- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

Sysco (SYY) Declares US$0.54 Quarterly Dividend for October 2025 Payout

Reviewed by Simply Wall St

Sysco (SYY) announced a consistent quarterly dividend of $0.54 per share, reinforcing investor confidence in its financial health and stability. Over the last quarter, the company's stock rose by 13%, underpinned by steady dividend payouts despite market challenges. This upward movement aligns with positive corporate actions, including business expansions and a strong client partnership with the MICHELIN Guide. These developments are noteworthy amidst an overall Dow decline, as the market braces for possible shifts in monetary policy. Sysco's resilience in the face of wider market pressures underscores its commitment to delivering shareholder value through ongoing growth initiatives.

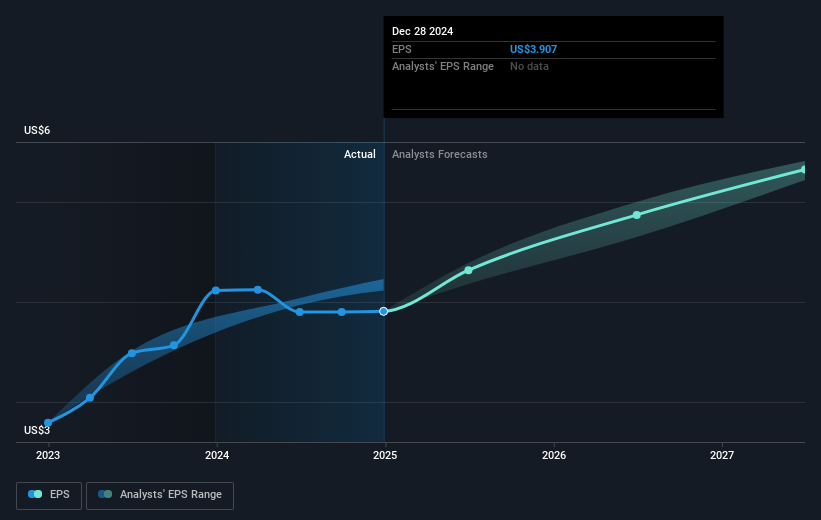

The recent news about Sysco (SYY) maintaining its quarterly dividend of US$0.54 is a signal of stability and confidence, potentially bolstering its narrative focused on growth and financial robustness. Sysco's ongoing international expansion and workforce enhancements highlight attempts to capture greater market share, thereby potentially driving revenue higher. The resilience in share price, which increased by 13% over the last quarter, is encouraging given the broader market conditions and aligns with Sysco's commitment to shareholder value. Moving forward, these developments may positively influence revenue and earnings forecasts, underscoring the company's strategic direction toward improving margins and enhancing market positions.

Over a five-year period, Sysco's total shareholder returns, including dividends, was 60.27%. This performance provides an indication of the company's long-term commitment to delivering value. However, while the stock rose 13% in the last quarter, it lagged the Consumer Retailing industry, which had a 21.8% return over the past year. This highlights the competitive challenges Sysco faces within its sector. With a current share price of US$80.98, there is a 6.91% discount to the consensus analyst price target of US$85.40, suggesting some potential for upward movement depending on the realization of growth forecasts. As Sysco proceeds with its growth strategies, continued alignment with analyst expectations could be pivotal in achieving the targeted price valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives