- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

Assessing Performance Food Group (PFGC) Valuation in Light of New Board Nominations by Sachem Head

Reviewed by Simply Wall St

Most Popular Narrative: 10.3% Undervalued

According to the most widely followed valuation narrative, Performance Food Group’s stock currently trades at a significant discount to its fair value estimate. Analysts see clear catalysts driving further upside, based on ambitious revenue, margin, and profit growth projections.

Ongoing investments in digital ordering platforms and e-commerce capabilities, particularly in the rapidly growing specialty and convenience divisions, are driving higher order frequency, increased client stickiness, and double-digit e-commerce sales growth. These factors contribute to recurring revenue and improved customer lifetime value.

What exactly is underpinning this bullish perspective? The growth runway analysts see is built on aggressive bets in digital, targeted acquisitions, and a margin story that hints at a dramatic transformation. Want to discover the numbers powering this forecast and the ambitious financial milestones the narrative expects PFG to reach? Find out what could set this stock apart from the rest.

Result: Fair Value of $117.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing gains in the Convenience segment or unexpected integration challenges from acquisitions could quickly shift sentiment and test this bullish forecast.

Find out about the key risks to this Performance Food Group narrative.Another View: What Multiples Say

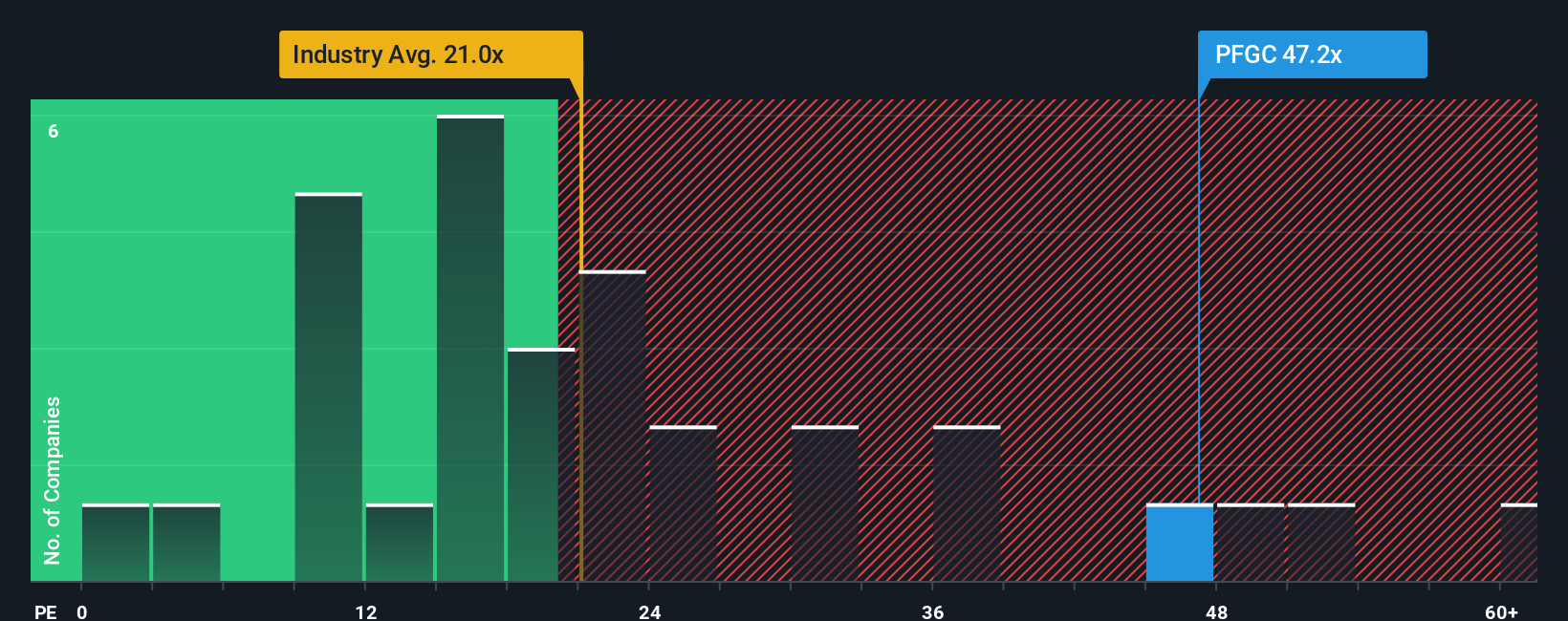

While the main narrative sees Performance Food Group as undervalued, judging by common market valuation ratios, the shares currently look much pricier than industry averages. Could this call for caution? Or is the market seeing more future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Performance Food Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Performance Food Group Narrative

If you have a different outlook or want to examine the numbers firsthand, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Performance Food Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want an edge on your next move, fuel your watchlist with innovative opportunities. These tailored searches could lead you to what others are missing.

- Accelerate your portfolio with fintech innovators and blockchain pioneers setting the pace for digital finance through cryptocurrency and blockchain stocks.

- Generate reliable income streams by finding companies offering above-market yield with dividend stocks with yields > 3% designed for steady growth.

- Stay ahead of the crowd by uncovering promising bargains trading below their intrinsic worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026