- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Trade Policy Uncertainty and Weak Margins Might Change the Case for Investing in Target (TGT)

Reviewed by Simply Wall St

- Shares of general merchandise retailer Target experienced a sharp decline after a federal court ruling challenged the legality of global tariffs, leading to profit-taking and increased market uncertainty.

- This event coincided with mixed second quarter results, including a slight miss on gross margin, reduced store traffic, and news of a CEO transition, adding to investor unease.

- We'll examine how concerns around trade policy uncertainty and softer store performance could influence Target's investment narrative going forward.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Target Investment Narrative Recap

To be a Target shareholder, you need to believe the company can leverage its owned brands, omnichannel reach, and store investments to deliver resilient earnings despite competitive and macroeconomic pressures. While the recent federal court ruling on global tariffs sparked a sharp share price decline and created fresh uncertainty around trade policy, this news does not appear to fundamentally change the company’s immediate margin risk, which is still most closely linked to softer store traffic and operational cost pressures.

Among Target's many recent announcements, the upcoming CEO transition may be most relevant in this period of volatility. Smooth leadership succession and the continued collaboration between outgoing and incoming executives offer a degree of near-term continuity, suggesting that current operational catalysts, such as digital investments and private label expansion, will remain a focus despite external headwinds.

However, investors should be especially cautious of escalating regulatory and labor cost pressures, as these could...

Read the full narrative on Target (it's free!)

Target's outlook anticipates $110.5 billion in revenue and $3.7 billion in earnings by 2028. This scenario assumes 1.4% annual revenue growth and a $0.5 billion decrease in earnings from the current $4.2 billion.

Uncover how Target's forecasts yield a $103.69 fair value, a 11% upside to its current price.

Exploring Other Perspectives

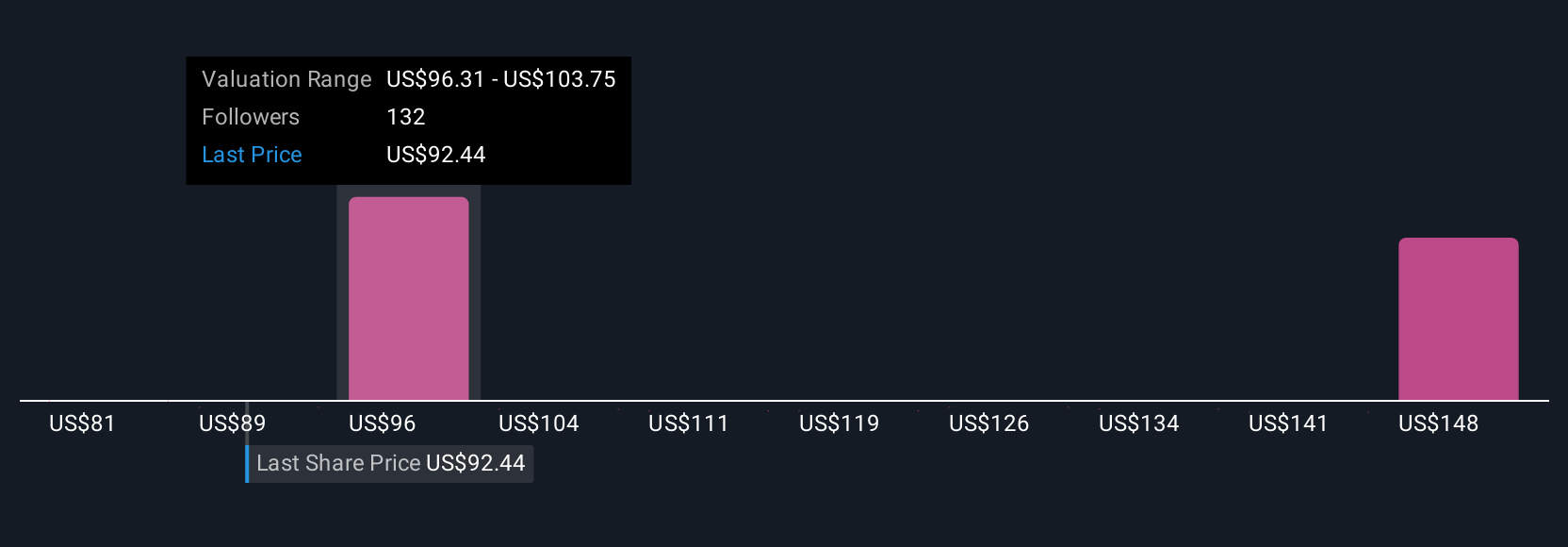

Twenty private investors in the Simply Wall St Community provided fair value estimates for Target, spanning from US$81.43 to US$155.67 per share. With earnings growth expected to lag the market and a large proportion of estimates below US$120, it is worth considering how evolving input costs could impact the range of opinions on Target’s long-term outlook.

Explore 20 other fair value estimates on Target - why the stock might be worth as much as 67% more than the current price!

Build Your Own Target Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Target research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Target's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives