- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

How Sysco’s COO Transition to Senior Advisor At Sysco (SYY) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Sysco Corporation disclosed that Greg D. Bertrand, its Executive Vice President and Global Chief Operating Officer, moved into a non-executive senior advisor role on January 1, 2026, as part of his transition toward retirement.

- This shift removes a key operational leader from day-to-day management, raising questions about how Sysco will sustain execution on its expansion, pricing, and efficiency priorities.

- We’ll now examine how Bertrand’s move to a senior advisor role could affect Sysco’s investment narrative and long-term operational execution.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sysco Investment Narrative Recap

To own Sysco, you generally need to believe it can steadily grow foodservice distribution revenues while protecting margins despite a soft restaurant environment and cost pressures. Greg Bertrand’s shift to a non‑executive senior advisor role removes a key operator but, given the company’s experienced management bench, it does not materially change the near term focus on improving sales force productivity or the key risk from macro driven restaurant traffic weakness.

The most relevant recent announcement here is Sysco’s Q1 FY2026 update, which showed modest sales growth alongside flat earnings and reiterated FY2026 guidance for low single digit revenue growth and mid single digit EPS growth. Bertrand’s transition will be watched in the context of these execution goals, particularly around pricing agility tools and expansion of new facilities in Florida and Europe that are intended to support more profitable growth.

Yet investors should also be aware that customer traffic and sales consultant turnover remain key pressure points that could...

Read the full narrative on Sysco (it's free!)

Sysco’s narrative projects $91.9 billion revenue and $2.6 billion earnings by 2028. This requires 4.2% yearly revenue growth and about a $0.8 billion earnings increase from $1.8 billion today.

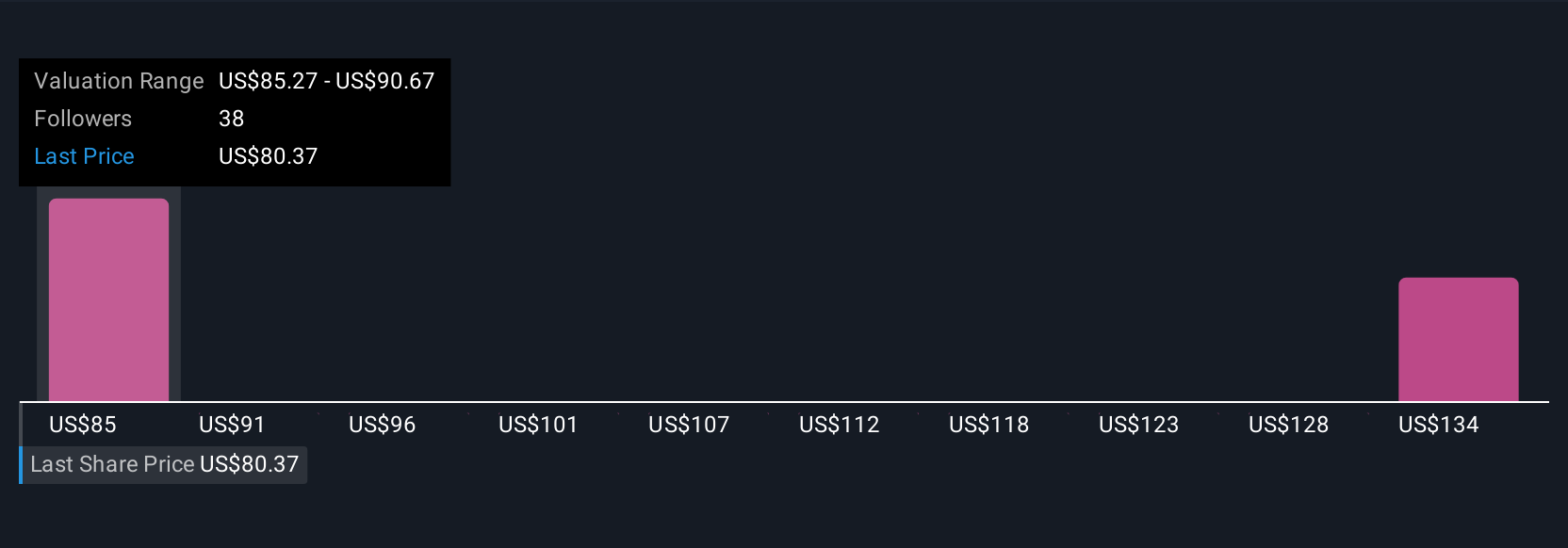

Uncover how Sysco's forecasts yield a $86.94 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Sysco span from US$86.94 up to US$163.46, showing wide disagreement on upside potential. You should weigh these views against current concerns about weak restaurant traffic and macro sensitivity before forming your own expectations for Sysco’s performance.

Explore 2 other fair value estimates on Sysco - why the stock might be worth over 2x more than the current price!

Build Your Own Sysco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sysco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sysco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sysco's overall financial health at a glance.

No Opportunity In Sysco?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026