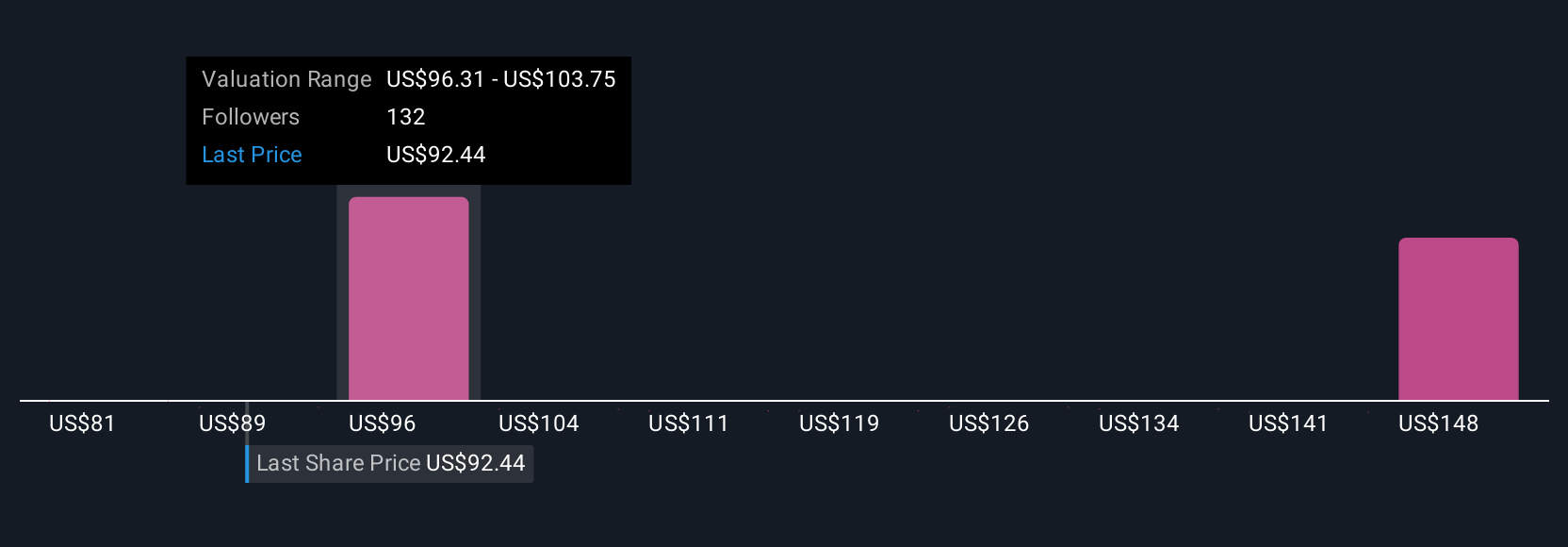

Uncover how Target's forecasts yield a $101.79 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Twenty-five members of the Simply Wall St Community provided fair value estimates for Target ranging from US$80.46 to US$159.55 per share. While opinions are far apart, many remain watchful of Target’s compressed margins and fierce industry competition, inviting you to weigh several viewpoints on long-term performance.

Explore 25 other fair value estimates on Target - why the stock might be worth 11% less than the current price!

Build Your Own Target Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Target research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Target's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026